Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin records strongest September since 2016 as BTC sellers target $27.5K.

Bitcoin (BTC) advocates lost their hold on $27,000 as September 30 approached, with the monthly and quarterly close becoming increasingly significant.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin prepares for three critical candle closures

Information from Cointelegraph Markets Pro and TradingView indicated a slowdown in BTC price movements leading up to the crucial September candle print.

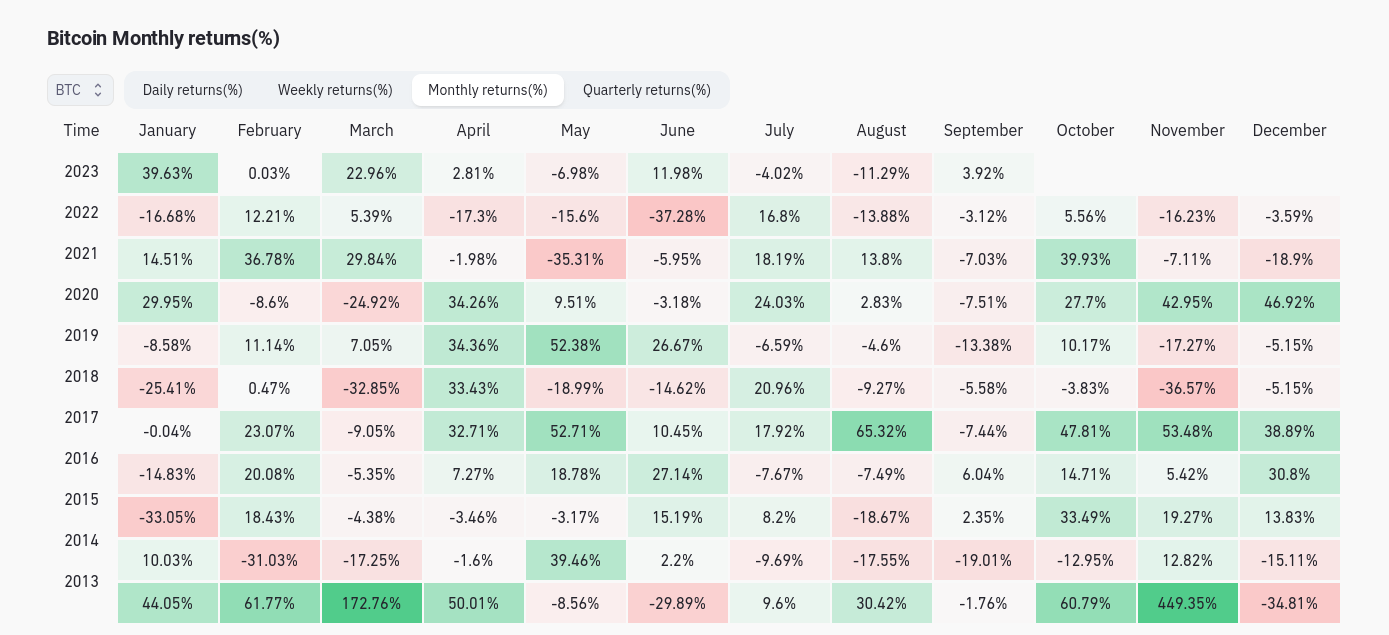

The foremost cryptocurrency remained nearly 4% higher for the month, representing its best September since 2016, according to data from monitoring platform CoinGlass.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

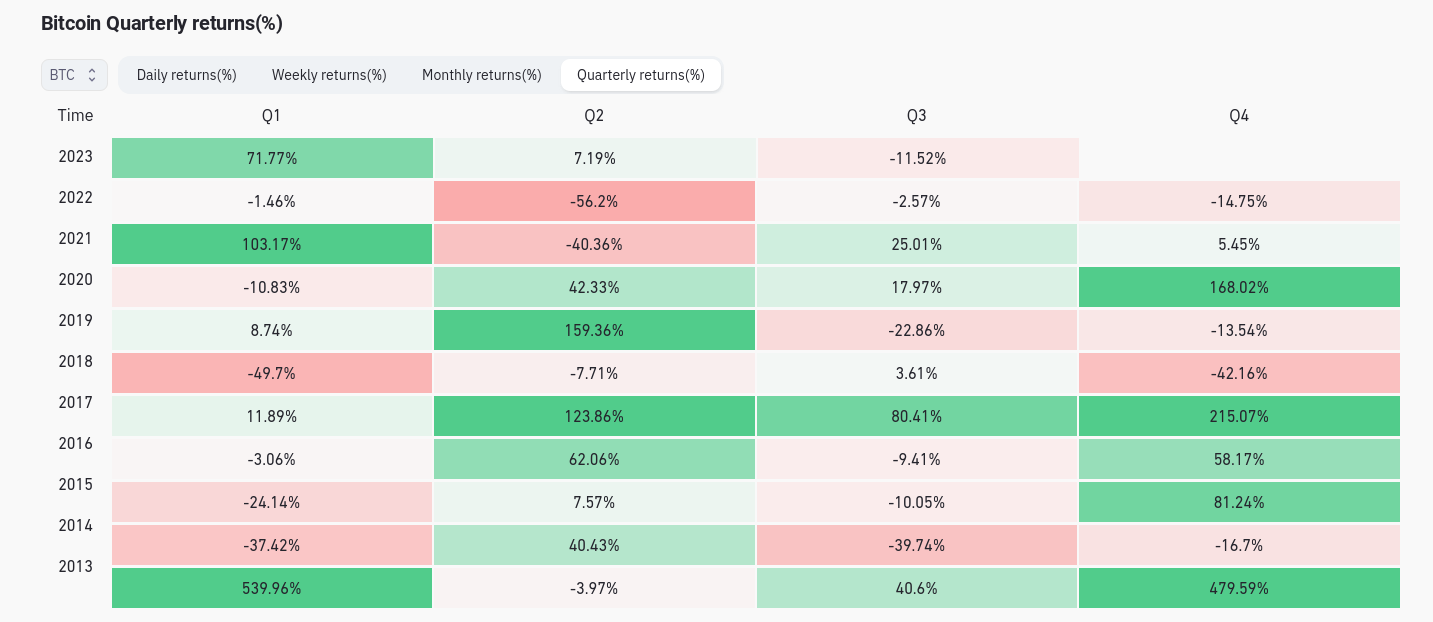

In contrast, the quarterly performance for Q3 revealed BTC/USD down 11.5% at the time of this report.

BTC/USD quarterly returns (screenshot). Source: CoinGlass

BTC/USD quarterly returns (screenshot). Source: CoinGlass

For traders and analysts, the final hours of the monthly candle could bring significant changes.

“Historically, a positive September has led to a fruitful October, November, and December,” remarked notable trader Jelle within the day’s X analysis.

“Will history repeat itself?”

The previous day, Jelle anticipated improved conditions for Q4, including a breakout above $30,000 for the first time since early August.

After several months of coin accumulation and gradually preparing for the bull market, I believe the time has come.

Anticipating Q4 to bring renewed strength — and a breach of $30k.

Let’s go.#Bitcoin pic.twitter.com/vkl0aq5hRS— Jelle (@CryptoJelleNL) September 29, 2023

“Classic bearish technicals”

In the meantime, Monitlonger and shorter timeframes.

Related: Bitcoin halving to elevate ‘efficient’ BTC mining costs to $30K

Aside from the monthly and weekly closure, the potential U.S. government shutdown is likely to continue hindering BTC price movements unless a resolution is reached promptly, it noted.

We are entering the final #trading day of the month with classic bearish technicals from the Key Moving Averages on Daily, Weekly, and Monthly timeframes, and #TrendPrecognition is signaling a new #TradingSignals on the #BTC Daily chart as if it knows we have a looming U.S.… pic.twitter.com/l9Mm2SHyFu

— Material Indicators (@MI_Algos) September 30, 2023

“There is a significant chance that large investors will escalate their weekend whale activities surrounding Daily, Weekly, and Monthly candle closures. Avoid falling into a trap,” part of additional remarks from Material Indicators co-founder Keith Alan stated.

A snapshot of the BTC/USD order book on the largest global exchange Binance revealed bid liquidity clustering around $26,800. Meanwhile, sellers were positioned at $27,500.

BTC/USD order book data for Binance. Source: Material Indicators/X

BTC/USD order book data for Binance. Source: Material Indicators/X

Others, including well-known trader Daan Crypto Trades, predicted reduced volatility until just before the new week begins.

<p“We experienced volatility last week, but open interest has decreased, so I doubt we’ll see any unusual price movements until perhaps later on Sunday,” he informed X subscribers on that day.

An accompanying chart demonstrated that the CME Group Bitcoin futures’ opening and closing prices might act as a magnet for BTC spot price — a typical occurrence.

BTC/USD annotated chart. Source: Daan Crypto Trades/X

BTC/USD annotated chart. Source: Daan Crypto Trades/X

This article does not offer investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research prior to making any choices.