Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin value declines to a two-month low — Were professional traders advantaged?

The value of Bitcoin decreased by 11.5% from August 16 to August 18, leading to the liquidation of $900 million in long positions and causing the price to reach a two-month low. Prior to this decline, numerous traders anticipated a surge in volatility that would elevate the price, but this expectation was clearly not fulfilled. Given the significant liquidations, it is crucial to examine whether professional traders benefited from the price drop.

Bitcoin recently experienced one of the largest daily liquidations by volume in its history.

Beginning at 4:30 PM yesterday, #Bitcoin plummeted 7.5% in just 20 MINUTES, wiping out $42 billion in market capitalization.

This mass liquidation event saw more outflows in a single day than during the FTX collapse in November… pic.twitter.com/KmVNkXoOLw— The Kobeissi Letter (@KobeissiLetter) August 18, 2023

There is a prevalent belief among cryptocurrency traders that whales and market makers possess an advantage in forecasting significant price movements, which enables them to outperform retail traders. This idea has some validity, as sophisticated quantitative trading software and strategically located servers play a role. Nevertheless, this does not render professional traders immune to considerable financial losses when the market becomes unstable.

For larger and professional traders, a significant portion of their positions may be fully hedged. Analyzing these positions in relation to previous trading days allows for assessments on whether recent fluctuations indicated an impending widespread correction in the cryptocurrency market.

Margin longs at Bitfinex and OKX were relatively high

Margin trading enables investors to amplify their positions by borrowing stablecoins and utilizing the funds to purchase additional cryptocurrency. Conversely, traders who borrow Bitcoin (BTC) use the coins as collateral for short positions, indicating a bet on price decline.

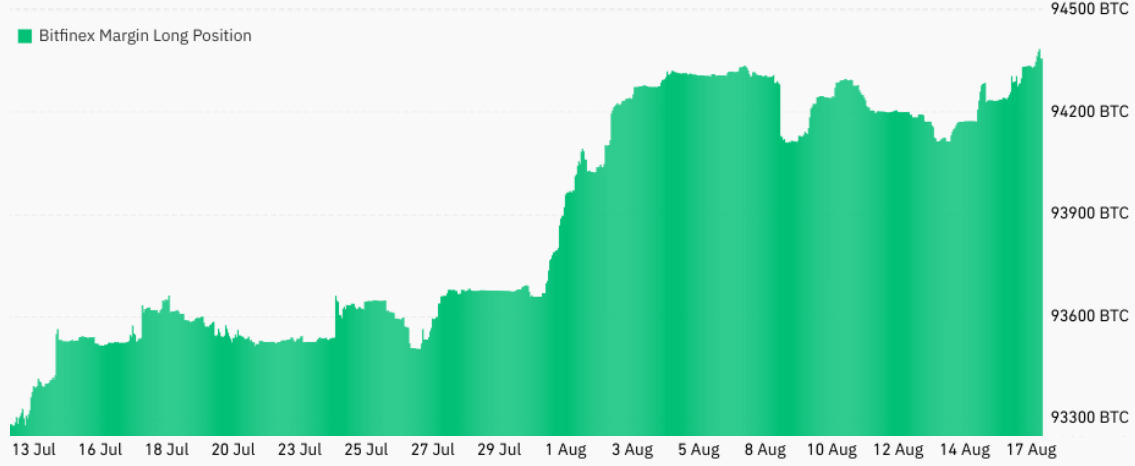

Bitfinex margin traders are recognized for quickly establishing position contracts of 10,000 BTC or more, highlighting the participation of whales and large arbitrage desks.

As illustrated in the chart below, the Bitfinex margin long position on August 15 was recorded at 94,240 BTC, approaching its highest level in four months. This indicates that professional traders were completely unprepared for the sudden BTC price drop.

Bitfinex margin BTC longs, measured in BTC. Source: TradingView

Bitfinex margin BTC longs, measured in BTC. Source: TradingView

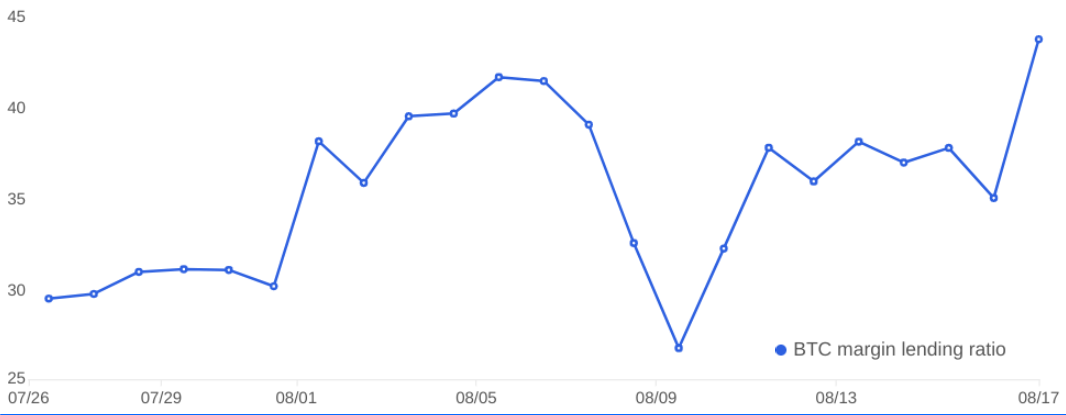

In contrast to futures contracts, the balance between margin longs and shorts is not inherently symmetrical. A high margin lending ratio indicates a bullish market, while a low ratio suggests bearish sentiment.

OKX USDT/BTC margin lending ratio. Source: OKX

OKX USDT/BTC margin lending ratio. Source: OKX

The chart above displays the OKX BTC margin lending ratio, which reached nearly 35 times in favor of long positions on August 16. Notably, this level corresponded with the preceding seven-day average. This suggests that even if external factors had previously influenced the metric, it can be inferred that whales and market makers maintained their positions in margin markets before the Bitcoin price decline on August 16 and 17. This information supports the assertion that professional traders were unprepared for any negative price movement.

Futures long-to-short data proves traders were unprepared

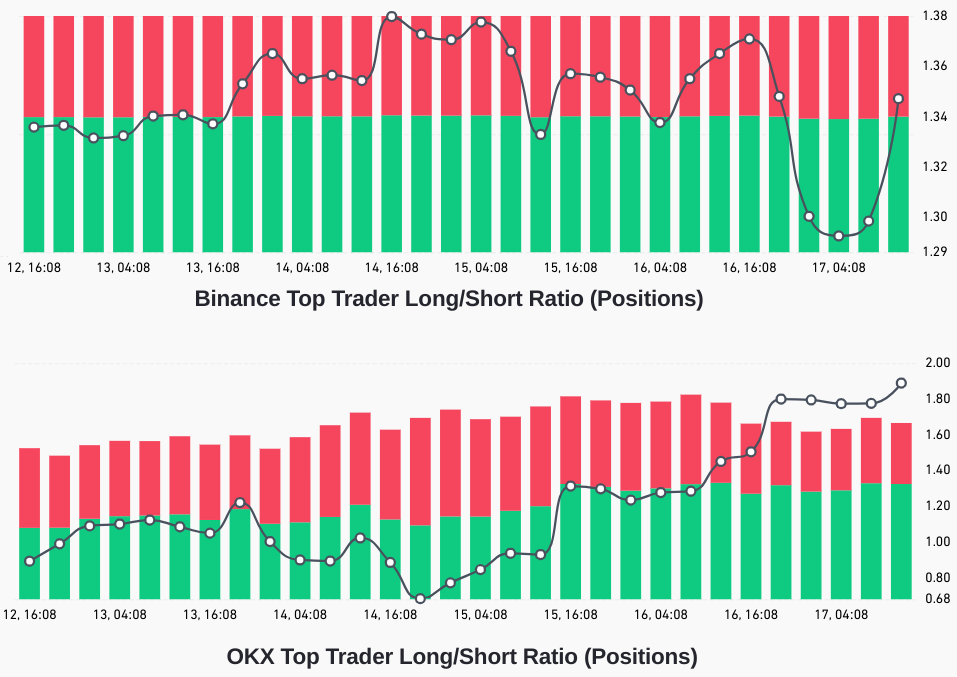

The net long-to-short ratio of the leading traders excludes external factors that may have specifically impacted the margin markets. By consolidating positions across perpetual and quarterly futures contracts, a clearer understanding can be obtained regarding whether professional traders are leaning towards a bullish or bearish outlook.

Occasional methodological differences among various exchanges exist, prompting observers to monitor changes rather than focus solely on absolute values.

Exchanges’ top traders' Bitcoin long-to-short ratio. Source: CoinGlass

Exchanges’ top traders' Bitcoin long-to-short ratio. Source: CoinGlass

Before the release of the Federal Reserve's Federal Open Market Committee minutes on August 16, prominent BTC traders on Binance displayed a long-to-short ratio of 1.37, consistent with the peak levels seen in the previous four days. A similar trend was observed on OKX, where the long-to-short indicator for Bitcoin’s leading traders reached 1.45 just before the BTC price correction began.

Related: Why did Bitcoin drop? Analysts point to 5 potential reasons

Regardless of whether those whales and market makers increased or decreased their positions following the onset of the crash, data from BTC futures further reinforces the notion of a lack of preparedness in terms of reducing exposure prior to August 16, whether in futures or margin markets. Therefore, it can be reasonably concluded that professional traders were caught off guard and did not profit from the price decline.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.