Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin struggles to maintain $26K as US dollar reaches highest level in 10 months.

Bitcoin (BTC) remained around $26,000 at the opening of Wall Street on September 24, following a weekly close that resulted in significant repercussions.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin needs to maintain support, analysts indicate

Data from Cointelegraph Markets Pro and TradingView revealed an uncertain price path for BTC after it briefly dipped below the $26,000 support level.

Weekend trading, which had been stagnant, took a downturn as the new week began, and a disappointing overnight session left bulls unable to recover lost ground.

#Bitcoin Weekend price movement wasn't thrilling until the later hours on Sunday as anticipated.

Price remained near the CME Close price until futures began trading, at which point it experienced a sharp decline. https://t.co/HgmYShdrjA pic.twitter.com/VAzov8haCJ— Daan Crypto Trades (@DaanCrypto) September 25, 2023

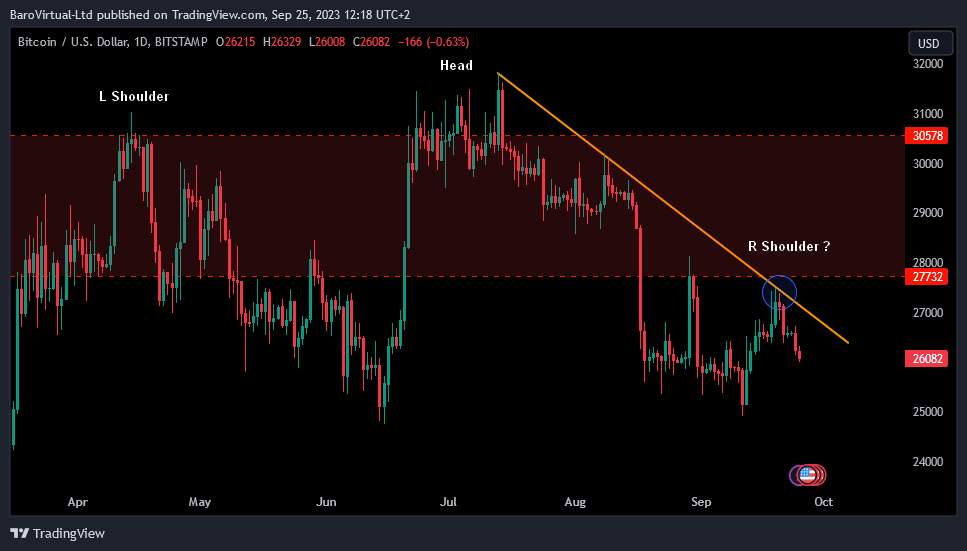

“Bitcoin was unable to surpass local resistance represented by a descending trend line, and it appears a bearish right shoulder may be forming,” analyst BaroVirtual, an ambassador for the on-chain data platform Whalemap, noted.

BaroVirtual shared a daily chart on X, indicating a potential head and shoulders pattern nearing completion.

“If this is accurate, BTC could fall into the $22,000-$20,000 range,” it added.

BTC/USD annotated chart. Source: BaroVirtual/X

BTC/USD annotated chart. Source: BaroVirtual/X

This viewpoint aligned with others who were already anticipating a return to the $20,000 level — a price point that has not been seen in BTC charts for six months.

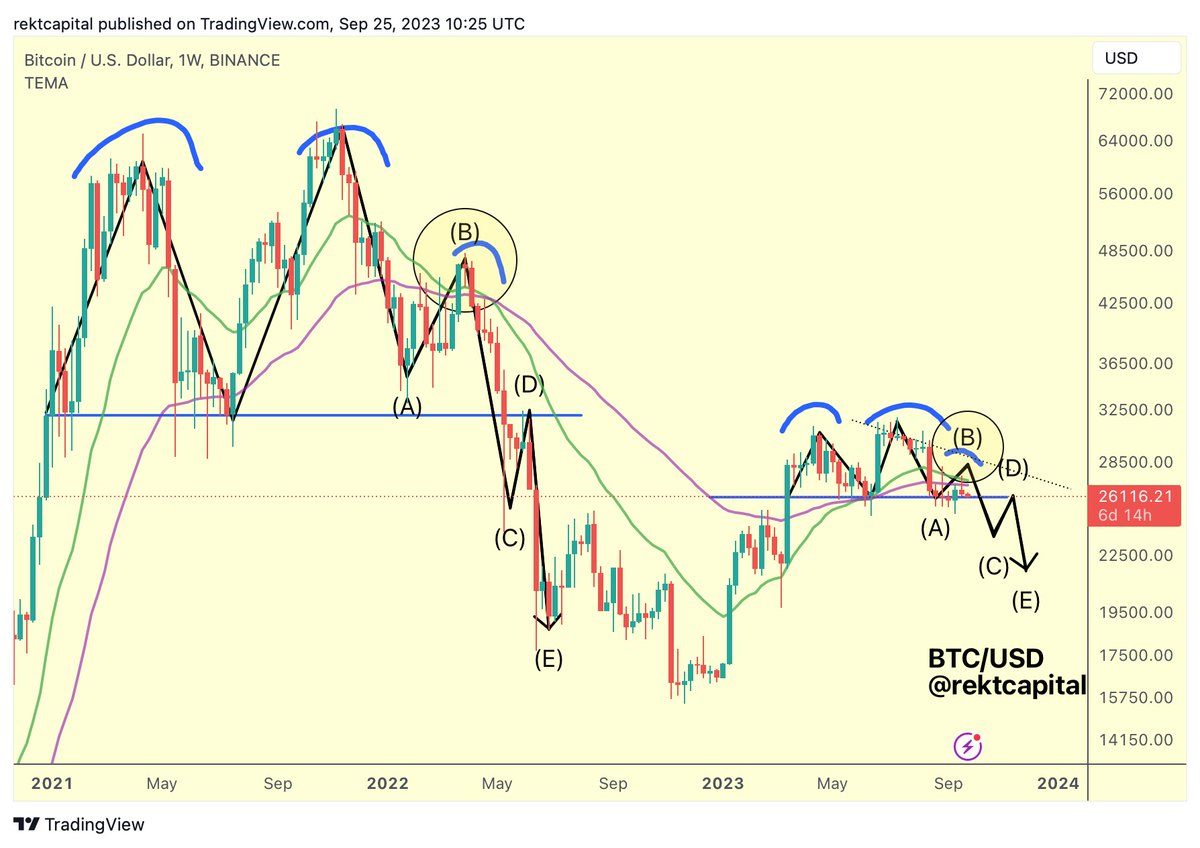

Well-known trader and analyst Rekt Capital, who had previously predicted the possible return of the low $20,000s as part of a breakdown from a double top pattern, now stressed the importance of maintaining current levels as support.

“Bitcoin could experience a downside wick into the ~$25000-$26000 range during this current downward movement,” he stated in a recent analysis on X.

“However, if ~$26000 starts to act as resistance, it could signal a bearish trend indicating that the ~$25000-$26000 area is weakening as support. If BTC converts the ~$25000-$26000 area into new resistance, the price may drop to the ~$22000-$24000 region to establish a Local Bottom ‘C.’”

An accompanying chart illustrated the critical levels.

DXY rises to new highs for 2023

Meanwhile, macro markets opened to another potential challenge for Bitcoin and crypto — a persistently strong U.S. dollar.

Related: US gov’t shutdown looms — 5 things to know in Bitcoin this week

The U.S. dollar index (DXY) continued its upward trend, reaching 106.1 — its highest level since November 2022.

U.S. dollar index (DXY) 1-day chart. Source: TradingView

U.S. dollar index (DXY) 1-day chart. Source: TradingView

Since hitting 15-month lows in July, DXY has increased by 6.5%, demonstrating strength that has historically hindered the performance of risk assets and the crypto market.

Painful decline in risk assets as yields and DXY rise

Going to let this trading session develop further https://t.co/C67I5tJHRH— Skew Δ (@52kskew) September 25, 2023

“DXY surging higher — negatively impacting BTC, crypto, and other risk assets,” Matthew Dixon, CEO of the crypto rating platform Evai, remarked in part of his response.

Dixon had previously anticipated a potential easing in DXY strength, which could provide Bitcoin and altcoins with an opportunity for a relief bounce.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should conduct their own research before making any decisions.