Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin value responds as CPI rises 3.7%, indicating inflation exceeds expectations.

Bitcoin (BTC) experienced sudden volatility on Sept. 13 as macroeconomic data from the United States indicated inflation surpassing expectations.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Fuel and housing drive August CPI above target

Data from Cointelegraph Markets Pro and TradingView tracked BTC price movements as it approached a potential drop below the $26,000 threshold.

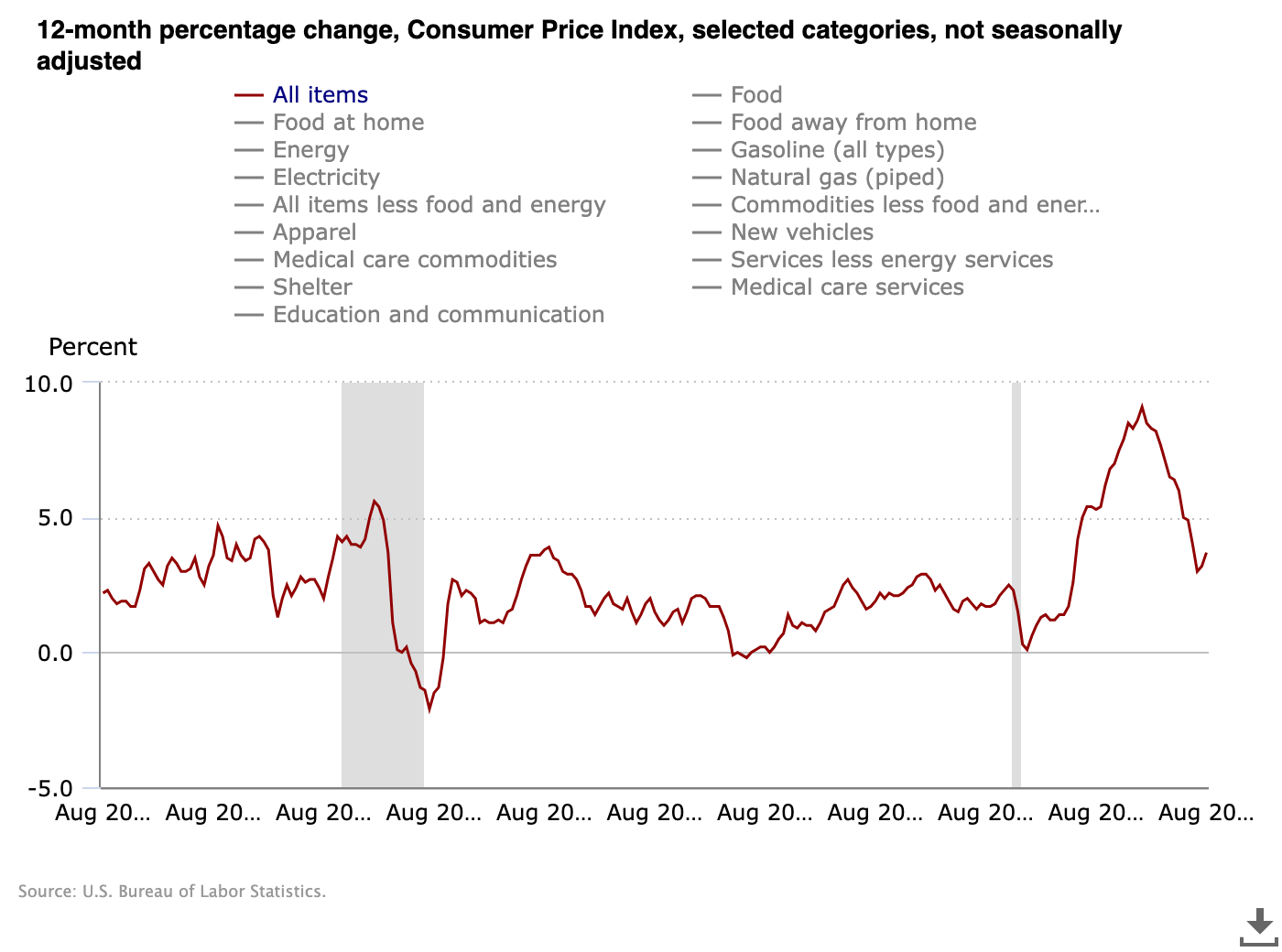

The Consumer Price Index (CPI) for August was reported at 3.7% year-on-year, which was 0.1% above expectations.

“The gasoline index was the primary factor in the monthly increase across all items, contributing to more than half of the rise,” stated part of an official announcement from the U.S. Bureau of Labor Statistics.

“Additionally, the shelter index continued to rise, marking its 40th consecutive month of increases.”

U.S. CPI 12-month percentage change chart. Source: U.S. Bureau of Labor Statistics

U.S. CPI 12-month percentage change chart. Source: U.S. Bureau of Labor Statistics

Earlier that day, participants in the crypto market had cautioned that a “hot” CPI figure could exert pressure on the market, suggesting that inflation was proving to be more persistent than anticipated. This could affect the future restrictiveness of economic policy.

CPI in 1 hour.

Tip: Avoid opening positions during news announcements and wait 30 minutes after data release to begin trading.

Previous: 3.2%

Est: 3.6%

– 3.5% or lower: $BTC may reach the liquidity zone at $26,800.

– 3.7% or higher: Asian pump likely to be retraced.— CrypNuevo (@CrypNuevo) September 13, 2023

“I anticipate that the next CPI will show +4% given the rapid increase in gasoline prices,” noted popular trader CrypNuevo in a response to subscribers on X (formerly Twitter).

“Inflation remains a significant issue, particularly in the latter half of the year.”

CPI was already expected to exceed its July year-on-year figure, with August projected at 3.6% compared to the previous 3.2%.

Bitcoin bid liquidity remains at $25,000 and lower

Before the data release, Keith Alan, co-founder of the on-chain monitoring platform Material Indicators, expressed optimism regarding the week’s BTC price momentum sustaining.

Related: GBTC ‘discount’ reaches smallest level since 2021 despite BTC price at 3-month lows

“The momentum of BTC has slightly diminished since yesterday, but it is still robust enough to maintain most of what was regained after the bounce,” part of an X post stated.

Alan emphasized that “significant technical resistance” persisted above the current price range, represented by several daily moving averages.

With the Wall Street opening still pending, volatility was evident, with BTC/USD lacking a definitive trend at the time of this report.

An accompanying snapshot of the BTC/USDT order book on Binance, the largest global exchange, indicated only limited liquidity around the spot price, with a greater number of bids positioned at $25,000.

BTC/USD order book data for Binance. Source: Material Indicators/X

BTC/USD order book data for Binance. Source: Material Indicators/X

This article does not provide investment advice or recommendations. All investment and trading activities carry risks, and readers should perform their own research before making decisions.