Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

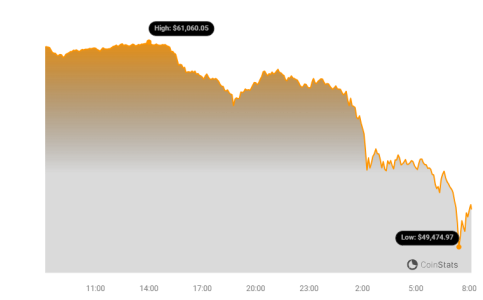

Bitcoin Value Dropped Below $50,000

- Bitcoin experienced a decline of 16% as its price fell below $50k in the past 24 hours, while Ethereum dropped by more than 23%.

The cryptocurrency market encountered a notable decrease in value as investors continued to move away from high-risk investments.

Bitcoin was at the forefront of the downturn with a 16% drop, falling below $50,000 in the last 24 hours, while Ethereum saw a decline exceeding 23% and is currently trading at $2,230. As per CoinStats, the overall market capitalization has decreased by 11%, now standing at $1.84 trillion.

BTC Price Chart | Source: CoinStats

BTC Price Chart | Source: CoinStats

This downturn in cryptocurrencies has coincided with a wider decline in equity markets across the Asia-Pacific region. Japan’s Nikkei 225 index fell by 10%, extending losses from the prior week, following the Bank of Japan’s announcement of an increase in its benchmark interest rate to a 16-year peak.

At the time of writing, the leading cryptocurrency has made a partial recovery, trading at $51,900, down 27% over the past week, with its market capitalization reduced to approximately $1 trillion.

Additionally, it was reported that $1,000,000,000 was liquidated from the cryptocurrency market within the last 24 hours.

The stock market also faced a decline last week, partly due to disappointing earnings, a weaker-than-anticipated jobs report, rising unemployment, and a contracting manufacturing sector.

The U.S. Federal Reserve opted to maintain its benchmark interest rate and did not indicate a rate cut for September, which many market analysts had anticipated. Typically, lower interest rates are associated with improved performance of riskier assets.