Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin reaches two-week low following US inflation report — When might BTC price recover?

Bitcoin (BTC) reached new lows for October following the Wall Street opening on Oct. 11, as one analyst described this as the “final stage” of the cryptocurrency bear market.

BTC/USD 12-hour chart. Source: TradingView

BTC/USD 12-hour chart. Source: TradingView

Bitcoin traders emphasize significance of $26,800

Data from Cointelegraph Markets Pro and TradingView indicated further weakness in BTC prices, leading to a loss of the $27,000 support level for bulls.

At the time of this report, the leading cryptocurrency was trending towards $26,600 as downward pressure intensified.

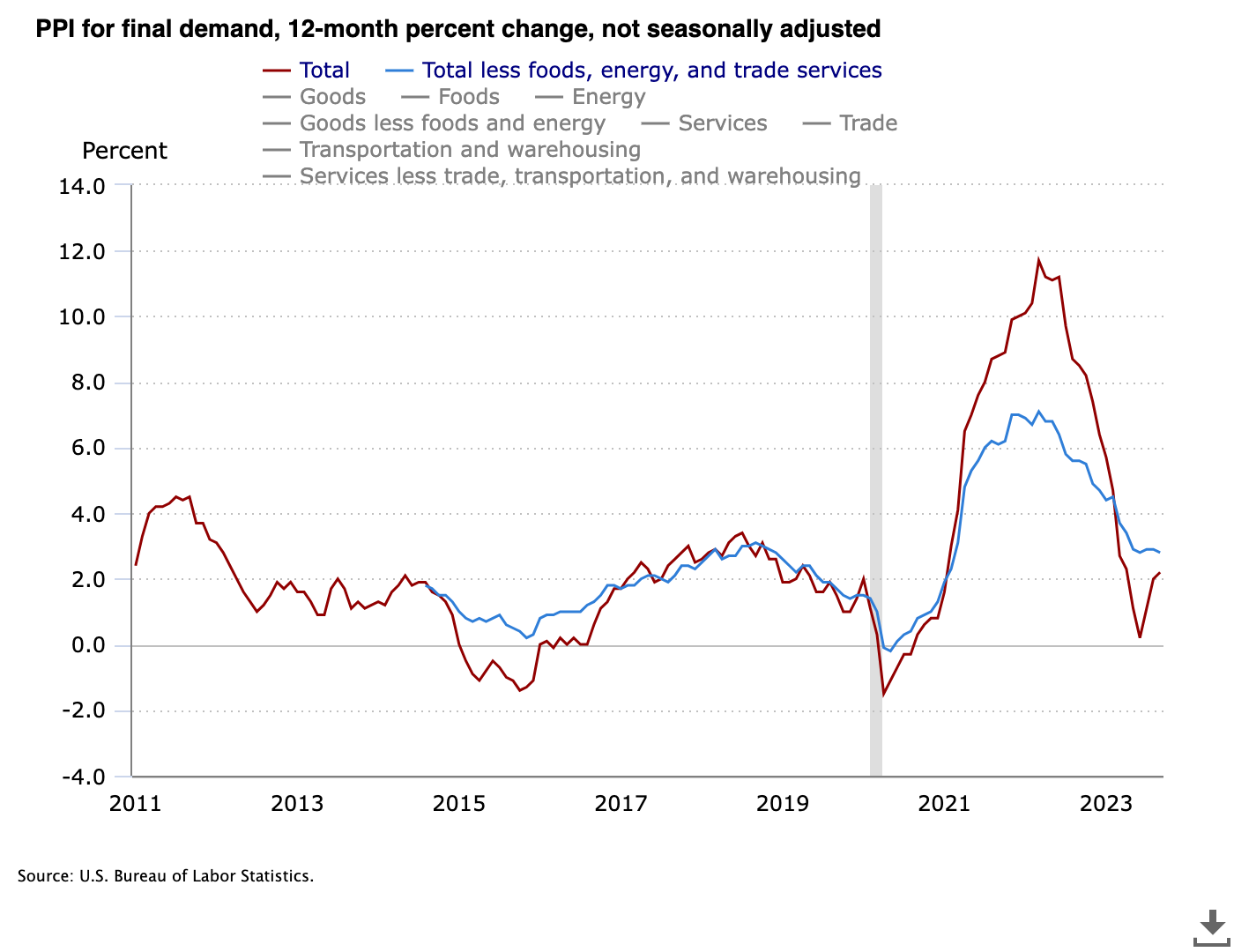

This decline followed the release of U.S. inflation data, specifically the Producer Price Index (PPI), which for September exceeded expectations at 2.2% compared to 1.6% year-on-year (YoY). This raised concerns regarding persistent inflation pressures in the U.S., with a stronger dollar and declining risk assets.

Producer Price Index (PPI) chart. Source: U.S. Bureau of Labor Statistics

Producer Price Index (PPI) chart. Source: U.S. Bureau of Labor Statistics

“PPI coming in hotter than anticipated suggests that the $DXY may experience an upward bounce, leading to some corrections for Bitcoin. I am still observing the lower boundaries here for potential entry points,” Michaël van de Poppe, founder and CEO of MN Trading, remarked on X.

Having already dropped $1,000 since a “death cross” was completed on the daily chart earlier in the week, Bitcoin reached its lowest point since Sep. 29. This development erased its prior gains for October, thereby negating the month’s reputation as a typical “Uptober.”

“The final stage of the bear market for Crypto,” Van de Poppe added.

“We might be reversing here already in October, moving into an uptrend in November (retesting the $26,800 area) or we might see a reversal at the end of December for a pre-halving & ETF rally. Positive times are ahead for Bitcoin.”

In light of the recent movements, well-known trader Skew also pointed out that $26,800 is a vital level within the current range.

“I will wait for a close, but it appears to be a rejection so far; this is also the last area for bulls to take action in my opinion ~ $26.8K,” he informed X subscribers regarding the 4-hour chart.

Simultaneously, fellow trader Daan Crypto Trades observed multi-month highs in open interest, with elevated levels triggering the volatility experienced in the first week of the month.

#Bitcoin At its highest Open Interest level since the August drop.

Typically, this is followed by some form of squeeze from this point. pic.twitter.com/IZuhVbt6lt— Daan Crypto Trades (@DaanCrypto) October 11, 2023

Binance order book reveals thin bids

Before the PPI announcement, monitoring resource Material Indicators highlighted a lack of bid support on the BTC/USD order book on the largest global exchange, Binance. This was concentrated around $26,650.

Related: War, CPI and $28K BTC price — 5 things to know in Bitcoin this week

BTC/USD order book data for Binance. Source: Material Indicators/X

BTC/USD order book data for Binance. Source: Material Indicators/X

“This morning’s YoY Core PPI report indicates this metric has been trending upward since July,” co-founder Keith Alan noted in part of his subsequent commentary.

Alan further stated that interest rates may remain at current levels without relief for risk assets for a longer duration than previously anticipated.

“I’m not an economist, but I interpret that as higher for an extended period,” he concluded.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.