Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin supporters gather around $28K as trader indicates a significant buyer needs to emerge.

Bitcoin (BTC) maintained significant pressure on the $28,000 mark as the weekly close approached on October 8, with geopolitical uncertainty becoming a focal point for traders.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Trader: Bitcoin’s behavior at resistance “not the best”

Data from Cointelegraph Markets Pro and TradingView indicated that BTC’s price performance avoided significant downside fluctuations over the weekend.

The pair rebounded from a quick retest of $27,000 on October 6, aided by unexpected employment data from the United States that diverged from adjustments by the Federal Reserve.

Currently, the $28,000 resistance has become the primary focus for market participants as the new week begins.

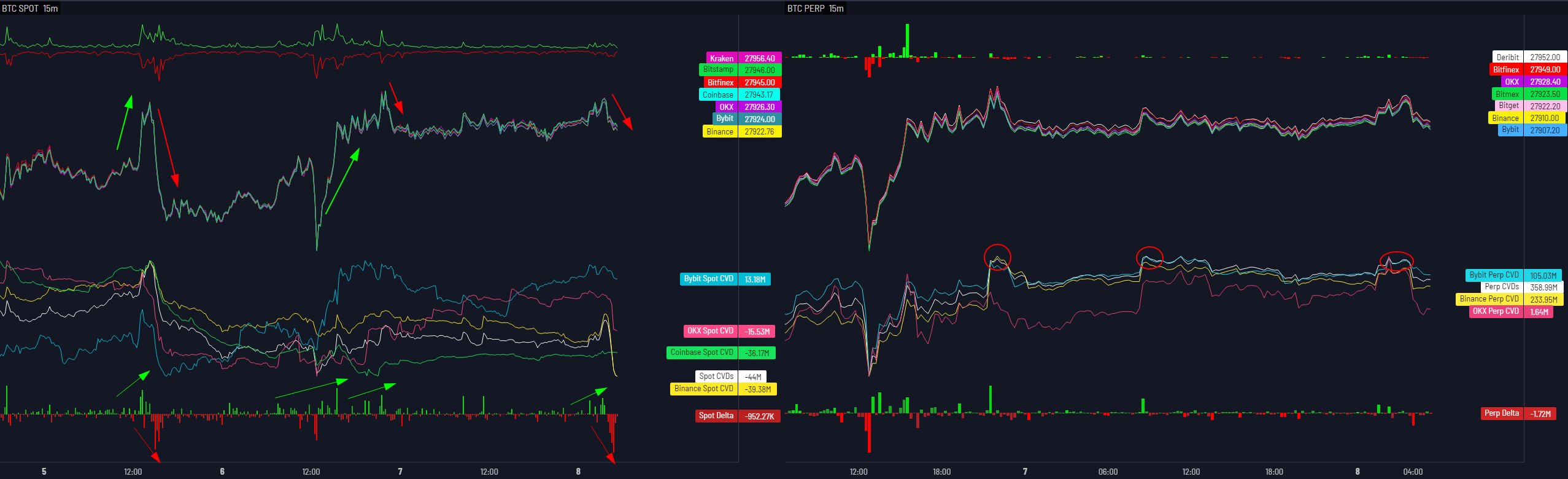

In low timeframe (LTF) analysis of exchange order books, well-known trader Skew noted that substantial buying power is still necessary to convert $28,000 into support.

“So on LTF we can see clearly the market is still trading $28K as resistance. Going to require a big spot buyer to crack that area imo,” he informed his X (formerly Twitter) followers.

“Perps are shorting every LTF bounce into $28K as well.”

Bitcoin order book data. Source: Skew/X

Bitcoin order book data. Source: Skew/X

Skew further characterized Bitcoin’s response to both that level and the 200-day moving average (MA), currently at $28,040, as “not the best kind.”

Another trader, Daan Crypto Trades, advised caution against shorting BTC if a sudden breakout occurs, as this could signal the beginning of further upward movement.

“I will say that with BTC sitting around this big $28K level which has the Daily/Weekly 200MA sitting there, I am personally not very keen on shorting any deviations above,” part of an X post stated.

“In the past, we’ve often seen a weekend breakout at these kinds of spots which tend to not retrace as easily as they otherwise would.”

An accompanying chart displayed the closing price of last week’s CME Bitcoin futures markets, which is likely to act as a price “magnet” as the new week unfolds.

“Trading around the CME price is best practiced during a ranging & choppy environment,” he added.

“We are still in such an environment but that would likely change upon a strong break above this region. Hence me not being too eager to short immediately in case we’d see a weekend pump.”

BTC/USD annotated chart with CME Bitcoin futures data. Source: Daan Crypto Trades/X

BTC/USD annotated chart with CME Bitcoin futures data. Source: Daan Crypto Trades/X

Analyst renews $30,000 BTC price forecast

In light of events in Israel, others highlighted geopolitical instability as a potential catalyst for BTC price movements ahead.

Related: Bitcoin bull market awaits as US faces ‘bear steepener’ — Arthur Hayes

Among them was Michaël van de Poppe, founder and CEO of trading firm MN Trading.

“Now; market perspective it’s going to be a volatile week,” he wrote in part of his X analysis.

“My idea is that Bitcoin continues the upwards grind & potentially reaches $30K as worldwide uncertainty grows.”

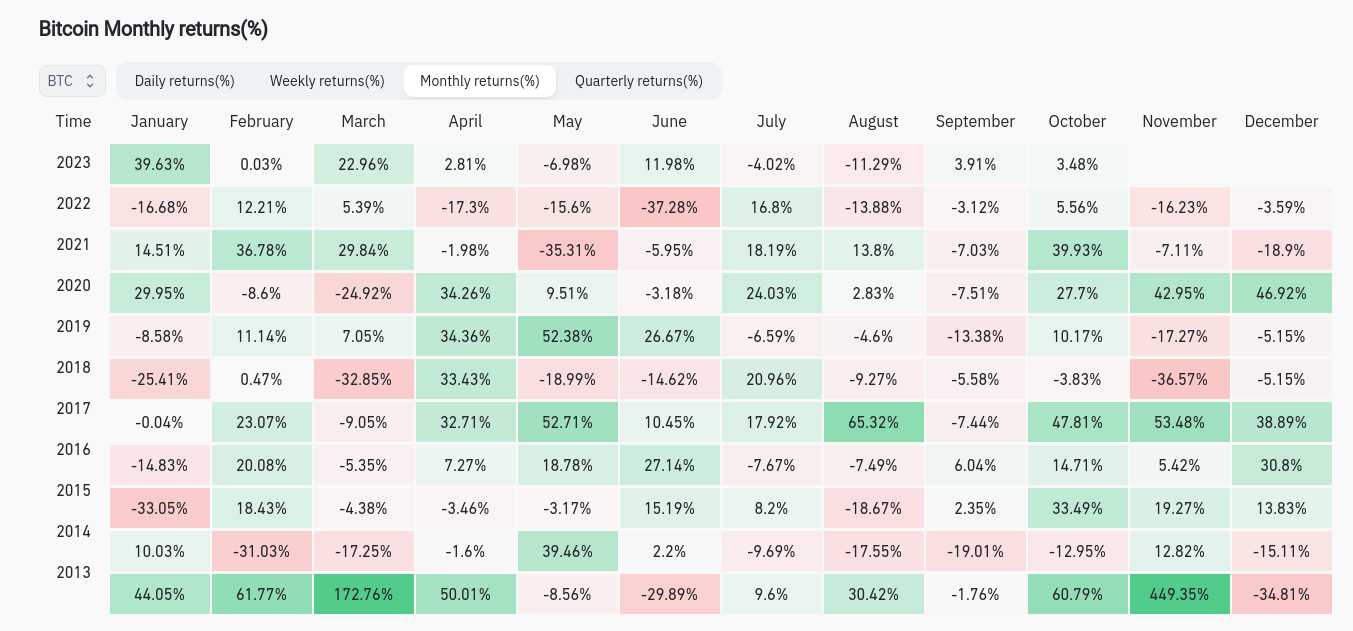

Van de Poppe had previously predicted a move beyond the $30,000 threshold in October, which is typically Bitcoin’s strongest month.

At just under $28,000, BTC/USD was up 3.5% month-to-date at the time of writing, according to data from monitoring resource CoinGlass.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.