Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin price hits a new low for April as traders assess chances of reaching $25K next.

Bitcoin (BTC) was approaching its range lows at the Wall Street opening on April 24, as investors debated the right moment to lock in profits.

BTC/USD 1-day candle chart (Bitstamp). Source: TradingView

BTC/USD 1-day candle chart (Bitstamp). Source: TradingView

BTC price targets reach $25,000

Data from Cointelegraph Markets Pro and TradingView revealed BTC/USD dropping beneath $27,300 on Bitstamp.

The pair initially reacted positively to the commencement of trading on Wall Street, but this was short-lived as a decline to $27,045 established fresh monthly lows.

Traders, eager for additional downside to capitalize on waiting bid liquidity, remained unfazed.

“Patiently waiting for the sweep,” noted popular trader Johnny.

Similar to others, Johnny identified $26,500 as a likely reversal zone, marking the range low established since mid-March and a crucial support level.

Some were more cautious, with Phoenix predicting a drop to $25,000 if the current support fails.

We'll likely head to 25K if this breaks, but it remains support until proven otherwise$BTC #Bitcoin pic.twitter.com/tfPQUnWHww

— Phoenix (@Phoenix_Ash3s) April 24, 2023

Financial information source Stockmoney Lizards also described $25,000 as “interesting” support if $27,000 does not hold.

Nonetheless, traders emphasized that Bitcoin remained in a bullish state, watching for a potential replication of price actions from February, when BTC/USD surged higher after a phase of consolidation.

#Bitcoin

4h chart… guess what? pic.twitter.com/5crcD2vv3v— Stockmoney Lizards (@StockmoneyL) April 24, 2023

BTC sellers “less decisive” around $30,000

New research has shown hodlers divided on whether to sell during bullish moments, even as Bitcoin approached $31,000.

Related: ‘Smart money’ eyes BTC bull run: 5 things to know in Bitcoin this week

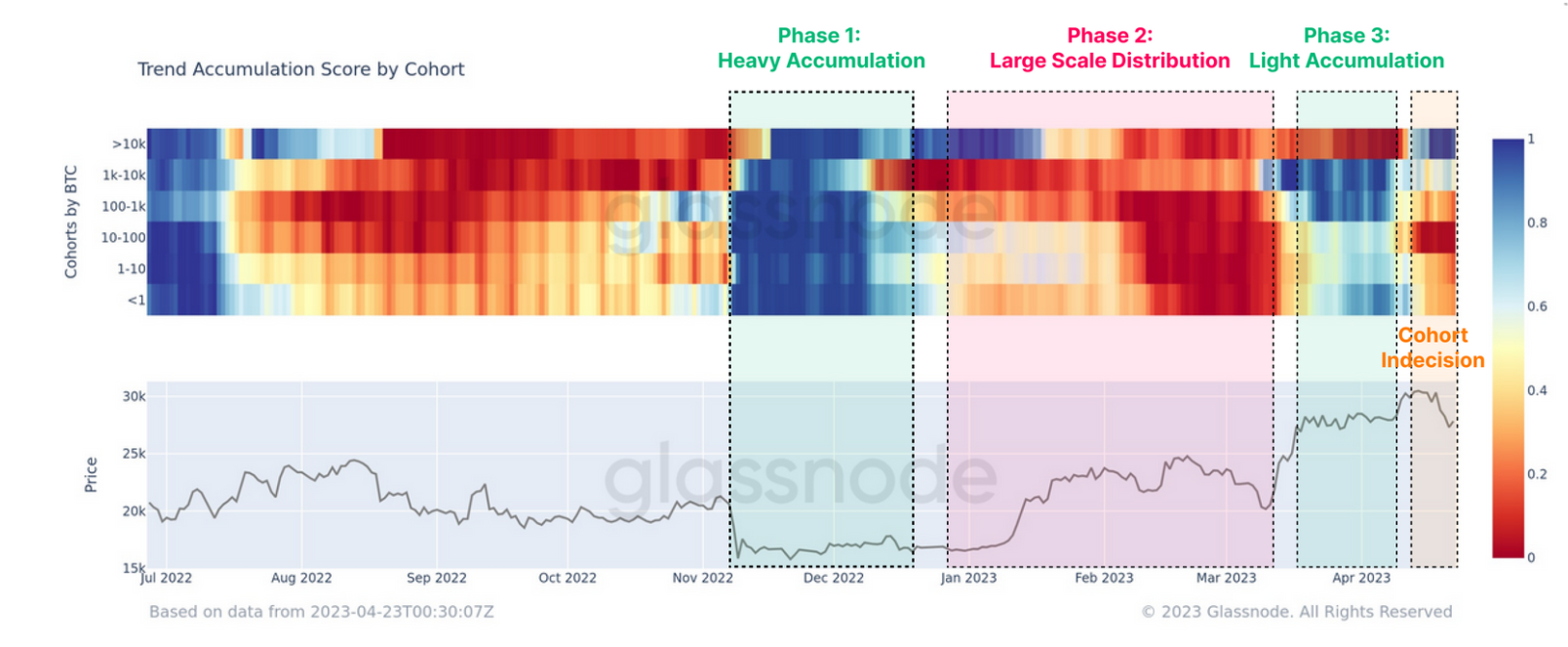

In the latest issue of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode analyzed profit and loss data from both long-term (LTHs) and short-term holders (STHs).

Unlike the sell-offs driven by news in 2021 and 2022, it suggested that the average investor is currently less willing to cut back on their exposure, even considering last week’s BTC price declines.

“In recent weeks, we observe a blend of behaviors, indicating indecision across all groups except for the largest entities holding 10k+ BTC,” it noted.

“This aligns with overall consolidation, the brief rise above $30k, and the subsequent pullback to $27k this week.”

With the range from $28,000 and above serving as a significant breakeven point for hodlers, the urge to take profits is likely to be strongly felt.

“The total value of realized profits remains relatively minor compared to the asset’s size; however, they correspond to a USD magnitude similar to the 2019 surge to $14k,” Glassnode concluded.

“Given the mixed accumulation and distribution behaviors across various wallet cohorts at this time, the market appears less resolute than in the first quarter of the year.”

Bitcoin hodler accumulation and distribution overview (screenshot). Source: Glassnode

Bitcoin hodler accumulation and distribution overview (screenshot). Source: Glassnode

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

This article does not provide investment advice or recommendations. Every investment and trading decision carries risks, and readers should perform their own research before making decisions.