Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin targets liquidity surpassing $30K as gold reaches record high.

Bitcoin (BTC) regained the $29,000 mark overnight on May 4 as the banking crisis in the United States posed a risk of affecting more institutions.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Gold and Bitcoin gain from U.S. banking turmoil

Data from Cointelegraph Markets Pro and TradingView indicated a rapid shift in sentiment for BTC/USD, which reached $29,242 on Bitstamp.

The pair had dropped to daily lows at the opening of Wall Street the previous day as traders awaited the Federal Reserve’s decision on interest rates.

Simultaneously, more regional bank stocks in the U.S. were under pressure, a trend that persisted as the Fed confirmed its widely anticipated 0.25% increase.

One institution, PacWest Bancorp (PACW), reportedly stated it was contemplating a buyout, further straining the regional banking sector while simultaneously benefiting safe-haven assets like Bitcoin.

Gold even achieved new all-time highs as market analysts criticized the Fed’s strategy and forecasted an end to rate hikes.

XAU/USD 1-month candle chart. Source: TradingView

XAU/USD 1-month candle chart. Source: TradingView

“The biggest irony is that Jerome Powell claims the banking system has improved and is healthy, sound, and resilient. It’s the weakest it has ever been, and more banks are collapsing after the market,” Michaël van de Poppe, founder and CEO of trading firm Eight, commented.

“This was the last hike.”

Van de Poppe referred to remarks made by Fed Chair Jerome Powell regarding the regional banking sector, which accompanied the rate decision.

“Conditions in that sector have broadly improved since early March, and the U.S. banking system is sound and resilient,” he stated in a declaration prior to a subsequent press conference.

“We will continue to monitor conditions in this sector. We are committed to learning the right lessons from this episode and will work to prevent events like these from happening again.”

US Regional Bank Stocks After Hours:

1. PacWest, $PACW: -60%

2. Western Alliance, $WAL: -30%

3. Metropolitan Bank, $MCB: -20%

4. Valley National, $VLY: -15%

5. HomeStreet, $HMST: -11%

6. Zions Bank, $ZION: -10%

7. KeyCorp, $KEY: -8%

8. Citizens Financial, $CFG: -5%…— The Kobeissi Letter (@KobeissiLetter) May 3, 2023

However, others remained skeptical.

Arthur Hayes, former CEO of the derivatives exchange BitMEX, disclosed that he was already searching for struggling regional banks. He argued that markets could hinge on the next actions of either Powell or Treasury Secretary Janet Yellen.

“You never know what might trigger Yellen or Powell to cave and bail everyone out. It’s all politics now, and politics is more about power than rational decisions,” part of a tweet stated.

Financial commentator Tedtalksmacro also pointed out that the Fed funds rate had now reached the expected peak set by its members.

Back in March, the majority of FOMC participants indicated that the terminal rate for this tightening cycle would be 5-5.25% —> that’s where we are now. pic.twitter.com/50d4EMG7Fg

— tedtalksmacro (@tedtalksmacro) May 3, 2023

An “important signal”

Regarding Bitcoin itself, the recovery of $29,000 offered a much-needed bullish contrast to recent price movements.

Related: BTC price may need a $24.4K dip as Bitcoin speculators stay in profit

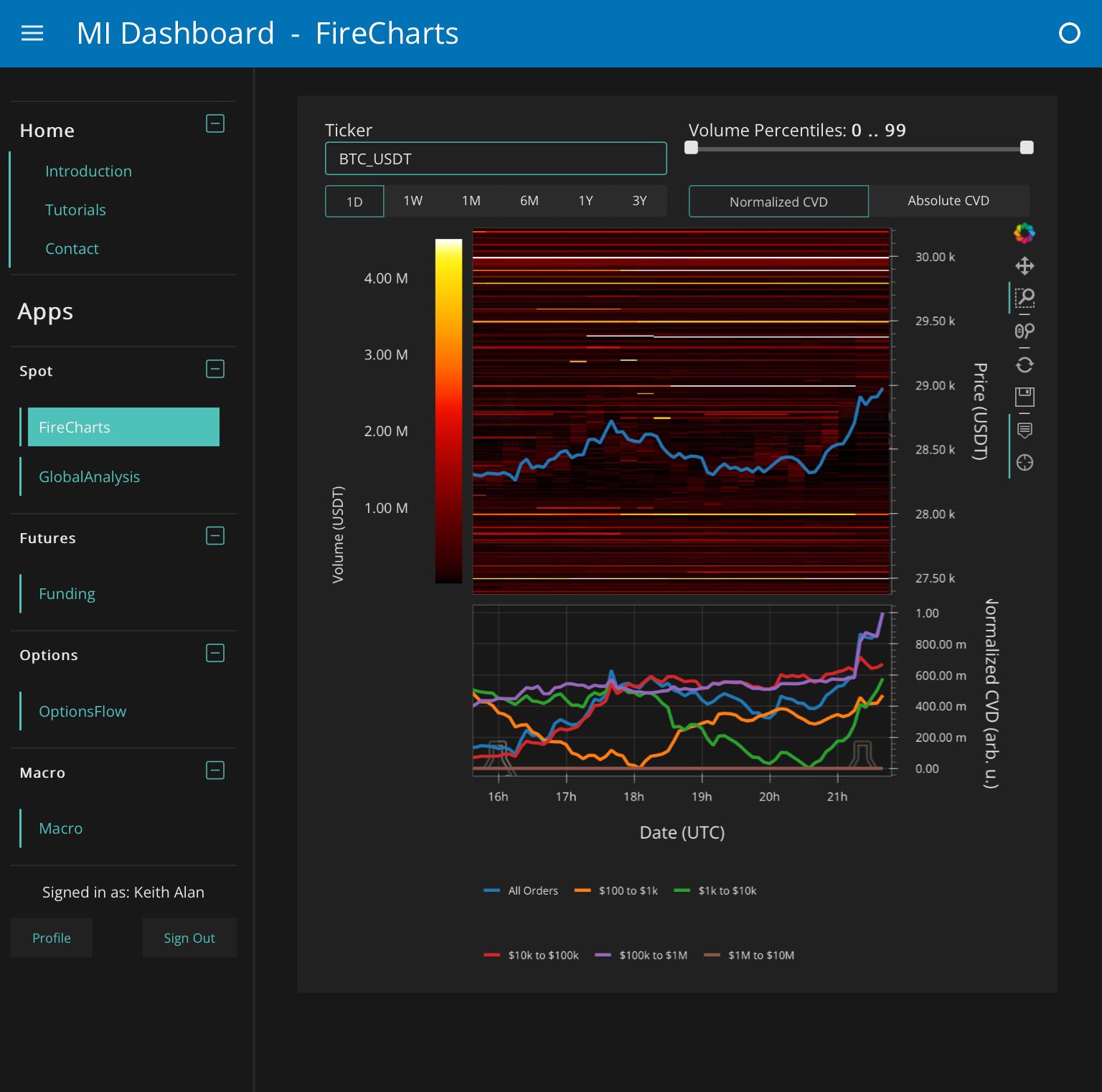

Observing changes on the Binance order book, monitoring resource Material Indicators noted that whale buying power had gained dominance amid the news events.

“After clearing out most of the liquidity in the range before the FOMC FED rate hike announcement, BTC whales had no trouble consuming the remaining liquidity and reclaimed $29k,” it summarized.

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

Market participants thus anticipated that further liquidity squeezes could follow, potentially providing momentum for a move above the $30,000 threshold.

If #bitcoin continues to trend upward, there is significant liquidity between $31k and $35k.https://t.co/sqKr3pvbYP pic.twitter.com/i3DTDKcvu6

— Philip Swift (@PositiveCrypto) May 4, 2023

“Even though Gold is reaching ATHs, Bitcoin continues to outperform it,” Checkmate, lead on-chain analyst at Glassnode, remarked, having described gold’s new highs as an “important signal.”

A tweet featuring Glassnode data illustrated the increase in BTC/XAU since the beginning of 2020.

Even though Gold is reaching ATHs, #Bitcoin continues to outperform it.

Shows periods where BTC was the superior asset to hold over that 30-day period.

On 1-Jan 2020, 1 $BTC = 4.9 oz Gold

Today, 1 $BTC = 14.2 oz Gold

>https://t.co/RLd2sM90xh https://t.co/eYJNRmI3Rh pic.twitter.com/3YaQi9VjU8— _Checkɱate ⚡☢️️ (@_Checkmatey_) May 3, 2023

Magazine: Magazine:Unstablecoins: Depegging, bank runs and other risks loom

This article does not offer investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a choice.