Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin targets $28K as traders anticipate CPI day volatility in BTC prices.

On May 10, Bitcoin (BTC) hovered around $27,500 as markets prepared for what is anticipated to be a favorable inflation report from the United States.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

CPI expected to decline over the coming months

Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it remained within a tight trading range ahead of the April Consumer Price Index (CPI) announcement.

The CPI serves as a traditional volatility trigger for risk assets and is one of the crucial indicators the Federal Reserve evaluates when adjusting interest rates.

The next adjustment is a month away, but both governmental and private-sector indicators suggest that the trend of decreasing inflation is likely to continue and may even accelerate in the upcoming months.

“There’s a bit of stagnation currently, but over the next two to three months, we’re expected to see a gradual decline, and indeed a quite significant drop, in inflation,” financial commentator Tedtalksmacro stated during a YouTube analysis on May 9.

Tedtalksmacro referred to both the Cleveland Fed inflation forecast and “Trueflation,” an unofficial leading indicator for inflation trends, which also indicated further significant declines ahead.

In a follow-up tweet that day, Tedtalksmacro illustrated potential BTC price fluctuations based on various CPI outcomes, along with the probabilities as estimated by JPMorgan Chase.

CPI gameplan for #Bitcoin

Above 5.5% –> $25,000 (4% probability)

5.3% to 5.5%–> $26,500 (25% probability)

5.0% to 5.2% –> $28,500 (50% probability)

4.7% to 4.9% –> $29,000 (20% probability)

4.5% or lower –> $30,000+ (1% probability)

*Probabilities according to JPMorgan— tedtalksmacro (@tedtalksmacro) May 10, 2023

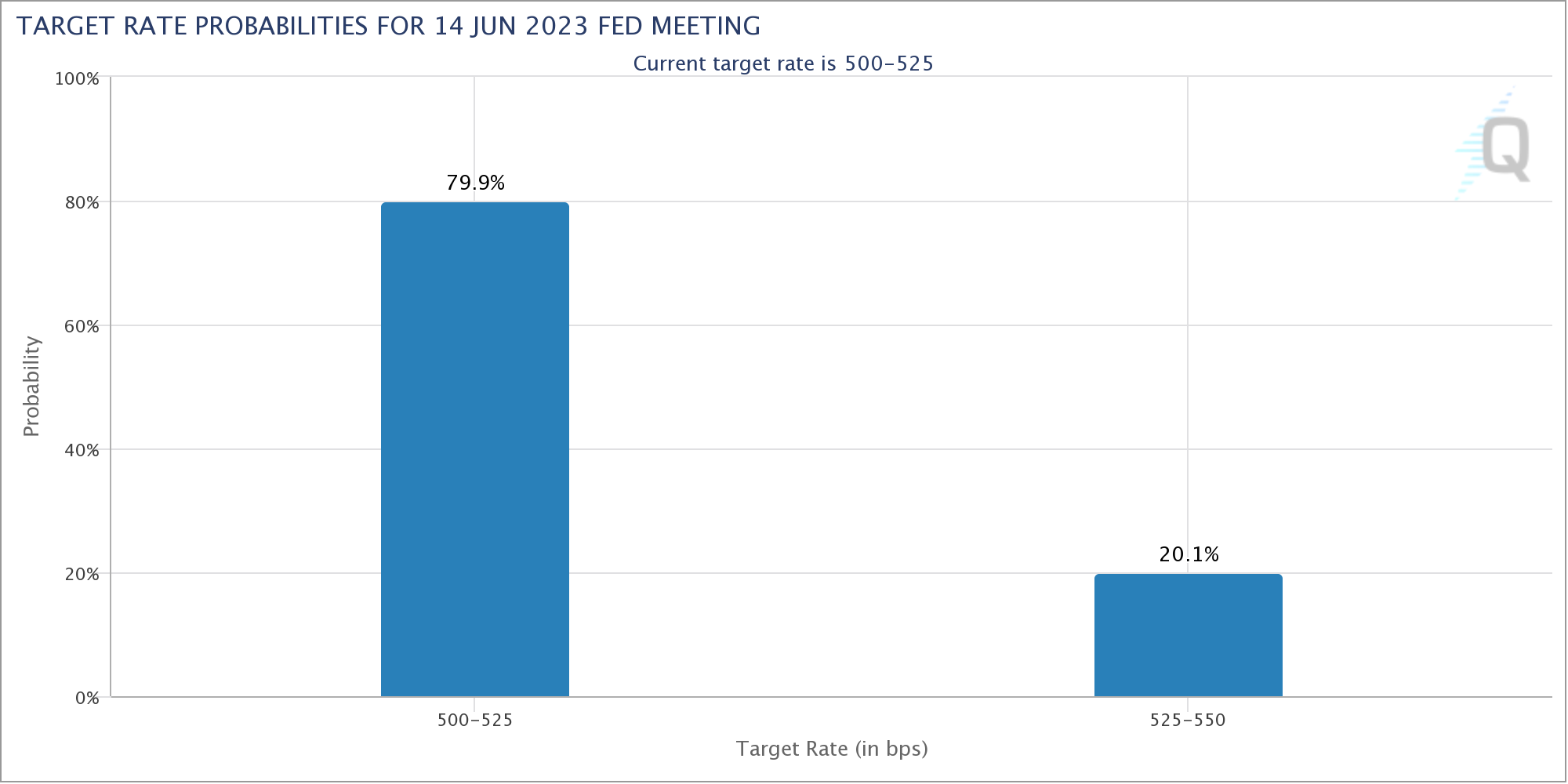

As per CME Group’s FedWatch Tool, market expectations for the Federal Reserve to halt interest rate increases to control inflation in June were at 80% at the time of this report.

Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME Group

Binance traders increase spot selling

In terms of short-term BTC price movements, the lingering effects of the Binance “FUD” incident earlier in the week meant that Bitcoin bulls struggled to regain levels closer to $30,000.

Related: Binance ‘FUD’ meets CPI — 5 things to know in Bitcoin this week

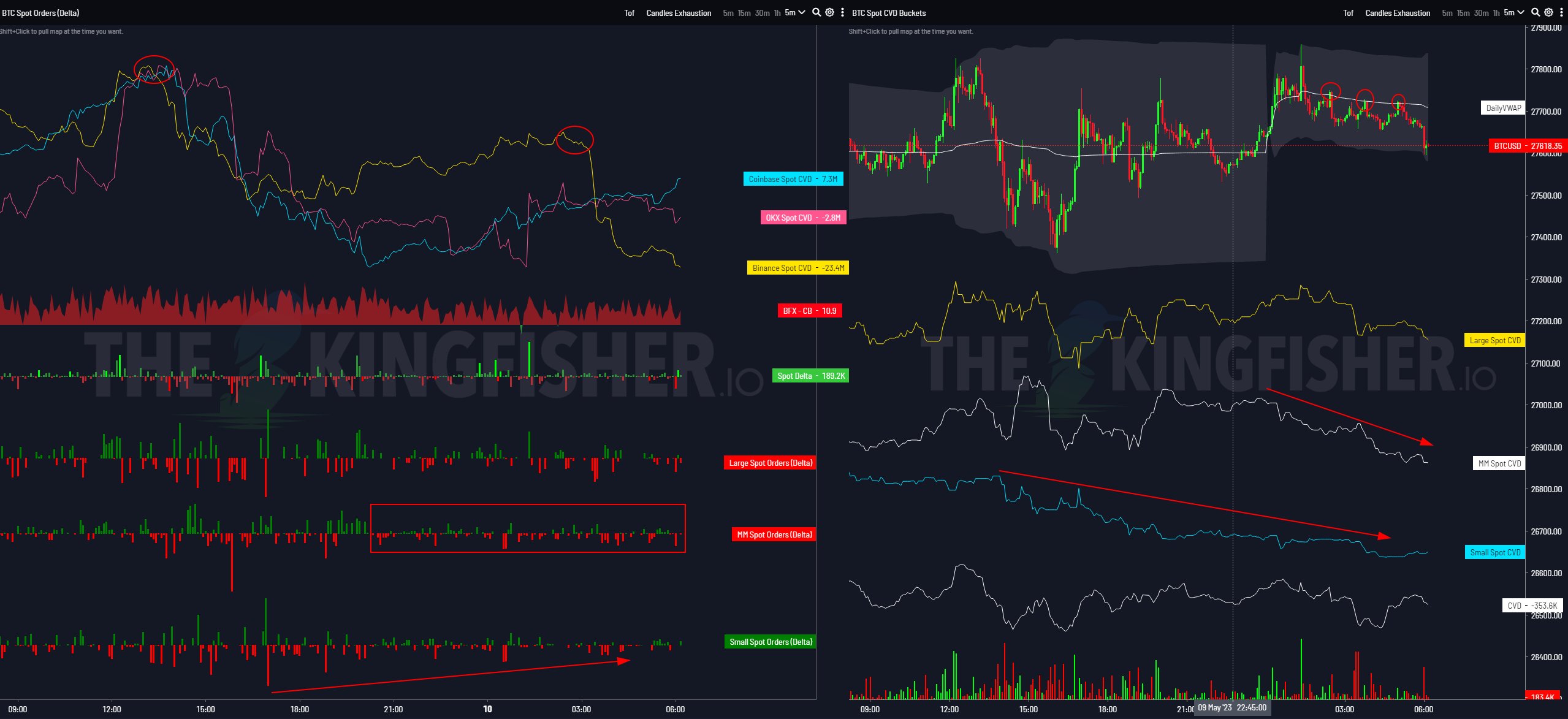

Examining the current situation among traders, monitoring resource Skew characterized the market as “overly saturated with shorts,” with market makers continuing to sell into minor price increases.

“Binance spot is the market selling aggressor today,” stated part of a Twitter commentary.

BTC/USD order book data. Source: Skew/ Twitter

BTC/USD order book data. Source: Skew/ Twitter

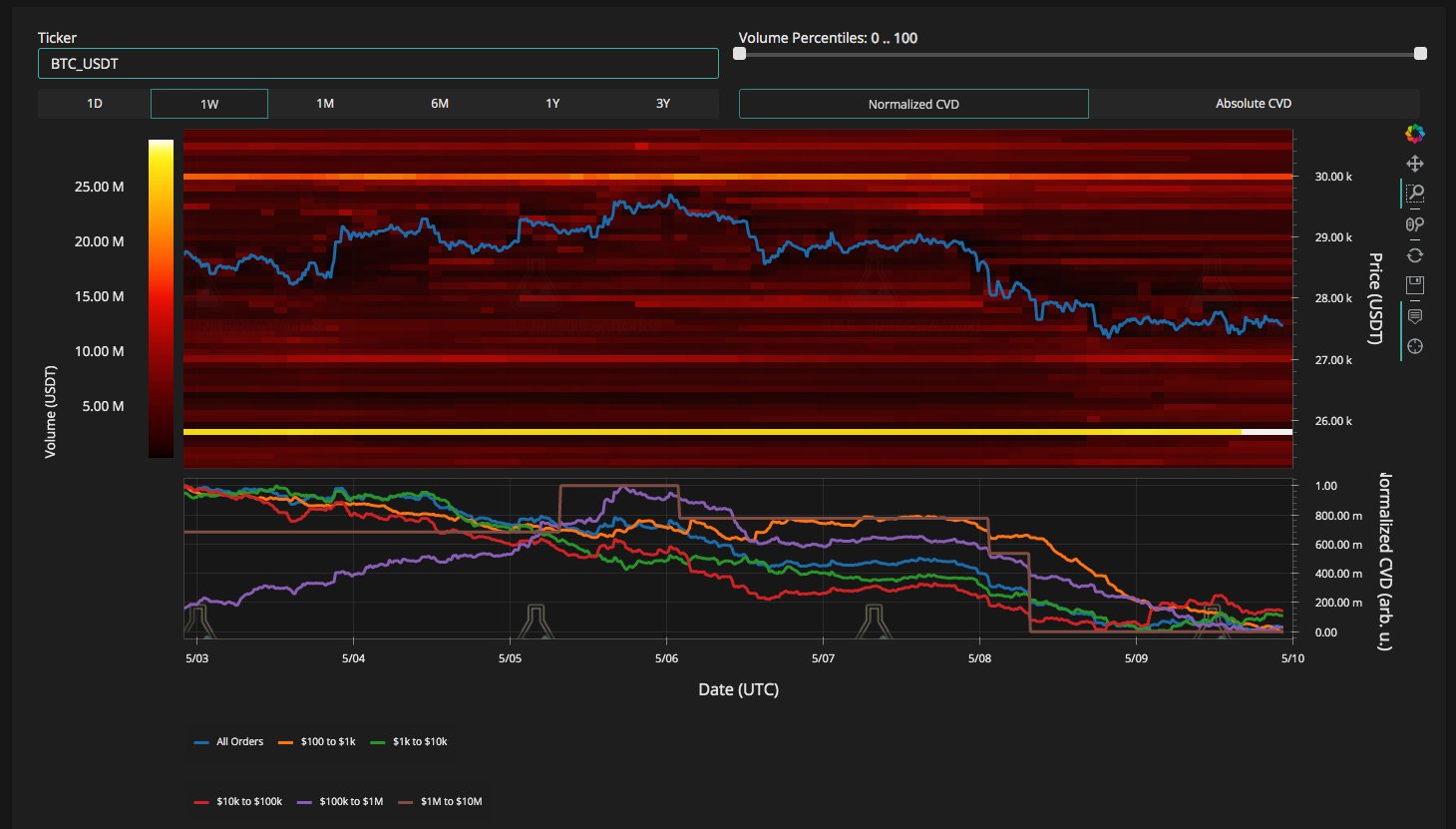

During the night, fellow monitoring resource Material Indicators observed an increase in bid liquidity just below the $26,000 level on the Binance BTC/USD order book.

“Expecting to see liquidity shifting around the order book between now and the morning economic reports,” part of the comments on an accompanying chart noted.

“The question is, will some of what’s there now get cleared out and create room for volatility, or will local support and resistance be fortified with buy and sell walls?”

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a decision.