Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin reaches $30,000 as BTC investors prepare for $3.2 billion in weekly options expiration.

On April 26, Bitcoin’s (BTC) price surpassed $29,800, achieving a 9.6% increase within 24 hours and peaking at $30,024 on Bitstamp. Some analysts suggest that the 50% decline in First Republic Bank (FRB) shares on April 25 acted as a trigger for Bitcoin’s surge.

Bitcoin benefits from banking turmoil

Despite this upward movement, its price is still down 22.5% over the past year, which accounts for the cautious sentiment among bulls.

The FRB situation unfolded following the bank’s earnings report, which revealed a 40.8% decrease in client deposits during the quarter as customers withdrew their funds. It is noteworthy that the bank received a $30 billion cash infusion in March, yet the quarterly outflows exceeded $100 billion.

Conversely, the U.S. Federal Reserve indicated plans to raise interest rates above 5%. While this increase in capital costs may help control inflation, it could also lead to a weaker economy and a bearish market environment for risk assets, including Bitcoin.

Some experts attribute the rejection at the $31,000 resistance level to the stringent cryptocurrency regulatory landscape, particularly in the U.S., which became more apparent after Coinbase initiated legal action to compel the Securities and Exchange Commission to clarify industry regulations.

Specifically, the exchange requested the SEC to elucidate its process for classifying tokens as securities.

Nonetheless, Bitcoin’s 27% increase from March 26 to April 26 aligns with what bulls required to navigate the $3.2 billion monthly options expiry in April.

Bitcoin options: Bears placed 94% of bets below $28,000

The open interest for the April 28 options expiry stands at $3.2 billion, although the actual amount will likely be lower since bears anticipated price levels below $28,000. These traders were taken aback as Bitcoin surged 9.6% between April 25 and April 26.

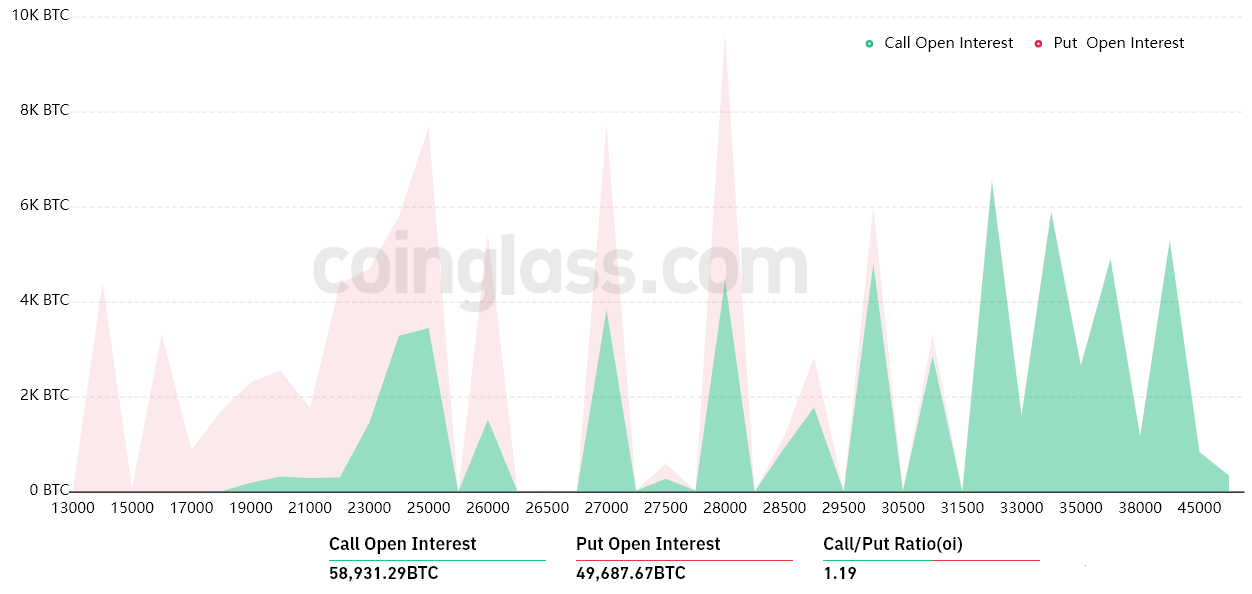

Bitcoin options aggregate open interest for April 28. Source: CoinGlass

Bitcoin options aggregate open interest for April 28. Source: CoinGlass

The call-to-put ratio of 1.19 indicates an imbalance between the $1.7 billion call (buy) open interest and the $1.5 billion put (sell) options.

However, if Bitcoin’s price remains around $29,500 at 8:00 am UTC on April 28, only $54 million worth of these put (sell) options will be in play. This discrepancy arises because the right to sell Bitcoin at $28,000 or $29,000 becomes irrelevant if BTC trades above those levels at expiry.

Bulls target $30,000 to secure a $780-million profit

Below are the four most probable scenarios based on the current price movements. The number of options contracts available on April 28 for call (bull) and put (bear) instruments varies according to the expiry price. The imbalance favoring each side represents the theoretical profit:

- Between $27,000 and $28,000: 14,300 calls vs. 8,700 puts. The net outcome favors the call (bull) instruments by $150 million.

- Between $28,000 and $29,000: 19,000 calls vs. 3,200 puts. Bulls expand their advantage to $445 million.

- Between $29,000 and $30,000: 21,700 calls vs. 1,900 puts. Bulls increase their advantage to $575 million.

- Between $30,000 and $31,000: 26,500 calls vs. 600 puts. The net result favors the call (bull) instruments by $780 million.

This rough estimate considers the call options utilized in bullish positions and the put options solely in neutral-to-bearish trades. However, this simplification overlooks more intricate investment strategies.

For instance, a trader might have sold a call option, thereby gaining negative exposure to Bitcoin above a certain price. Unfortunately, estimating this effect is not straightforward.

Related: Circle CEO attributes US crypto crackdown to declining USDC market cap

BTC bears face mass-liquidation in leveraged shorts

Bitcoin bulls are likely to be content with $575 million in profits if they cannot breach the $30,000 resistance. Meanwhile, bears require a 6.5% price decline from $29,800 to limit their losses to $150 million. However, leveraged positions betting on a price drop using futures contracts have recently experienced $166 million in forced liquidations, reducing the bears’ maneuverability.

Given the bullish momentum generated by the First Republic Bank issues, Bitcoin bulls are well-positioned for the April $3.2 billion BTC monthly options expiry.

It is probable that these profits will be utilized to further bolster the $28,000 support, with BTC’s price currently well above $29,000, making the anticipated outcome particularly concerning for bears.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any choices.