Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin’s recovery has stalled at $71,000 as market sentiment reaches its lowest point since 2022.

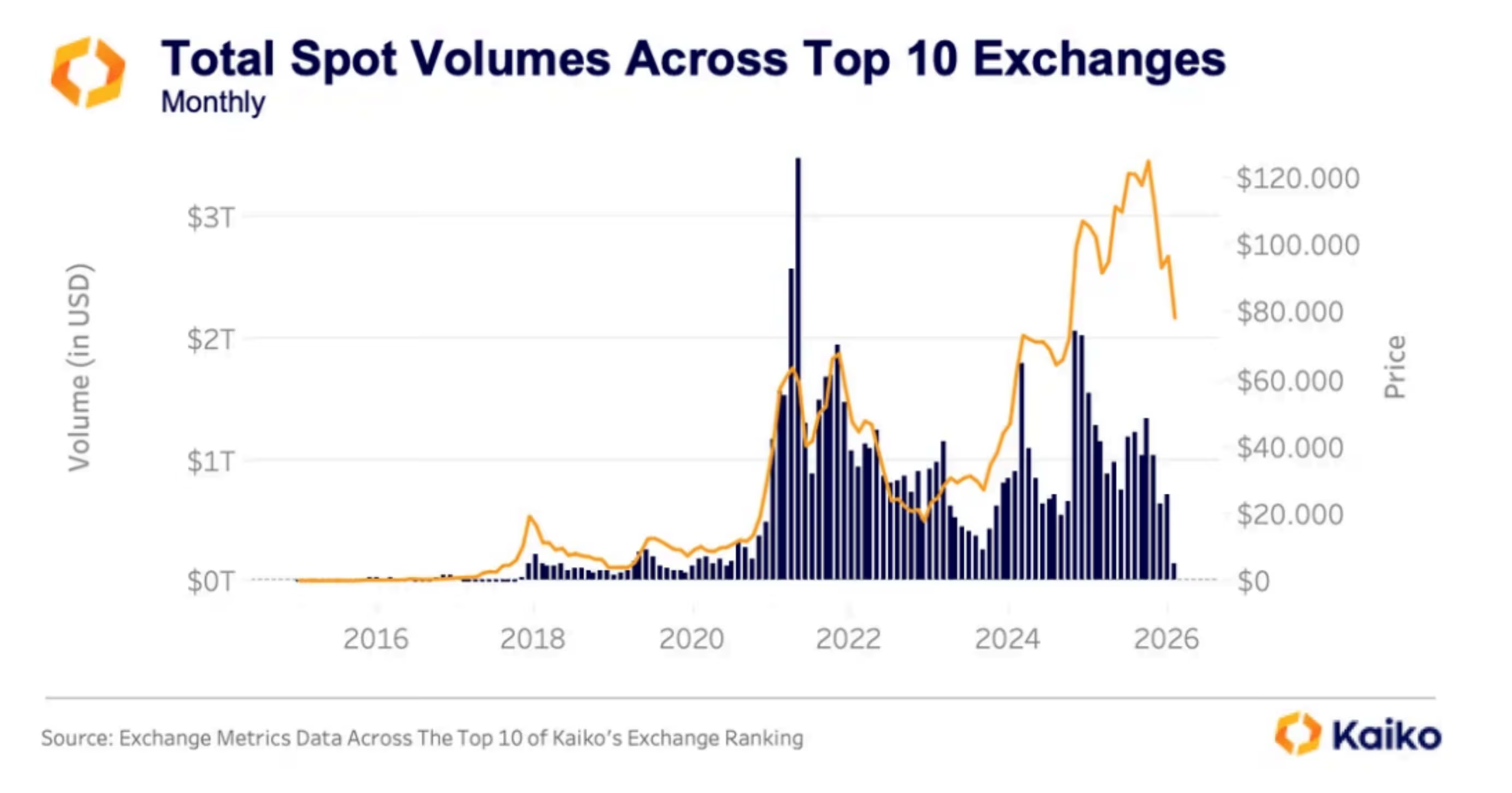

Trading data indicate a widespread risk-off unwind, with spot volumes on major exchanges decreasing by approximately 30% since late 2025 and retail engagement diminishing

What to know:

- Bitcoin’s rapid recovery from last week’s drop to the low-$60,000s has stalled near $70,000, prompting traders to interpret the movement as a typical bear-market relief rally instead of the initiation of a new upward trend.

- Analysts caution that significant overhead supply, tenuous sentiment, and low liquidity might lead to another examination of critical long-term support around the 200-week moving average and the $60,000 mark.

- Trading data reveal a widespread risk-off unwind, with spot volumes on key exchanges declining by approximately 30 percent since late 2025 and retail involvement dwindling, conditions that can incite sharp price fluctuations without a definitive capitulation bottom.

Bitcoin’s recovery from last week’s decline is already facing challenges.

After briefly dipping into the low-$60,000s in a capitulation-like movement last week, the largest cryptocurrency rebounded toward the $70,000 level over the weekend, but momentum has since diminished.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

This stall has led traders to reinterpret the bounce as a typical bear-market formation, a sharp relief rally that attracts dip buyers, only to encounter a wave of supply from investors seeking to exit at more favorable prices.

“There remains a significant supply in the markets from those wanting to exit the first cryptocurrency during the rebound,” FxPro chief market analyst Alex Kuptsikevich stated in an email. “In such circumstances, it is prudent to prepare for a new test of the 200-week moving average soon.”

“We maintain a strong skepticism about the near future, as the recovery momentum has faltered over the weekend, facing a sell-off near the $2.4 trillion level. It is possible that we have only witnessed a bounce on the way down, which is not yet finished,” he added.

Sentiment data also reflects a similarly fragile scenario. The Crypto Fear and Greed Index dropped to 6 over the weekend, matching the levels seen during the FTX-driven downturn in 2022, before recovering to 14 by late Monday.

Kuptsikevich noted that these readings remain “too low levels for confident purchases,” suggesting that the shift indicates more than just temporary anxiety.

Liquidity conditions are contributing to the apprehension. With thinner order books, even modest selling pressure can lead to significant price movements, which can trigger additional stop-outs and liquidations—a feedback loop that can create erratic price behavior.

This dynamic, rather than a single news item, can elucidate why bitcoin can fluctuate thousands of dollars in a trading session while still failing to overcome significant resistance.

A Kaiko report on Monday characterized the environment as a broader risk-off unwind. It noted that aggregate trading volumes across major centralized exchanges have diminished by approximately 30% since October and November, with monthly spot volumes falling from around $1 trillion to the $700 billion range.

(Kaiko)

(Kaiko)

The company stated that while last week experienced a few sharp spikes in trading, the overall trend has been a consistent decline in participation. This indicates that traders, especially retail investors, are gradually exiting the market rather than being compelled to leave all at once.

When liquidity decreases in this manner, prices can drop rapidly on relatively modest selling pressure, lacking the heavy, panic-induced volume that typically signifies a clear capitulation and a sustainable bottom.

Kaiko also contextualized the movement within the established four-year halving cycle framework. Bitcoin reached a peak of around $126,000 in late 2025/early 2026 and has since retraced sharply, with the decline into the $60,000-$70,000 range representing a drop of over 50% from the highs.

Historically, these bottoms may take several months to form and often involve multiple failed rallies.

At this point, bitcoin’s ability to maintain the $60,000 level is critical. If buyers continue to uphold it, the market might enter a period of erratic consolidation. Conversely, if this support fails, the same liquidity dynamics that contributed to the downturn could quickly resurface, particularly if broader macroeconomic conditions remain risk-off.