Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

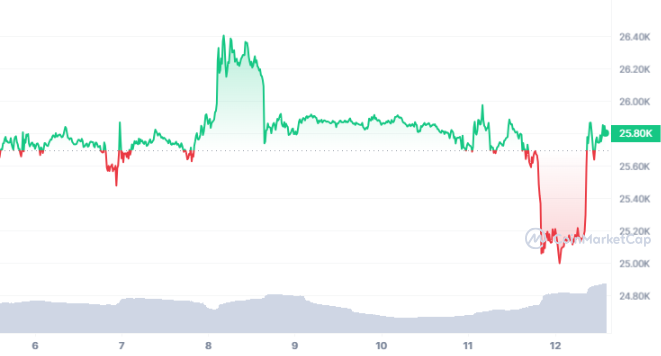

Bitcoin Value Temporarily Rebounds Following Recent Significant Decline

- Significant volatility is expected this week due to the upcoming release of important U.S. CPI and PPI data.

- If the BTC price surpasses the $26,380 threshold, a new rally is anticipated.

Bitcoin’s price has thus far managed to stave off further declines by securing support near the $25,000 level; it was around this price point that the previous surge to $31,500 commenced. Following yesterday’s drop, BTC experienced a notable recovery, rising to approximately $26,000 earlier today. In a brief period, the BTC price increased from $25,210 to $25,973. Additionally, significant volatility is expected this week due to the release of U.S. CPI and PPI figures.

Arthur Hayes, the former CEO of BitMEX, recently proposed that a reduction in interest rates by the Federal Reserve could propel BTC to the $70,000 mark and rejuvenate the U.S. financial landscape. This assertion introduces a new aspect to the ongoing dialogue among investors regarding the potential trajectory of the cryptocurrency market.

High Volatility Expected

As reported by Glassnode, a blockchain data analytics company, the digital asset market “continues to dry up.” The liquidity, volatility, and volume within the digital asset sector have all been declining, with several indicators reverting to levels seen before the bull market of 2020.

At the time of this report, Bitcoin is trading at $25,800, reflecting a 0.03% increase over the past 24 hours according to data from CMC. Furthermore, the trading volume has surged by 111.92% in the last 24 hours. Should the price exceed the $26,380 level, a new rally towards $28,000 is anticipated.

Source: CoinMarketCap

Source: CoinMarketCap

Conversely, if the bears manage to push the price below the $25,000 mark, a decline down to $20,130 is highly likely. Investors and traders are closely monitoring the forthcoming U.S. CPI and PPI data release this week to ascertain the next steps.