Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin price remains at $26K as derivatives information suggests a potential conclusion to the volatility surge.

In recent months, Bitcoin traders had become accustomed to lower volatility; however, historically, it is not unusual for the cryptocurrency to experience price fluctuations of 10% within just a few days. The recent 11.4% decline from $29,340 to $25,980 between August 15 and August 18 caught many off guard and resulted in the largest liquidation event since the FTX collapse in November 2022. Nevertheless, the question persists: Was this correction meaningful in terms of market structure?

Some analysts attribute the recent volatility spikes to diminished liquidity, but is this truly accurate?

BTC increased by over 70% in 2023, yet the "Alameda gap" – the liquidity drop following the FTX and Alameda Research collapse – persists, supported by low volatility.

Read full analysis here: https://t.co/kVslgLQtpL pic.twitter.com/g8Ac7udBl7— Kaiko (@KaikoData) August 17, 2023

According to the Kaiko Data chart, the 2% reduction in Bitcoin (BTC) order book depth has paralleled the decline in volatility. It is possible that market makers have modified their algorithms to correspond with the current market conditions.

Therefore, it seems prudent to explore the derivatives market to evaluate the implications of the drop to $26,000. This analysis seeks to ascertain whether whales and market makers have turned bearish or if they are seeking higher premiums for protective hedge positions.

To start, traders should pinpoint similar occurrences in the recent past, with two notable events standing out:

Bitcoin/USD price index, 2023. Source: TradingView

Bitcoin/USD price index, 2023. Source: TradingView

The first decline occurred from March 8 to March 10, leading to an 11.4% drop in Bitcoin to $19,600, marking its lowest level in over seven weeks at that time. This correction followed the liquidation of Silvergate Bank, a key operational partner for several cryptocurrency firms.

The next significant movement took place between April 19 and April 21, resulting in a 10.4% decrease in Bitcoin’s price. It returned to the $27,250 level for the first time in more than three weeks after Gary Gensler, the chair of the United States Securities and Exchange Commission, spoke before the House Financial Services Committee. Gensler’s remarks offered little assurance that the agency’s enforcement-driven regulatory actions would come to an end.

Not every 10% Bitcoin price crash is the same

Bitcoin quarterly futures typically trade at a slight premium compared to spot markets. This reflects sellers’ preference for receiving extra compensation for delaying settlement. Healthy markets generally see BTC futures contracts traded with an annualized premium ranging from 5 to 10%. This situation, known as “contango,” is not exclusive to the cryptocurrency sector.

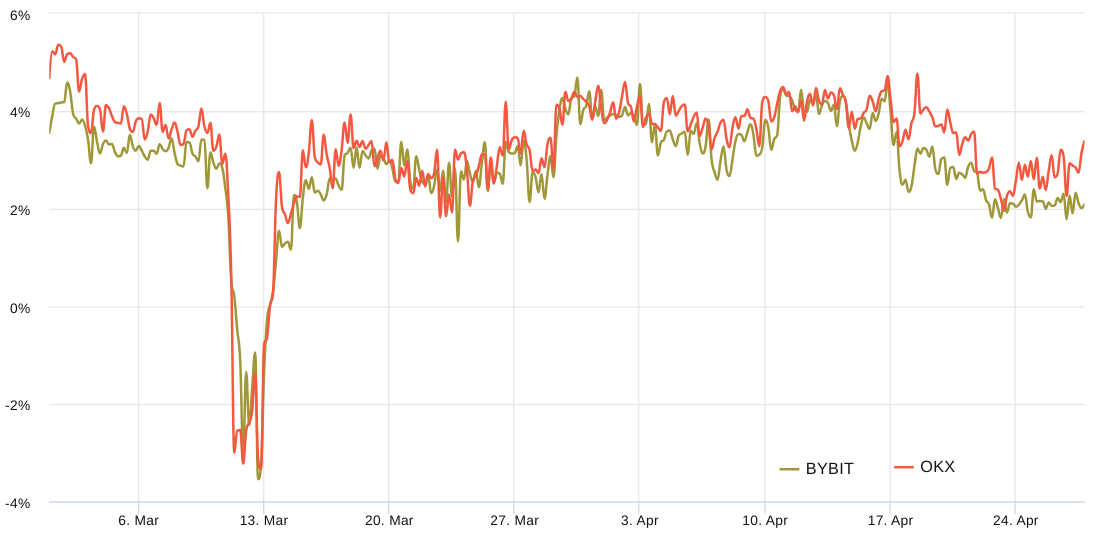

Bitcoin 3-month futures premium, March/April 2023. Source: Laevitas

Bitcoin 3-month futures premium, March/April 2023. Source: Laevitas

Leading up to the crash on March 8, Bitcoin’s futures premium was at 3.5%, indicating a moderate level of confidence. However, when Bitcoin’s price fell below $20,000, a heightened sense of pessimism emerged, causing the indicator to shift to a discount of 3.5%. This phenomenon, known as “backwardation,” is characteristic of bearish market conditions.

In contrast, the correction on April 19 had minimal effect on Bitcoin’s futures main metric, with the premium remaining around 3.5% as the BTC price revisited $27,250. This could suggest that professional traders were either very confident in the stability of the market structure or were well-prepared for the 10.4% correction.

The 11.4% BTC decline between August 15 and August 18 shows notable differences from previous occurrences. The initial level of Bitcoin’s futures premium was higher, exceeding the 5% neutral threshold.

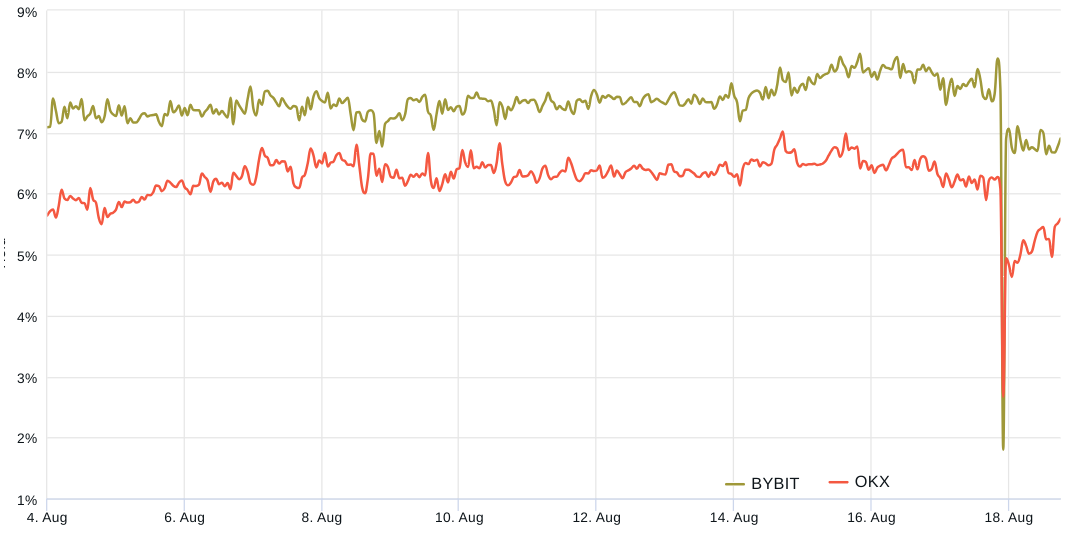

Bitcoin 3-month futures premium, August 2023. Source: Laevitas

Bitcoin 3-month futures premium, August 2023. Source: Laevitas

Observe how quickly the derivatives market absorbed the shock on August 18. The BTC futures premium rapidly returned to a 6% neutral-to-bullish position. This indicates that the drop to $26,000 did not significantly diminish the optimism of whales and market makers regarding the cryptocurrency.

Options markets confirm lack of bearish momentum

Traders should also examine options markets to determine whether the recent correction has led professional traders to become more risk-averse. In essence, if traders expect a decline in Bitcoin’s price, the delta skew metric will rise above 7%, while periods of enthusiasm typically exhibit a -7% skew.

Related: Why is the crypto market down today?

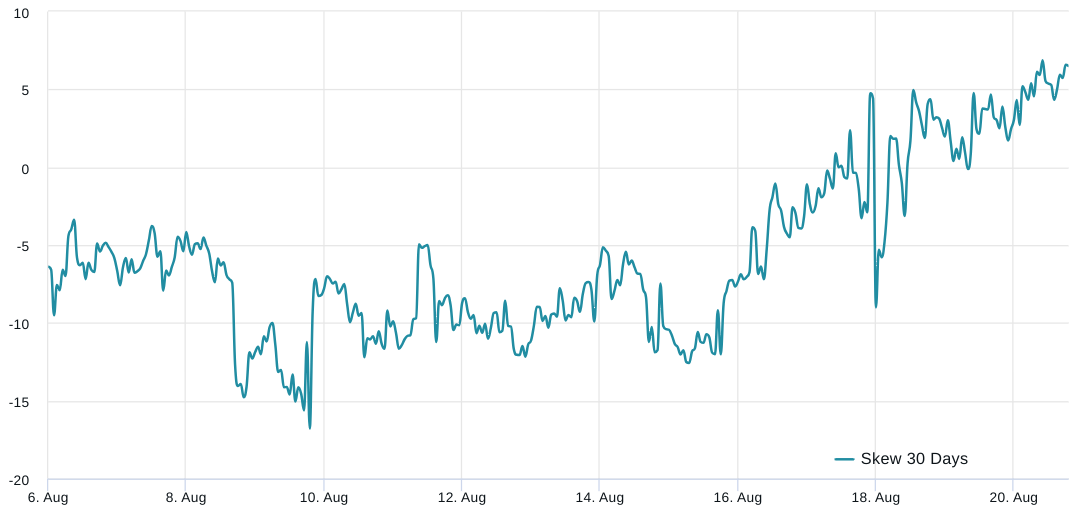

Bitcoin 30-day options 25% delta skew. Source: Laevitas

Bitcoin 30-day options 25% delta skew. Source: Laevitas

Data reveal strong demand for call (buy) BTC options prior to the August 15 crash, with the indicator at -11%. This trend shifted over the following five days, although the metric remained within the neutral range and did not surpass the 7% threshold.

Ultimately, both Bitcoin options and futures metrics indicate no signs of professional traders adopting a bearish outlook. While this does not necessarily ensure a quick return of BTC to the $29,000 support level, it does lessen the probability of a prolonged price correction.

This article is for informational purposes only and is not intended to be and should not be construed as legal or investment advice. The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.