Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin price rises 5% in October — 5 key updates to follow this week in cryptocurrency

Bitcoin (BTC) embarks on a new week, a fresh month, and a new quarter with a robust bullish surge beyond $28,000.

The leading cryptocurrency welcomes “Uptober” with its most favorable weekly close since mid-August — what developments might follow?

Following a mixed BTC price trend in September, market participants braced for a potentially turbulent monthly close, which ultimately favored the bulls.

With October often being a period of notable BTC price increases, anticipation is building regarding what may unfold in the upcoming weeks.

Macro factors may not provide immediate clarity, as October commences with a quiet period for U.S. macro data and the government successfully avoiding a shutdown at the last moment.

Bitcoin’s fundamentals have yet to reflect the surge in spot price, with mining difficulty set to decrease during its next automated adjustment on Oct. 2.

Cointelegraph examines these issues and more in the weekly summary of BTC price catalysts awaiting attention.

Bitcoin bulls recognize BTC price reversal risk

Leading up to the Oct. 1 weekly close, Bitcoin had already surpassed the end of the September monthly candle with minimal overall volatility.

This changed dramatically as the week concluded, with a sudden surge propelling BTC price action to just below $28,000. In the subsequent hours, new local highs of $28,451 were recorded on Bitstamp.

Since the beginning of Oct. 1, the largest cryptocurrency has risen over 5%, as confirmed by data from Cointelegraph Markets Pro and TradingView.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

This movement resulted in Bitcoin achieving its highest weekly close since mid-August, negating the weaker performance observed since then.

“Bitcoin back up to $28,000,” Michaël van de Poppe, CEO and founder at MNTrading, informed X (formerly Twitter) followers on that day.

“Might fully retrace, but the trend is clearly upwards. Every consolidation of Bitcoin will be a period where altcoins are starting to follow the path of Bitcoin. This quarter will be fun!”

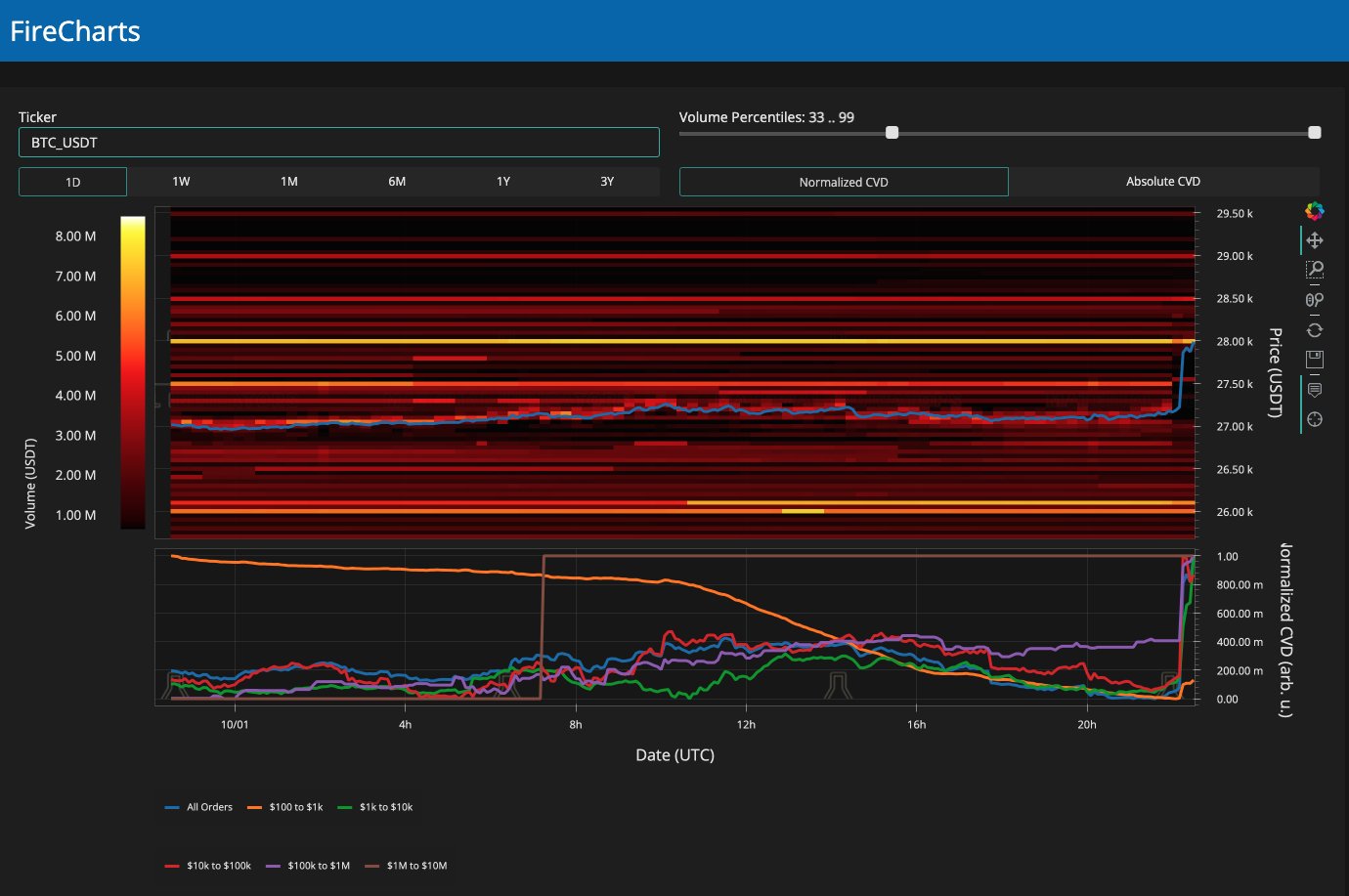

Notable trader Skew similarly highlighted the possibility of a decline, citing exchange order book trends as evidence.

“Pretty wide orderbook here in terms of available / resting liquidity,” he noted on that day.

“Bigger price reaction comes out of this imo Increasing ask liquidity on spot orderbooks; implies greater volume needed by spot takers to clear $28K – $29K (Market structure shift).”

BTC/USD 1-day chart with 200-week simple moving average (SMA). Source: TradingView

BTC/USD 1-day chart with 200-week simple moving average (SMA). Source: TradingView

He added that the impetus to determine the market’s direction now rests with spot traders.

$BTC Aggregate CVDs & Delta

Mostly seeing sell pressure just in perps for now

Price decline with Perp CVD decline & Perp sell delta picking up

Next move that decides fate of this entire move is spot pic.twitter.com/7mAB2XMvUh— Skew Δ (@52kskew) October 2, 2023

Keith Alan, co-founder of monitoring resource Material Indicators, shared a snapshot of the Binance order book, indicating $28,000 as the primary obstacle to surpass just after the move.

Bitcoin, he noted, was now facing resistance from the 200-week moving average at $27,970.

“Expecting another run at resistance this month, but since I’m still in ‘Buy the Dip, Sell the Rip Mode’ I’m going to stick to those rules, take the quick money and look for the next setup,” part of his accompanying commentary stated.

“Expecting volatility to continue over the next 24 hours.”

BTC/USD order book data for Binance. Source: Keith Alan/X

BTC/USD order book data for Binance. Source: Keith Alan/X

A classic “Uptober?”

Bitcoin’s strong start to October contrasts sharply with the events of last year.

As Cointelegraph reported, a 0.7% decline marked the beginning of what is statistically the most robust month for BTC price increases.

A surprisingly stagnant month ensued, culminating in the FTX collapse, which caused crypto markets to plummet to two-year lows later in Q4.

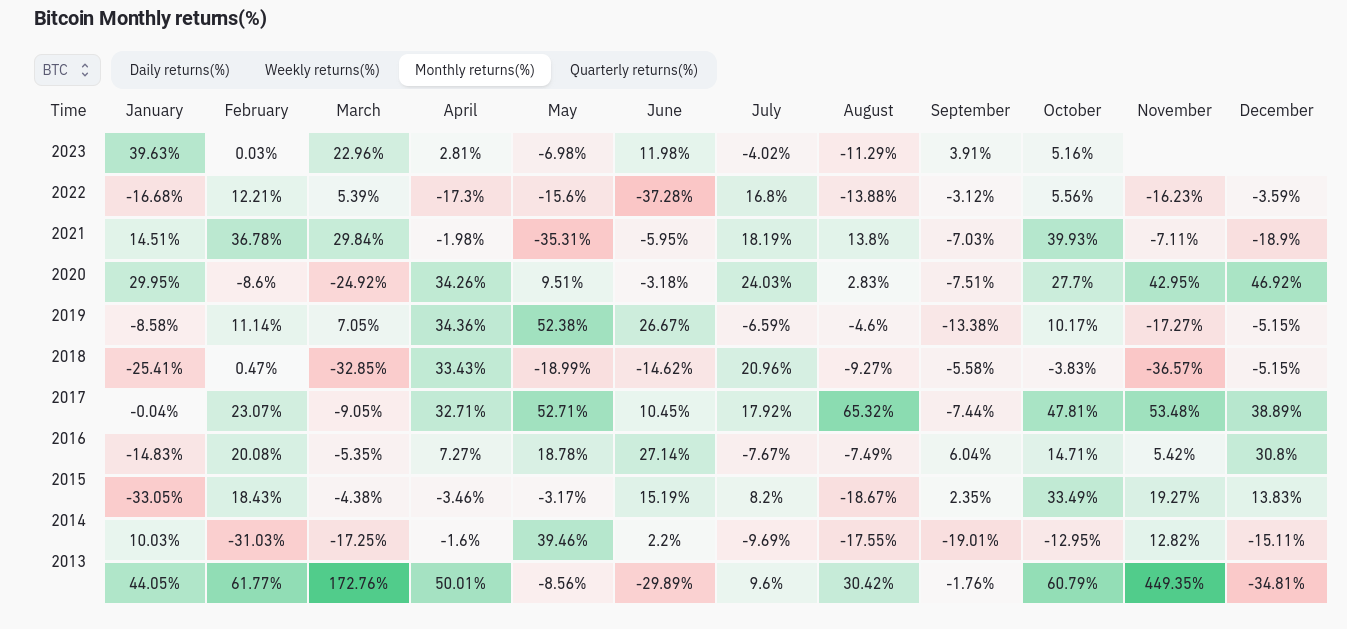

This year, however, the atmosphere feels different, resembling the traditional “Uptober” of previous years. Data from monitoring resource CoinGlass indicates that BTC/USD has not concluded October lower than its starting point since 2018.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

In discussions on the topic, prominent market commentators were eager to evoke the spirit of 2021 — a year in which Q4 did not witness a multiyear low but instead a new all-time high for Bitcoin.

Happy Uptober to those who celebrate.

Remember 2021? pic.twitter.com/qgHy1ThGOf— The Wolf Of All Streets (@scottmelker) October 2, 2023

Trader Jelle went further, suggesting that Bitcoin was undergoing a more significant trend shift.

“Bitcoin broke its mid-term downtrend, retested it, and is now starting the next leg higher,” he stated alongside an illustrative chart.

“Strong weekly close behind us, most charts look like we'll push even higher this week. Welcome to Uptober.”

BTC/USD annotated chart. Source: Jelle/X

BTC/USD annotated chart. Source: Jelle/X

Previously, like Van de Poppe, Jelle had suggested that this month could see BTC/USD surpass $30,000 for the first time since June.

“8 out of the previous 10 Octobers were positive for Bitcoin,” noted popular analytics account Stack Hodler in part of his own analysis on Oct. 1, highlighting that, on average, returns during that period had reached 22%.

Difficulty set to decrease from record high

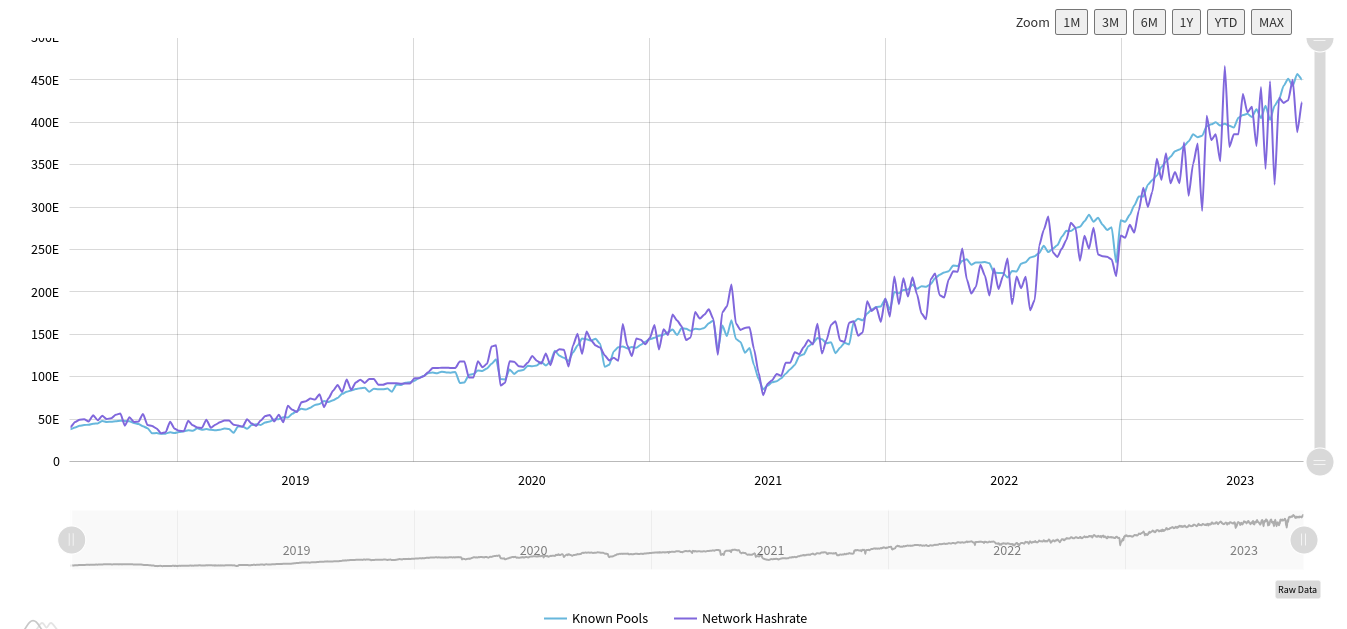

In a departure from the trend observed in recent months, Bitcoin network fundamentals are not reflecting the optimistic sentiment in spot markets.

The latest projections from data resource BTC.com indicate that, conversely, difficulty is expected to decline by 0.7% during its next automated adjustment on Oct. 2.

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

Currently at all-time highs, difficulty last increased by nearly 6% during a period when BTC price performance was notably uncertain.

Miner competition remains intense, as Cointelegraph reported in September, and increases in hash rate highlight the ever-evolving landscape as miners commit to the network for profitability.

With hash rate — the estimated processing power allocated to the network — also at unprecedented levels, the traditional saying “price follows hash rate” has resurfaced.

Not everyone subscribes to this notion, with some of Bitcoin’s most respected figures contending that the reverse is true: that hash rate follows price.

Among them is Jameson Lopp, co-founder and chief technology officer at Bitcoin storage firm Casa.

Hashrate follows price. Some folks believe price follows hashrate, possibly because hashrate doesn't simply track ~spot~ price, but rather tracks some ~speculative~ future price. Miners are speculators too!

— Jameson Lopp (@lopp) June 23, 2018

In a blog post published over the weekend, Lopp shared the outcomes of his efforts to enhance hash rate predictions.

“By blending together many hashrate estimates and weighting them based upon recent estimates with a variety of trailing data time frames we were fairly easily able to improve upon the 1100 block estimate and decrease the average error rate by 13% and lower the standard deviation by 14%,” he summarized.

Depending on the resource utilized, hash rate values can vary significantly, with only the overarching trend clearly discernible to observers.

Bitcoin raw hash rate data (screenshot). Source: MiningPoolStats

Bitcoin raw hash rate data (screenshot). Source: MiningPoolStats

Fed speakers dominate macro calendar

While Bitcoin experiences excitement in the first week of October, the same cannot be said for U.S. macro data, which is set for a calmer start to the month.

The primary anticipated event of the week has arguably already taken place, as lawmakers successfully avoided a government shutdown at the last moment.

Ukraine aid was the sticking point, which was removed to finalize a deal in Congress.

US Congress just passed a plan to avert US gov shut down.

This will likely calm the stock market and give us some green candles next week! Its a short term 45 days emergency extension.

No Gov Shut Down for now = Calm and Green week for #SP500 and #Bitcoin #Crypto… pic.twitter.com/DY6PhJPJqn— Seth (@seth_fin) October 1, 2023

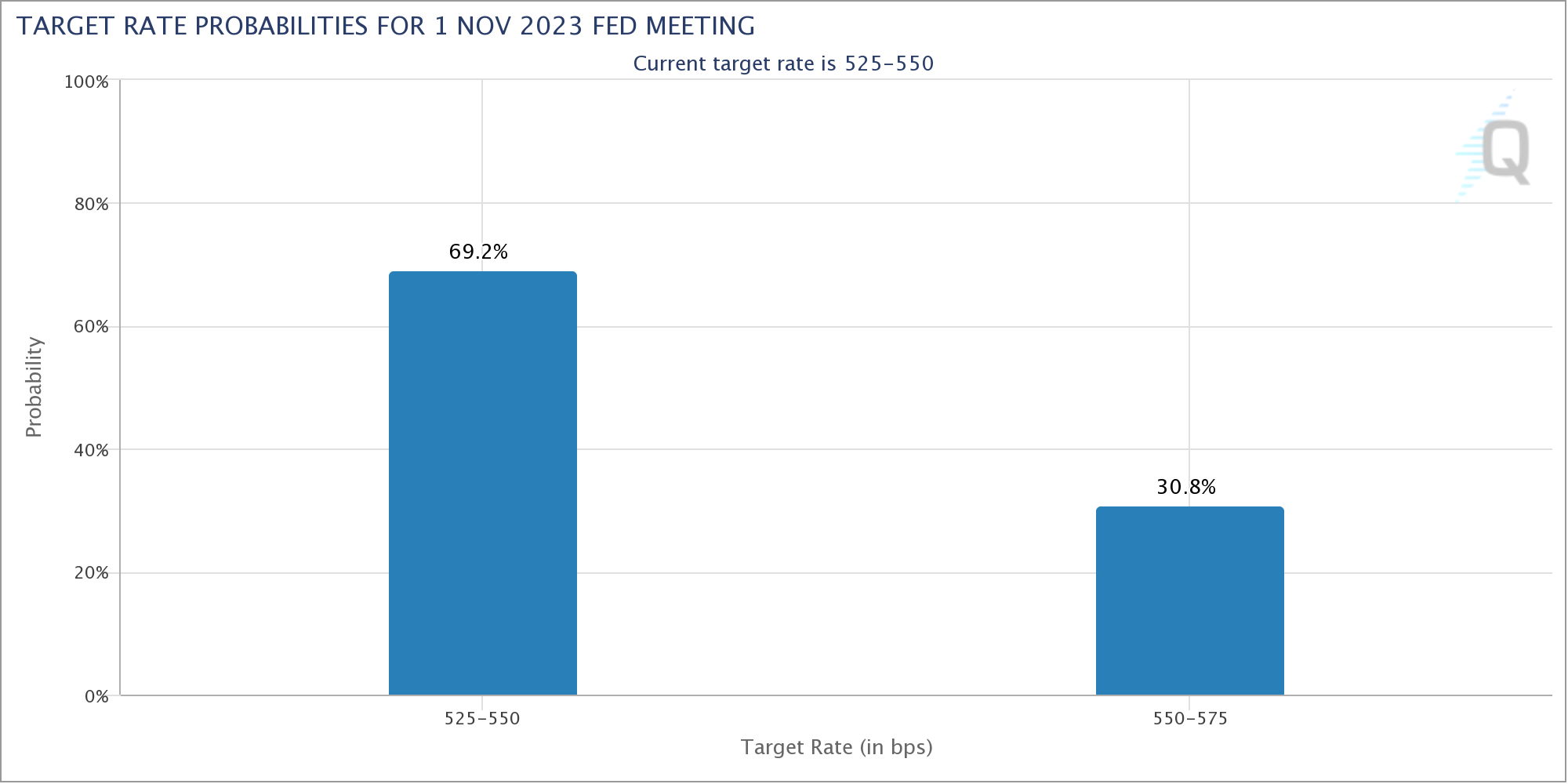

Looking ahead to the month’s outlook, the financial commentary resource The Kobeissi Letter focused on upcoming remarks from officials at the Federal Reserve.

As the next Federal Open Market Committee (FOMC) meeting approaches to determine interest rate policy on Nov. 1, markets will continue to monitor official statements for insights.

“The next Fed meeting is in exactly one month. With 13 Fed speakers this week, we expect even more volatility,” Kobeissi summarized on X.

The next Fed meeting is in exactly one month.

With 13 Fed speakers this week, we expect even more volatility.

We're publishing our trades for the week shortly.

In 2022, our calls made 86%.

Subscribe to access our analysis and see what we're trading:https://t.co/SJRZ4FrfLE— The Kobeissi Letter (@KobeissiLetter) October 1, 2023

The latest data from CME Group’s FedWatch Tool indicates mixed sentiments regarding the FOMC’s decisions. Currently, the market assigns a 62% probability to rates remaining at their current levels.

Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME Group

Analysis turns positive on dollar liquidity

Focusing on a related macro phenomenon, financial commentator Tedtalksmacro pointed to U.S. liquidity trends and their potential influence on BTC price movements in the future.

Related: Will Bitcoin ‘Uptober’ bring gains for MKR, AAVE, RUNE and INJ?

The correlation between global liquidity and the performance of risk assets is well established — particularly given the fluctuations since the onset of the COVID-19 pandemic.

Late last week, Tedtalksmacro illustrated a divergence between net U.S. dollar liquidity and BTC/USD.

Yes pic.twitter.com/cgzD5OoeKa

— tedtalksmacro (@tedtalksmacro) September 29, 2023

In the accompanying analysis, he argued that assessing delta over “outright liquidity” provides better insight. Regarding Bitcoin’s outlook, he expressed a positive view.

“Most importantly, the path of least resistance is now sideways / higher from here in the years to come… but substantial risk remains ( for at least a few quarters ), that you get chopped up before things rip quickly higher,” he stated.

Measuring liquidity outright is not so useful for informing investment decisions and tends to lag, however, measuring the delta or change week-on-week, month-on-month is much more powerful.

As there is often a lead on the liquidity side, at least when comparing with BTC price… pic.twitter.com/1DvE7xInxC— tedtalksmacro (@tedtalksmacro) September 29, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.