Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin stabilizes around $67,000 as investors seek crash safeguards.

The typical bitcoin ETF investor currently faces a 20% paper loss, which could expose the market to capitulation selling if prices decline further, according to a trader from Wintermute.

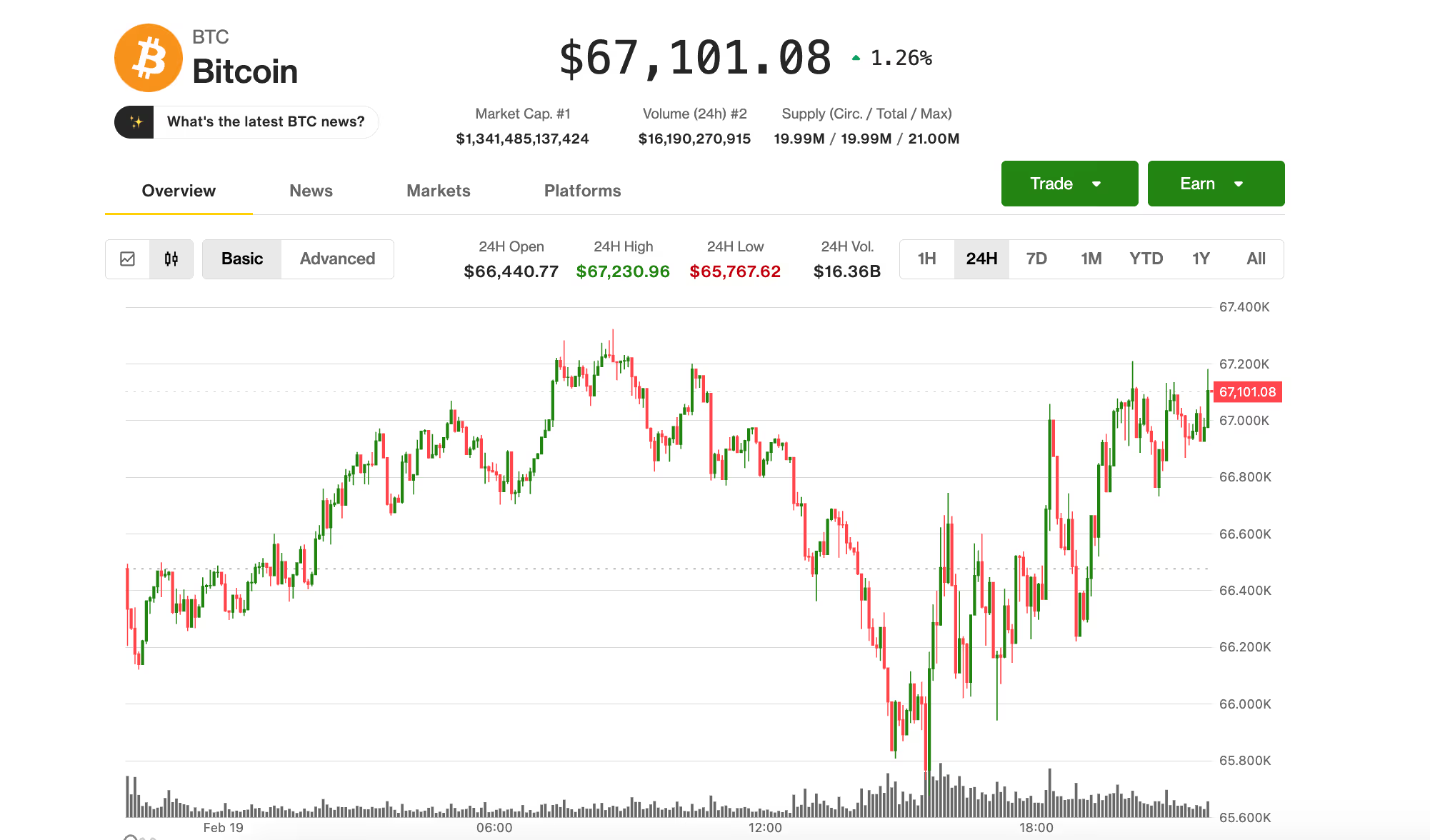

Bitcoin (BTC) price on Feb. 19 (CoinDesk)

Bitcoin (BTC) price on Feb. 19 (CoinDesk)

What to know:

- Bitcoin has stabilized near $67,000, successfully avoiding a further decline for the time being, while altcoins are trailing behind.

- Discussions at the White House regarding the cryptocurrency market structure bill have shown gradual advancement, yet concerns surrounding private credit markets and the possibility of U.S. military actions against Iran cast a shadow over high-risk assets.

- Traders in crypto derivatives are adopting a defensive strategy by purchasing downside protection in anticipation of a potential price drop, as observed by the head of OTC at Wintermute.

Bitcoin managed to establish a foothold on Thursday, remaining above a crucial technical threshold after briefly dipping below $66,000 earlier in U.S. trading. The leading cryptocurrency recently traded at approximately $67,000, reflecting an increase of about 1% over the preceding 24 hours.

The CoinDesk 20 Index underperformed, with ether (ETH), XRP, BNB, and solana (SOL) remaining flat or slightly declining during the same timeframe, potentially indicating ongoing caution in altcoins amidst volatile crypto markets.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Stocks associated with crypto experienced a slight increase across the board, with bitcoin mining companies CleanSpark (CLSK) and MARA (MARA) highlighting notable gains of 6%. Meanwhile, the S&P 500 and the tech-oriented Nasdaq 100 experienced declines of 0.3% and 0.6%, respectively.

On the legislative front, there are early indications of progress regarding the digital asset market structure bill. As reported by CoinDesk’s Jesse Hamilton, discussions held at the White House between representatives of the crypto industry and bankers have shown incremental progress, although no agreement has yet been reached.

Simultaneously, the repercussions of the recent crypto downturn continue to emerge. Blockfills, a Chicago-based crypto lending platform, is reportedly considering a sale following a $75 million lending loss during the recent price collapse and had temporarily halted client deposits and withdrawals last week. As crypto prices have sharply declined in recent months, investors are preparing for potential disruptions akin to those experienced by Celsius and FTX in 2022. Nonetheless, the current fallout seems to be contained — alleviating the most severe fears while also preventing the kind of comprehensive collapse that characterized the bottom of that harsh bear market and the onset of the 2023-25 bull run.

However, external risks persist, creating hesitance among investors to take on additional risks.

Concerns regarding increasing stress in credit markets were heightened after Blue Owl (OWL), a private-equity firm, permanently limited redemptions in its $1.7 billion retail-focused private credit fund. OWL shares dropped 6% on Thursday, while stocks of other prominent private credit managers, including Apollo Global (APO), Ares Capital (ARES), and Blackstone (BX), fell by over 5%.

Geopolitical tensions also present an additional concern, with the possibility of U.S. military action against Iran still a factor amid ongoing regional escalations. Crude oil prices increased by another 2.8% to over $66 per barrel, reaching their highest level since August.

Traders play defense

This sense of caution is evident in the crypto derivatives markets, as noted by Jake Ostrovskis, head of OTC at trading firm Wintermute. Numerous traders are acquiring downside protection while limiting their potential upside, which implies they are effectively paying for insurance against another price drop while restricting possible gains in the event of an upward breakout.

The average cost basis for U.S. bitcoin ETFs is currently around $84,000, resulting in a significant portion of ETF investors being underwater — averaging a 20% paper loss — and potentially susceptible to “capitulation selling” if prices decline further.

Nevertheless, total ETF holdings remain within approximately 5% of their peak in bitcoin terms, indicating that institutions are reducing exposure rather than hastily exiting the market.