Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

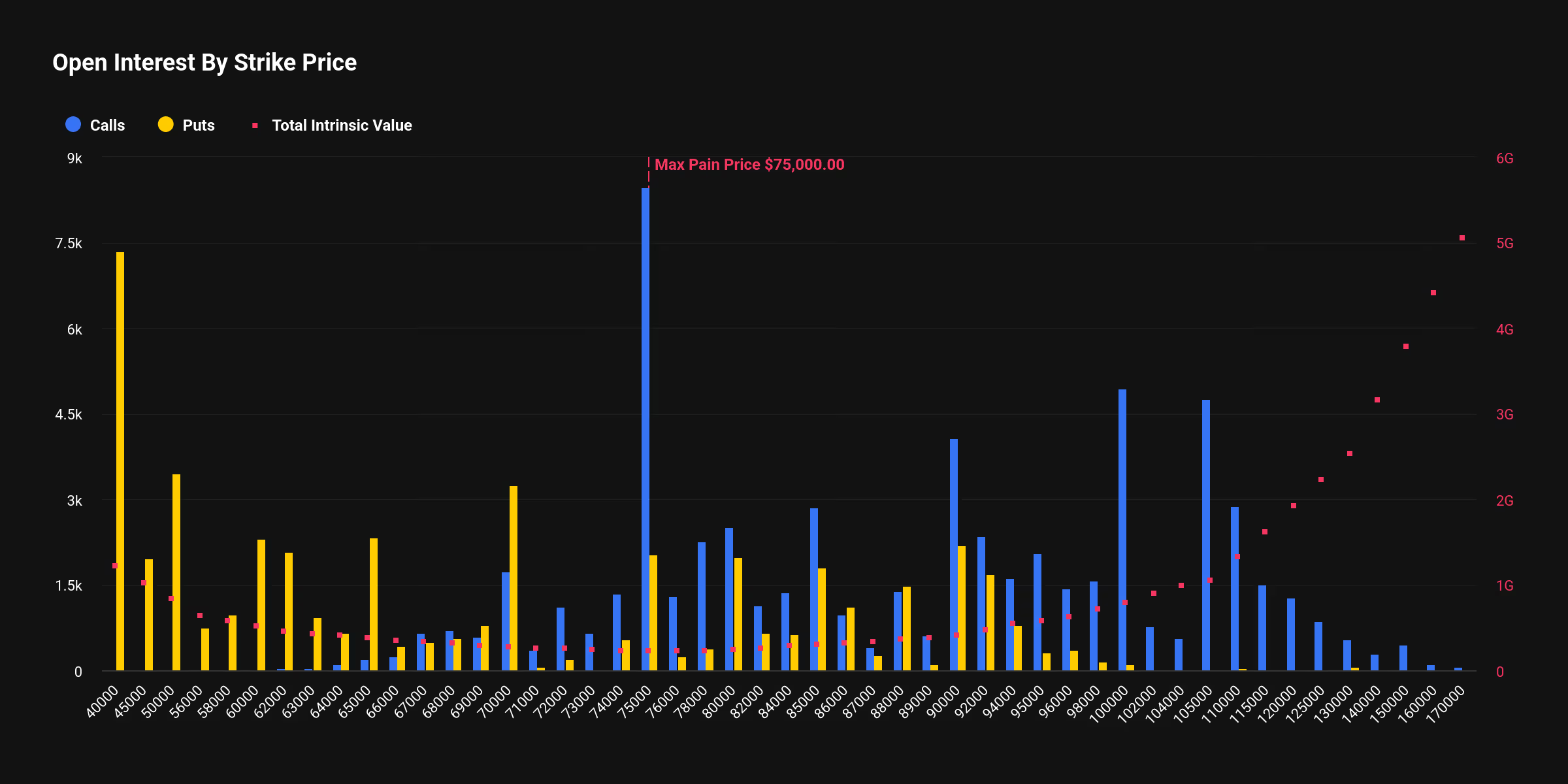

Bitcoin’s $40,000 put option ranks as the second-largest wager as February expiration approaches next week.

Significant positioning at lower strikes indicates an increasing demand for downside protection for bitcoin.

Open Interest by Strike Price (Deribit)

Open Interest by Strike Price (Deribit)

Key points:

- The $40,000 put option ranks as the second largest strike in terms of open interest, with approximately $490 million in notional value, indicating considerable demand for protective measures against market declines approaching the Feb. 27 expiry.

- About $566 million is allocated at the $75,000 strike, representing the max pain level.

- Overall, calls continue to outnumber puts, suggesting traders are balancing exposure to potential rebounds with protective hedges.

The $40,000 put option has become one of the most notable positions within bitcoin’s market as the Feb. 27 expiry approaches, reflecting a significant need for downside protection following a substantial selloff.

Options serve as derivatives that provide holders the choice, but not the obligation, to purchase or sell bitcoin at a predetermined price before the expiry date. Put options function as a safeguard against price drops, yielding payouts if BTC falls beneath a specified strike.

STORY CONTINUES BELOWStay informed on the latest news.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The $40,000 put stands as the second-largest strike based on open interest, with around $490 million in notional value linked to this level, highlighting interest in robust tail-risk hedges. BTC has experienced a drop of up to 50% from its October peaks and is currently trading near $66,000, altering positioning across the market as traders seek to hedge against additional losses.

Data from Deribit, a Dubai-based exchange owned by Coinbase, reveals that roughly $7.3 billion in bitcoin options notional value is set to expire at the month’s end.

Additionally, $566 million is concentrated at the $75,000 strike, which also signifies the max pain level. Max pain describes the price point at which the highest number of options expire worthless, thereby reducing payouts to option buyers. With the spot price below $75,000, a price increase approaching expiry could alleviate losses for call sellers.

While calls exceed puts overall, with 63,547 call contracts compared to 45,914 puts, positioning is not entirely bullish. The put-to-call ratio of 0.72 indicates that bullish bets are still prevalent, yet the notable concentration of substantial put open interest at lower strikes reveals a distinct demand for downside coverage.

Traders maintain exposure to a potential rebound while simultaneously hedging against the possibility of another significant downturn.