Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin’s demand in the U.S. shows signs of recovery following the decline.

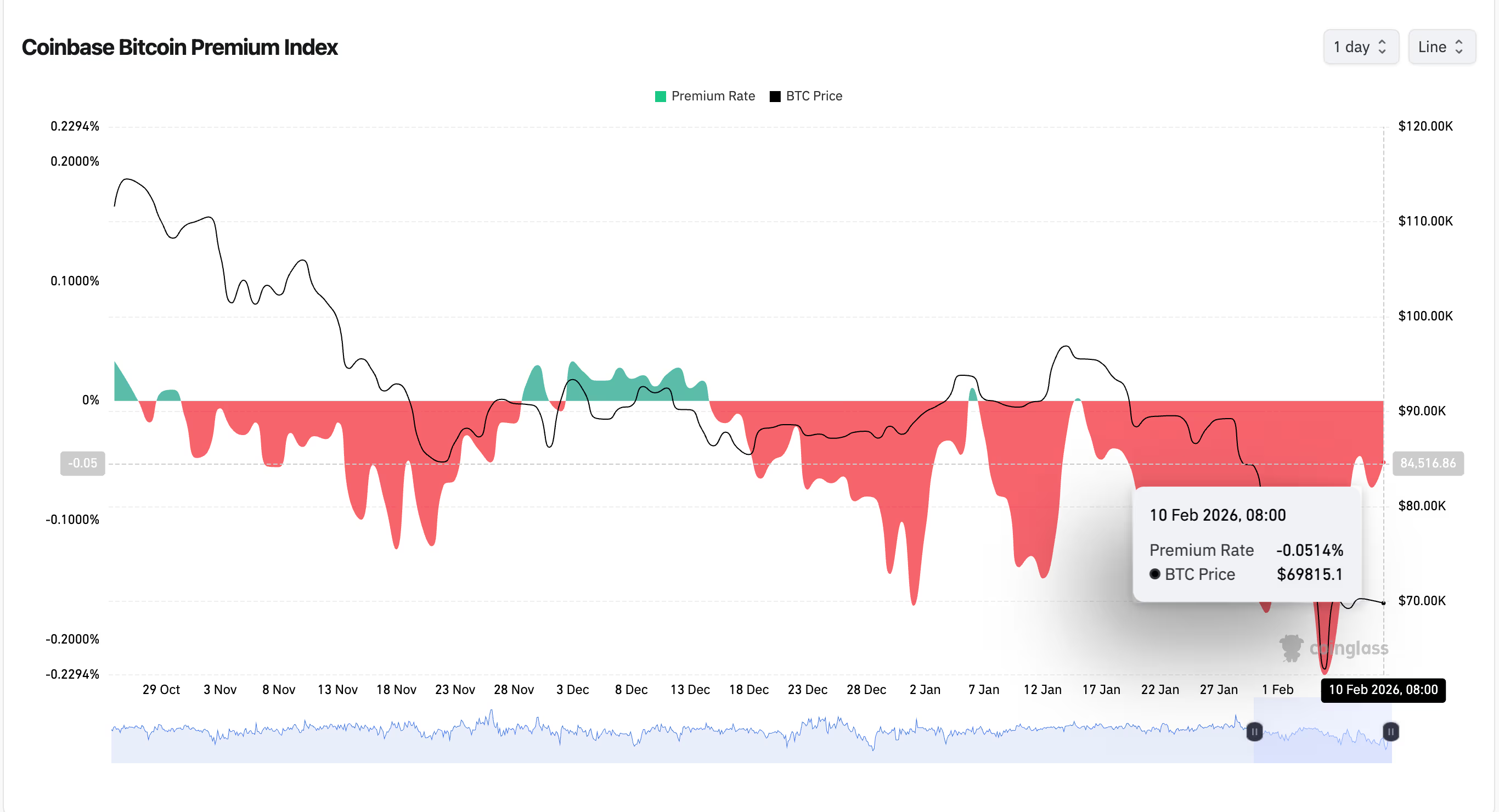

A rise in the Coinbase Bitcoin Premium Index indicates that U.S. buyers have entered the market near recent lows, although it does not imply a wider risk-on shift.

Key points:

- Bitcoin has bounced back to just under $70,000, recovering over 15% from last week’s intraday low but is still down more than 10% for the week.

- The Coinbase Bitcoin Premium Index has improved from approximately -0.22% during the sell-off to about -0.05%, indicating that investors in the U.S. purchased the dip as forced selling subsided.

- The premium’s inability to turn positive, along with low trading volumes and limited liquidity, suggests that buying has been selective rather than indicative of widespread, sustained demand from U.S. funds.

Bitcoin’s strong recovery from last week’s drop towards $60,000 has been accompanied by a notable yet subtle change in a closely monitored indicator of U.S. demand.

The Coinbase Bitcoin Premium Index — which measures the price difference between bitcoin traded on Coinbase and the global market average — has significantly risen from a deeply negative level, moving from around -0.22% at the peak of the selloff to roughly -0.05% by Tuesday.

STORY CONTINUES BELOWDon’t overlook another story.Sign up for the Crypto Daybook Americas Newsletter today. Explore all newslettersEnroll me

Although the index remains negative, the rebound indicates that U.S. investors have stepped in to purchase the dip as the pressure from forced selling has diminished.

Coinbase is regarded as a barometer for institutional and dollar-based transactions. A significantly negative premium typically indicates that U.S. investors are either selling aggressively or are remaining on the sidelines entirely. The shift back toward a neutral stance suggests that some buyers have perceived value at lower price points, especially as bitcoin has stabilized after experiencing its fastest decline since the FTX collapse in 2022.

Nonetheless, the premium has not reached a positive level, a benchmark that historically aligns with sustained accumulation and renewed risk appetite among U.S. funds. Instead, the current trend points to selective buying rather than widespread conviction.

Market structure data corroborates this cautious view. Aggregate trading volumes across major exchanges are still significantly below the highs of late 2025, as reported by Kaiko, with spot activity reflecting gradual decline rather than a strong surge in demand.

Limited liquidity means prices can rebound sharply once selling pressure subsides, but it also leaves the market susceptible to renewed downward movement if buyers do not maintain their engagement.

Bitcoin is currently trading just under $70,000 after rebounding over 15% from its intraday low, although it is still down over 10% for the week.