Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin UTXOs reflect March 2020 ‘black swan’ market downturn — Recent study

Bitcoin (BTC) is in the process of recovering from an unprecedented event that has not been seen since the March 2020 COVID-19 crash, according to data.

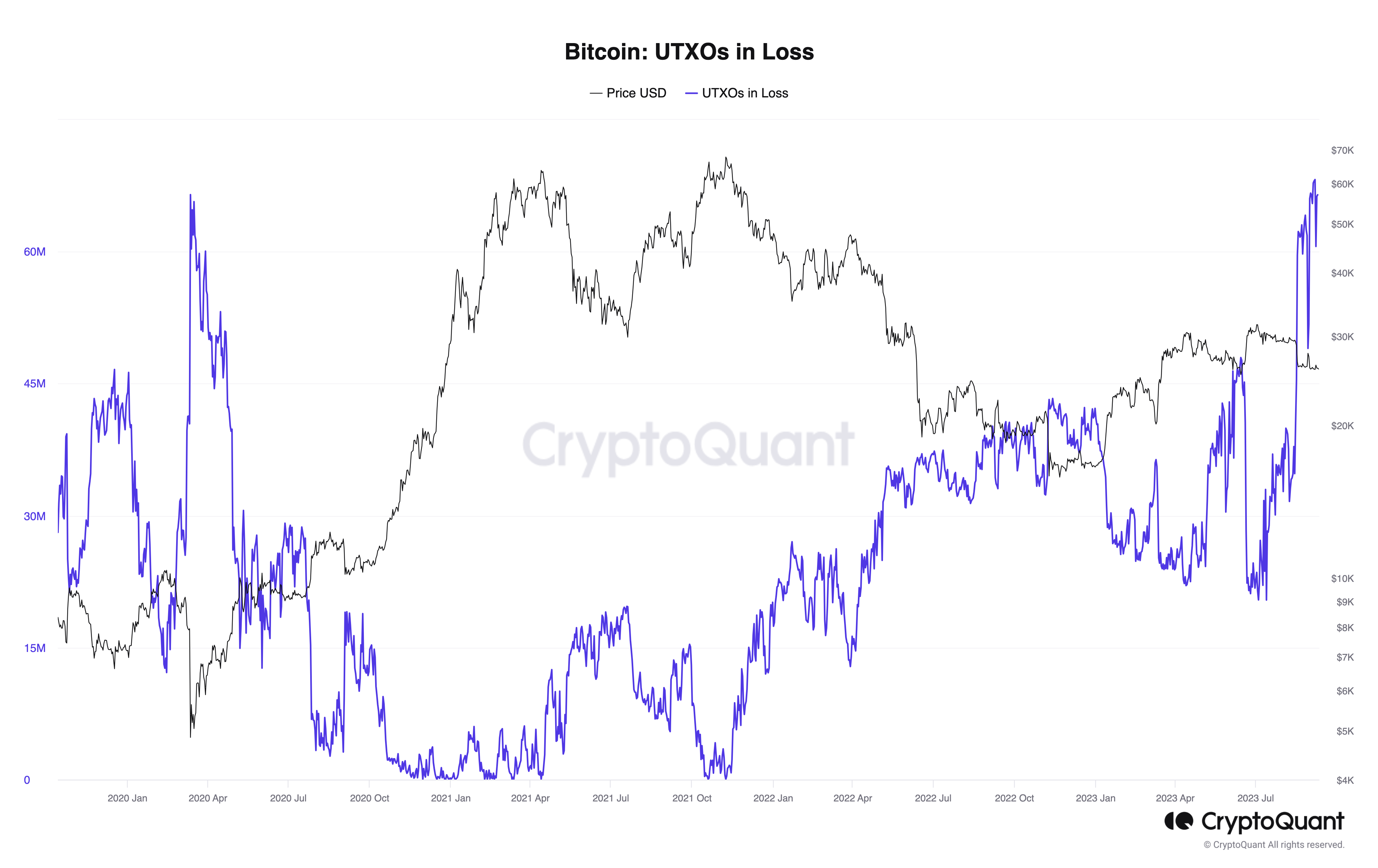

In a Quicktake post dated Sep. 7, the on-chain analytics platform CryptoQuant highlighted a significant increase in loss-making unspent transaction outputs (UTXOs).

CryptoQuant: Bitcoin UTXOs in Loss "reflect" March 2020

While the current weakness in BTC prices may be concerning for market participants, on-chain data reveals a compelling narrative of activity occurring “beneath the surface.”

UTXOs signify the BTC remaining after an on-chain transaction has been completed. CryptoQuant’s UTXOs in Loss metric monitors instances when a substantial number of these UTXOs are valued less than their original purchase price.

At present, a greater number of these UTXOs are at a loss compared to their initial acquisition cost than at any point since March 2020.

During that period, BTC/USD experienced a 60% decline, reaching its lowest levels since March 2019—levels that have not been revisited.

Taking into account the current data regarding UTXOs in Loss, CryptoQuant contributor Woominkyu suggested that, similar to March 2020, Bitcoin might be experiencing, or is already recovering from, an unexpected selling event.

He summarized:

“Considering that the current level of the ‘UTXOs in loss’ indicator reflects that of the Black Swan event between March and April 2020 (due to the Coronavirus), those expecting another Black Swan event might want to evaluate whether we are already in the midst of the event they are anticipating.”

Bitcoin UTXOs in loss chart. Source: CryptoQuant

Bitcoin UTXOs in loss chart. Source: CryptoQuant

In percentage terms, 38% of UTXOs were in loss at the close of August, a level last observed in April 2020.

“When a significant number of UTXOs are in loss, investors may be more likely to sell, indicating market unease. Conversely, when the majority of UTXOs are profitable, it reflects a positive outlook and stronger holding sentiment among investors,” Woominkyu added.

Underwater Bitcoin speculators increase

Meanwhile, Bitcoin remains confined within a narrow range due to a lack of a definitive BTC price trend.

Related: Bitcoin speculators now hold the least BTC since $69K all-time highs

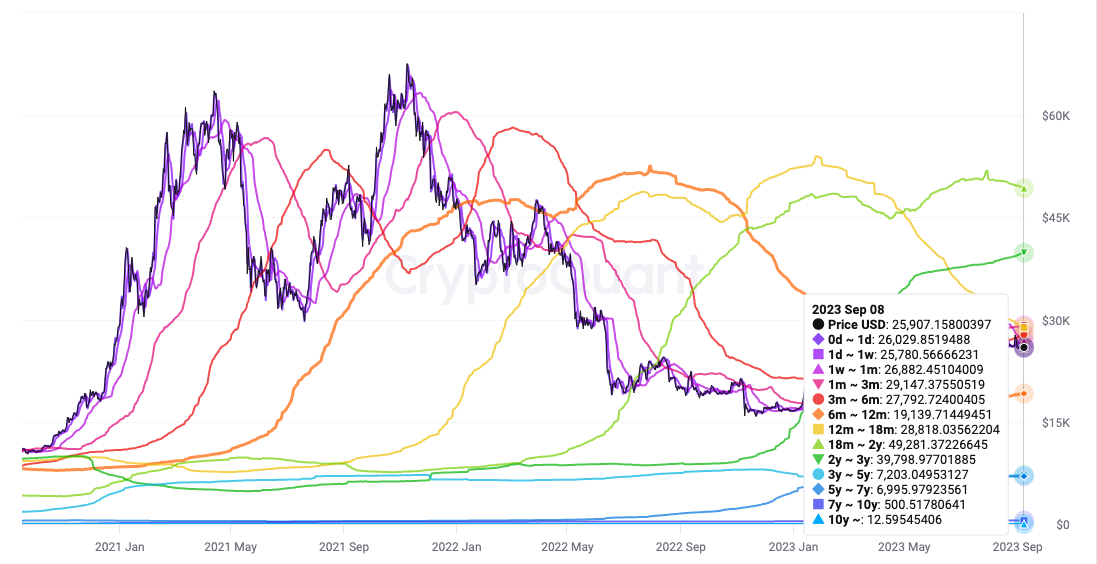

With neither a breakout nor a breakdown forthcoming, cost basis data similarly indicates that the current spot price is situated between the acquisition prices of various investor groups.

This “Realized Price”—the price at which the supply last changed hands, segmented by age group—indicates that short-term holders are collectively at a loss when BTC/USD is below approximately $27,000.

However, a complete capitulation event has yet to be documented on-chain.

Bitcoin Realized Price chart (screenshot). Source: CryptoQuant

Bitcoin Realized Price chart (screenshot). Source: CryptoQuant

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.