Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin trading volume reaches five-year lows as the Federal Reserve encourages BTC holding.

Bitcoin (BTC) exchanges have experienced a significant decline in trading volume as traders navigate ongoing macroeconomic uncertainty.

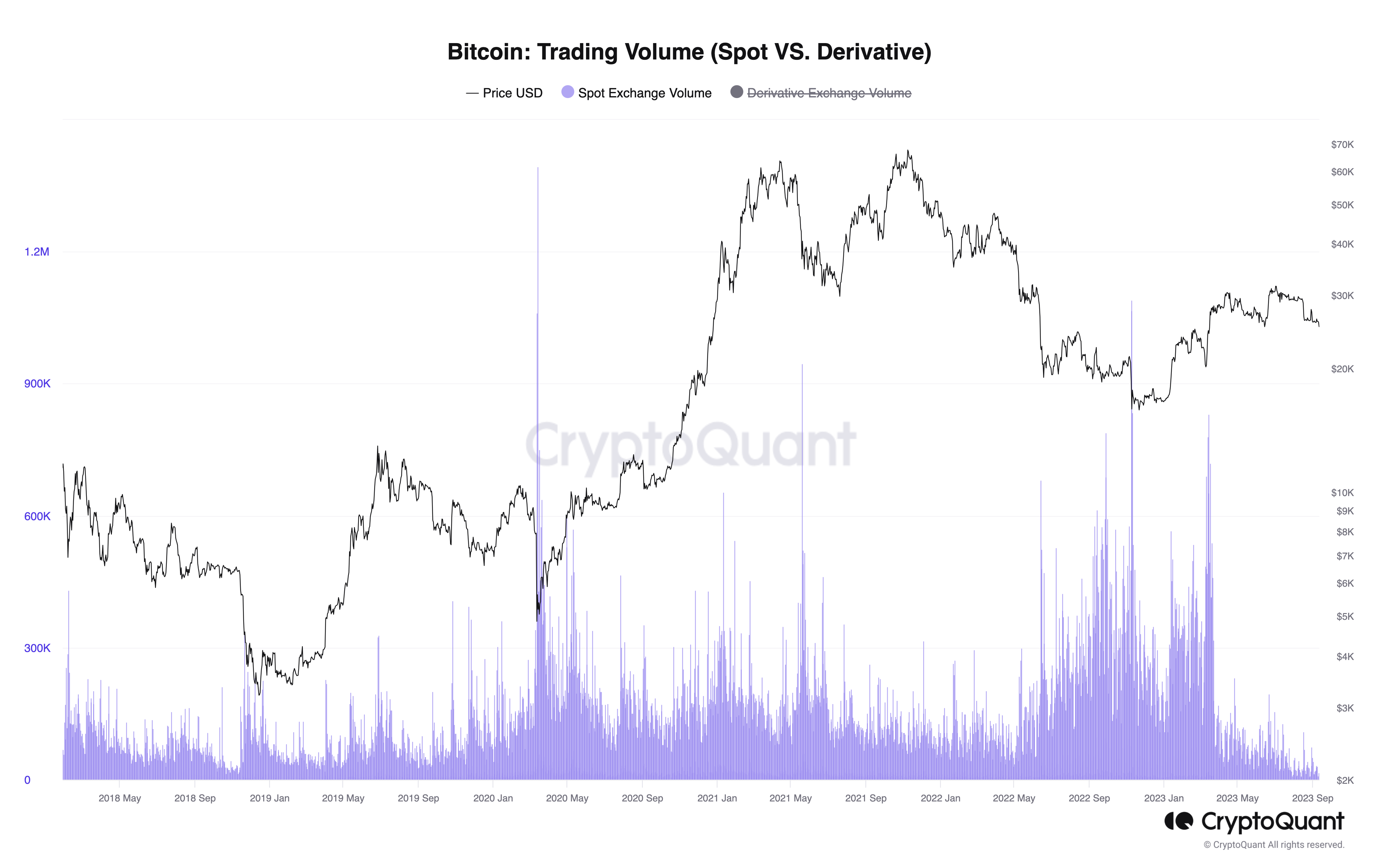

As per recent findings from the on-chain analytics platform CryptoQuant, released on Sept. 25, daily BTC volumes have reached levels not seen since 2018.

Fed keeps Bitcoin investors cautious about “potential recession”

Bitcoin’s price movements have remained within a familiar range for several months, and interest in trading seems to be diminishing over time.

Data from CryptoQuant, which monitors activity on both spot and derivatives exchanges, underscores the degree to which volumes have fallen since BTC/USD entered its current range in March.

In the past week, daily spot exchange transactions ranged from 8,000 to 15,000 — a small fraction of the typical daily volume in March, which surpassed 600,000.

According to analyst Caue Oliveira, a key factor behind this trend is the macroeconomic environment.

“One of the primary reasons mentioned is the increasing anxiety regarding the macroeconomic situation,” he noted in part of the commentary accompanying the data.

“The actions of the United States Central Bank contribute to a persistent sense of uncertainty, leaving investors anticipating a potential recession.”

Oliveira pointed to the current economic policy in the U.S., where the Federal Reserve has alternated between interest rate increases and pauses in 2023 while maintaining overall tight conditions.

He further observed that Bitcoin holders have opted to retain their BTC capital as a consequence.

“Rather than pursuing quick gains through short-term trading, an increasing number of individuals are considering bitcoin and other cryptocurrencies as long-term investments,” he concluded.

“They are more focused on holding their coins, believing in their future value, than selling at the first indication of profit.”

Bitcoin: Trading Volume (Spot vs. Derivative) chart. Source: CryptoQuant

Bitcoin: Trading Volume (Spot vs. Derivative) chart. Source: CryptoQuant

Limited support for BTC price bulls

As Cointelegraph has reported, conditions have become challenging for Bitcoin speculators in recent weeks.

Related: Bitcoin price struggles for $26K as US dollar strength reaches 10-month peak

Short-term holders — those holding BTC for a maximum of 155 days — now find nearly all their funds at an unrealized loss, with their cost basis exceeding the current spot price.

In additional research this week, fellow CryptoQuant contributor Yonsei_dent concluded that the cost basis of various new Bitcoin investors would serve as “strong resistance.”

“Excluding investors who have been holding for the long term for 1.5 years (12m) or more, newcomers to the market over the past year are believed to have a stronger inclination to engage in short-term buying and selling,” he cautioned.

An accompanying chart illustrated unspent transaction output (UTXO) numbers categorized by age band, establishing resistance and support levels.

Bitcoin UTXO age bands annotated chart (screenshot). Source: CryptoQuant

Bitcoin UTXO age bands annotated chart (screenshot). Source: CryptoQuant

Meanwhile, external interest in BTC exposure remains notably low. Google Trends data indicates the least interest in “Bitcoin” as a search term since October 2020.

Collect this article as an NFT to commemorate this moment in history and support independent journalism in the crypto sector.

This article does not offer investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a decision.