Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin’s narrow price range suggests a prolonged period between $70,000 and $80,000.

Limited historical trading activity and a sparse onchain supply indicate potential further consolidation or a retest of the lower range.

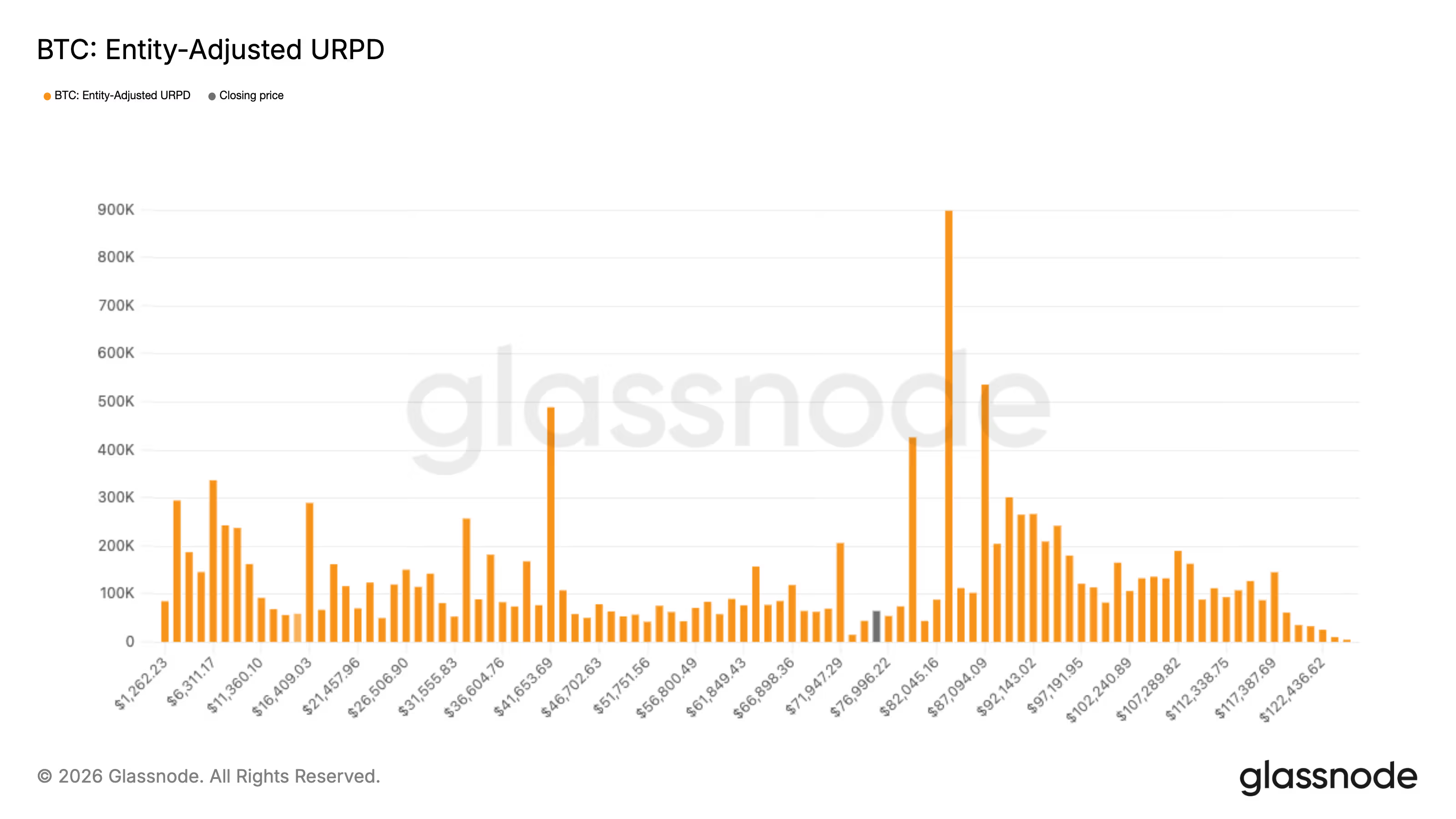

BTC URPD: (Glassnode)

BTC URPD: (Glassnode)

Key points:

- Bitcoin has remained in a relatively narrow range between $70,000 and $79,999 for five days, which is an unusually extended period for a price bracket where it has typically spent minimal time.

- Due to the limited trading history in this zone, it lacks robust historical support or resistance and may either stabilize or trend towards the lower end.

- Trading metrics indicate a structural shortage of supply in this area, highlighted by a single significant purchase by Strategy and previous instances where the price moved through it swiftly.

Following the weekend’s decline, the bitcoin price has been restricted between $70,000 and $79,999 for five consecutive days. This duration is notably long for a range where the leading cryptocurrency has typically spent a brief period.

In fact, bitcoin has occupied approximately 35 days within that $10,000 segment. In comparison to other increments, this is one of the least developed, highlighting how swiftly the price has tended to traverse rather than establish enduring support or resistance.

STORY CONTINUES BELOWStay updated with the latest story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The longer the price remains within a specific range, the greater the opportunity for position-building, which can later translate into stronger support. This suggests that the price is more likely to consolidate within this range or potentially make another move toward the lower end before establishing a more stable foundation.

During the volatility driven by tariffs last April, bitcoin remained below $80,000 for only a few weeks before bouncing back. Similarly, when it reached a then-record high near $73,000 in March 2024, it spent only a brief time at those levels before decreasing.

A particularly clear example of how swiftly bitcoin has traversed this range occurred in November 2024 following Donald Trump’s presidential election victory. The price surged from approximately $68,000 to $100,000 in a matter of weeks, providing minimal opportunity for consolidation between $70,000 and $80,000.

It is worth noting that Strategy (MSTR), the largest corporate holder of bitcoin, has only once acquired bitcoin within this range. On Nov. 11, 2024, the firm purchased 27,200 BTC for around $2 billion at an average price of $74,463.

The data clearly indicates a shortage of supply between $70,000 and $80,000, suggesting that this zone remains structurally weak.