Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin price aligns with CPI as fluctuations decrease — 5 key points to note in Bitcoin this week

Bitcoin (BTC) begins the second week of August with minimal activity as its price remains within a narrow range.

Following one of its least volatile weekly closures, BTC/USD is still hovering around $29,000 — but will the upcoming week bring the necessary changes to break this stagnation?

At the forefront of potential volatility drivers is the United States inflation data, specifically the Consumer Price Index (CPI) — a crucial indicator leading up to the next interest rate decision in September.

Nonetheless, given Bitcoin’s well-known resistance this quarter, it may require more than this to reestablish a trend.

Additionally, on-chain data suggests that whales and other significant investors are in an accumulation phase. Network fundamentals are expected to gradually improve, while the number of new wallets continues to rise despite the price movements.

Cointelegraph examines the key topics to consider this week regarding BTC price movements.

Bitcoin price forecasts trend downward after quiet weekly close

Bitcoin concluded the week quietly, maintaining its tight trading range and providing no last-minute surprises.

Data indicates that BTC/USD has been operating within a $200 range overnight — a situation that remains unchanged at the time of this report.

For many traders, this poses a risk of lower price levels emerging next, as bulls lack the strength to overcome selling pressure beneath the critical resistance levels of $29,250, $29,500, and $30,000.

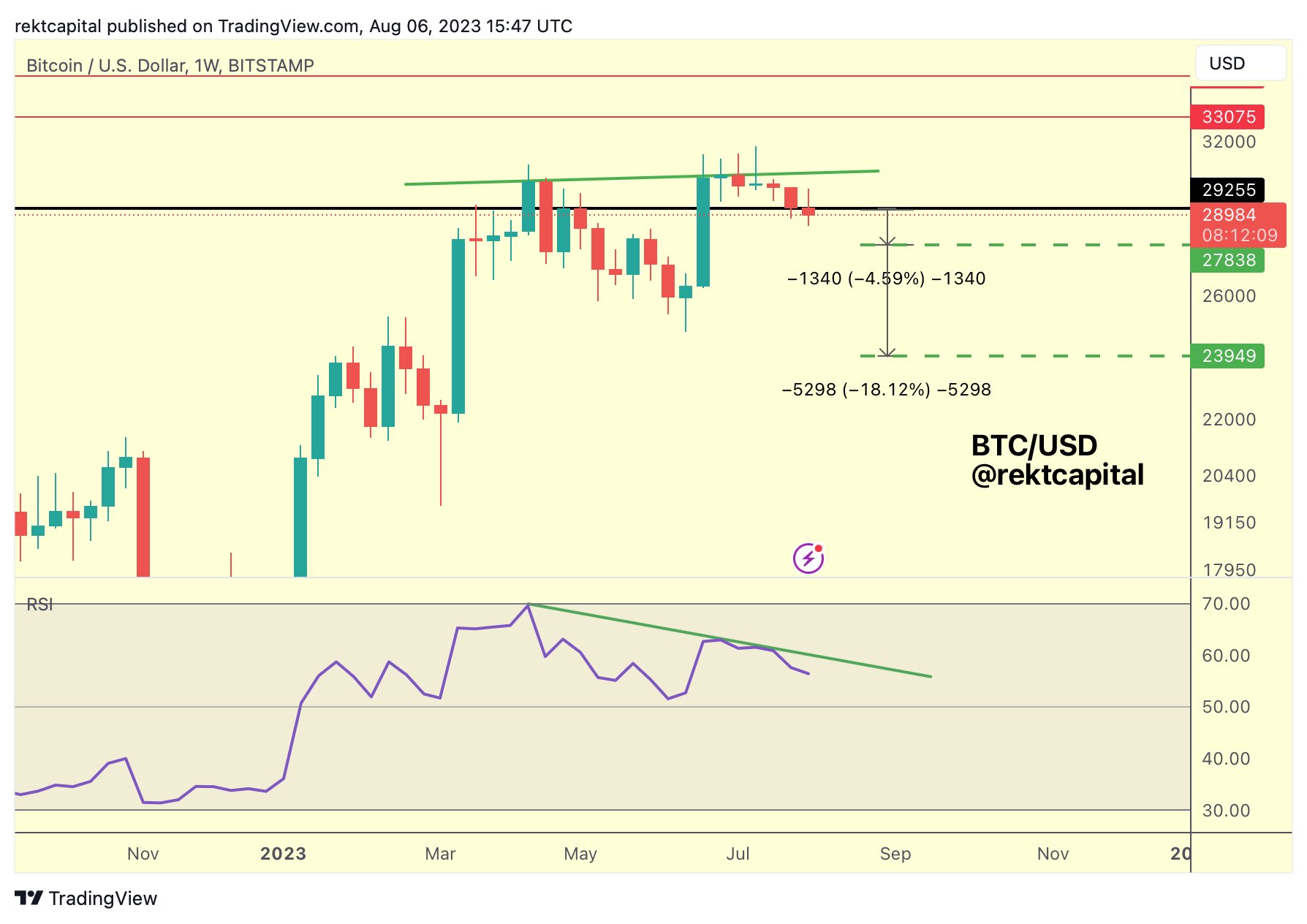

“BTC continues to face resistance around ~$29,250. As long as this persists, the bias leans towards lower prices,” trader and analyst Rekt Capital noted.

BTC/USD annotated chart. Source: Rekt Capital/X (Twitter)

BTC/USD annotated chart. Source: Rekt Capital/X (Twitter)

Considering a potential support area just below the current price, fellow trader Credible Crypto suggested that volatility might increase simply due to the return of the workweek.

“In any case, I want to see some strength here soon, or we might still have one more local low to reach (which would be acceptable),” he informed his followers on X (formerly Twitter) as part of a recent analysis.

A rather subdued response from our green zone thus far, but it’s also the weekend, so we might see some strength once the week begins.

In any case, I want to see some strength here soon, or we might still have one more local low to go (which would be fine). $BTC https://t.co/Lm4lqxqUFZ pic.twitter.com/3kQ38dbjnb— CrediBULL Crypto (@CredibleCrypto) August 7, 2023

Continuing, Michaël van de Poppe, founder and CEO of trading firm Eight, indicated that Monday could present a local low for Bitcoin to respond to throughout the week.

“With Monday approaching, it’s typically a day when Bitcoin experiences its usual drop. In that case, I’m targeting $28K to buy,” he stated.

“If we do not drop to that level, then I clearly want to see a breakout above $29.7K to increase my long positions.”

BTC/USD annotated chart. Source: Michaël van de Poppe/Twitter

BTC/USD annotated chart. Source: Michaël van de Poppe/Twitter

Examining the return of BTC volatility

Overall, Bitcoin is experiencing a significant reduction in trading volume, resulting in volatility returning to its lowest levels ever recorded.

On weekly timeframes, noted trader Skew observed that volume was nearly nonexistent. An accompanying volume profile chart illustrated the context behind Bitcoin’s current multi-month trading range between $26,000 and $32,000.

$BTC 1W Volume Profile (range Nov 2020 – Current)

Quite useful for identifying key levels / market inflection points

Key points for volume profile:

HVN – High Volume Node

LVN – Low Volume Node

POC – Point of control

VA – Value Area

Just utilized the total volume profile here so… pic.twitter.com/49mKz4rV9h— Skew Δ (@52kskew) August 7, 2023

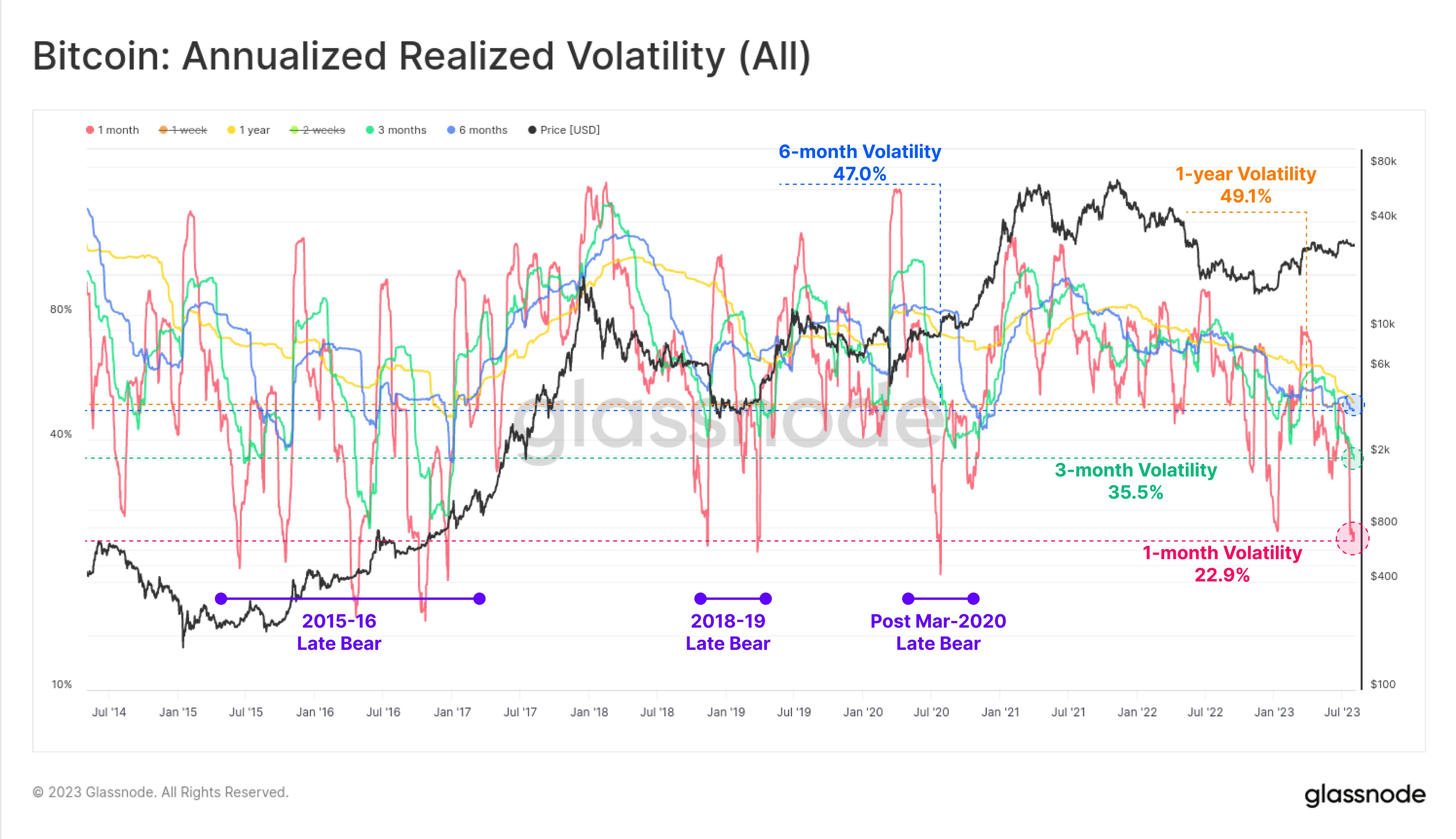

“Realized volatility for Bitcoin has dropped to historic lows,” Checkmate, lead on-chain analyst at Glassnode, remarked on August 7.

Sharing a chart of Bitcoin’s annualized realized volatility, Checkmate indicated that such flat behavior was last observed over three years ago in the months following the March 2020 COVID-19 cross-market crash.

“Across 1-month to 1-year timeframes, this is the quietest we have seen Bitcoin since after March 2020,” he added.

“Historically, such low volatility corresponds with post-bear-market recovery periods (re-accumulation phase).”

Bitcoin annualized realized volatility annotated chart. Source: Checkmate/X

Bitcoin annualized realized volatility annotated chart. Source: Checkmate/X

“Reaccumulation” becomes a buzzword in Bitcoin discussions

The term “reaccumulation” is frequently mentioned in the current market environment.

As Cointelegraph has reported, there is a particular focus on Bitcoin whales, as they gradually position themselves for what could be the next surge to all-time highs.

Reaccumulation has been a defining characteristic following every BTC price cycle bear market, and analysts are hopeful that this time will be no exception.

“Retail investors sold during the last bear market, while whales remained unfazed,” popular technical analyst CryptoCon stated last week.

“The wind is at our backs this cycle; this is significant.”

In contrast to previous bear markets, whales are refraining from selling while still engaging in reaccumulation, strengthening the bullish outlook for what lies ahead.

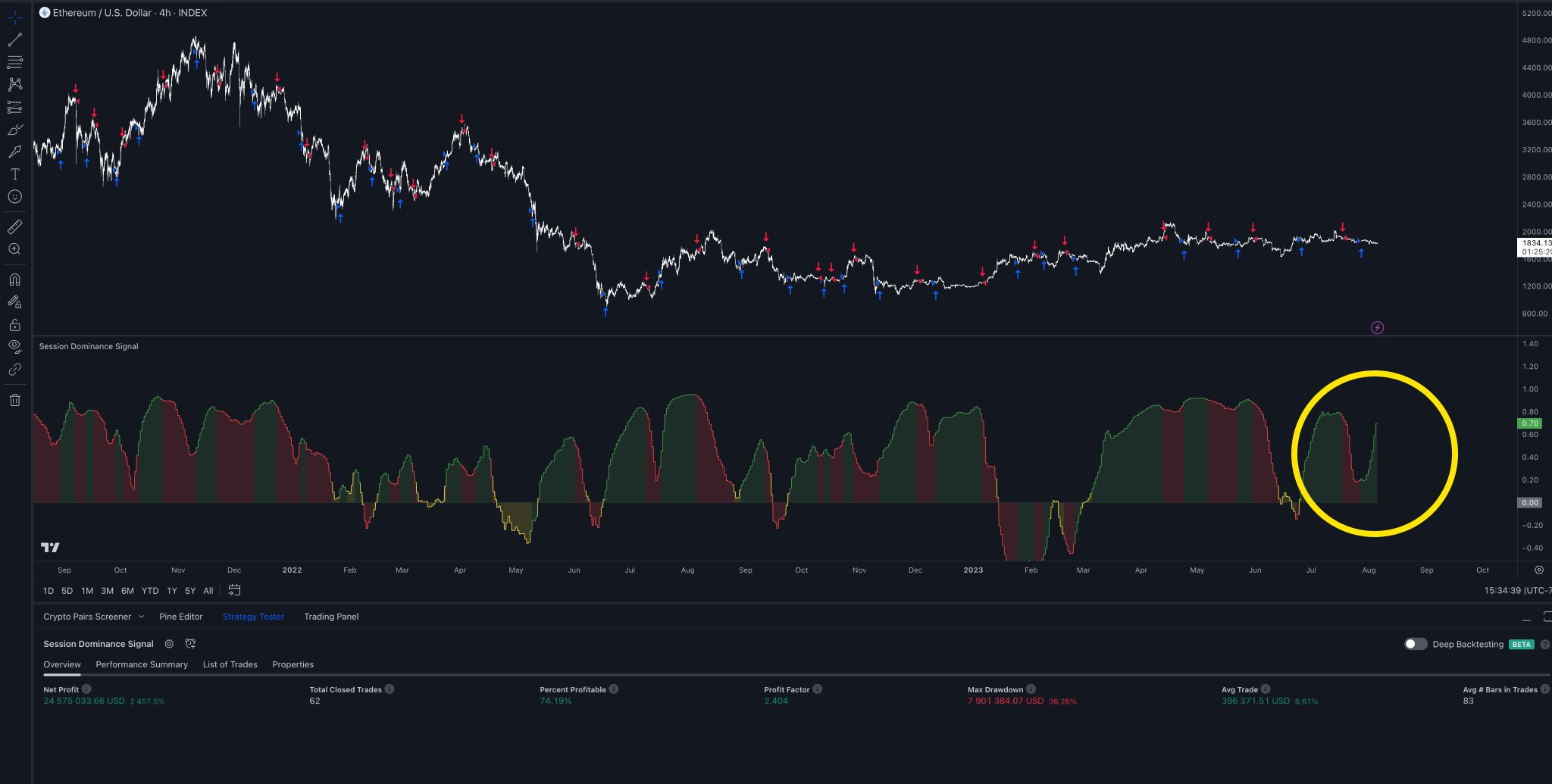

It is not only whales; day traders are also providing market analyst Cole Garner with reasons for optimism.

Asian buyers continue to dominate the daily trading landscape, which is an equally important indicator suggesting that BTC price increases are likely ahead, not behind the market.

“When buyers dominate the Asian session, BTC & ETH prices tend to rise. As a general trend, this is almost always the case,” he explained in part of an X thread over the weekend.

“When Asia starts selling: usually near a local top.”

Garner characterized the Asian buying trend as “potent alpha that goes unnoticed.”

BTC/USD chart with trading session dominance data. Source: Cole Garner/Twitter

BTC/USD chart with trading session dominance data. Source: Cole Garner/Twitter

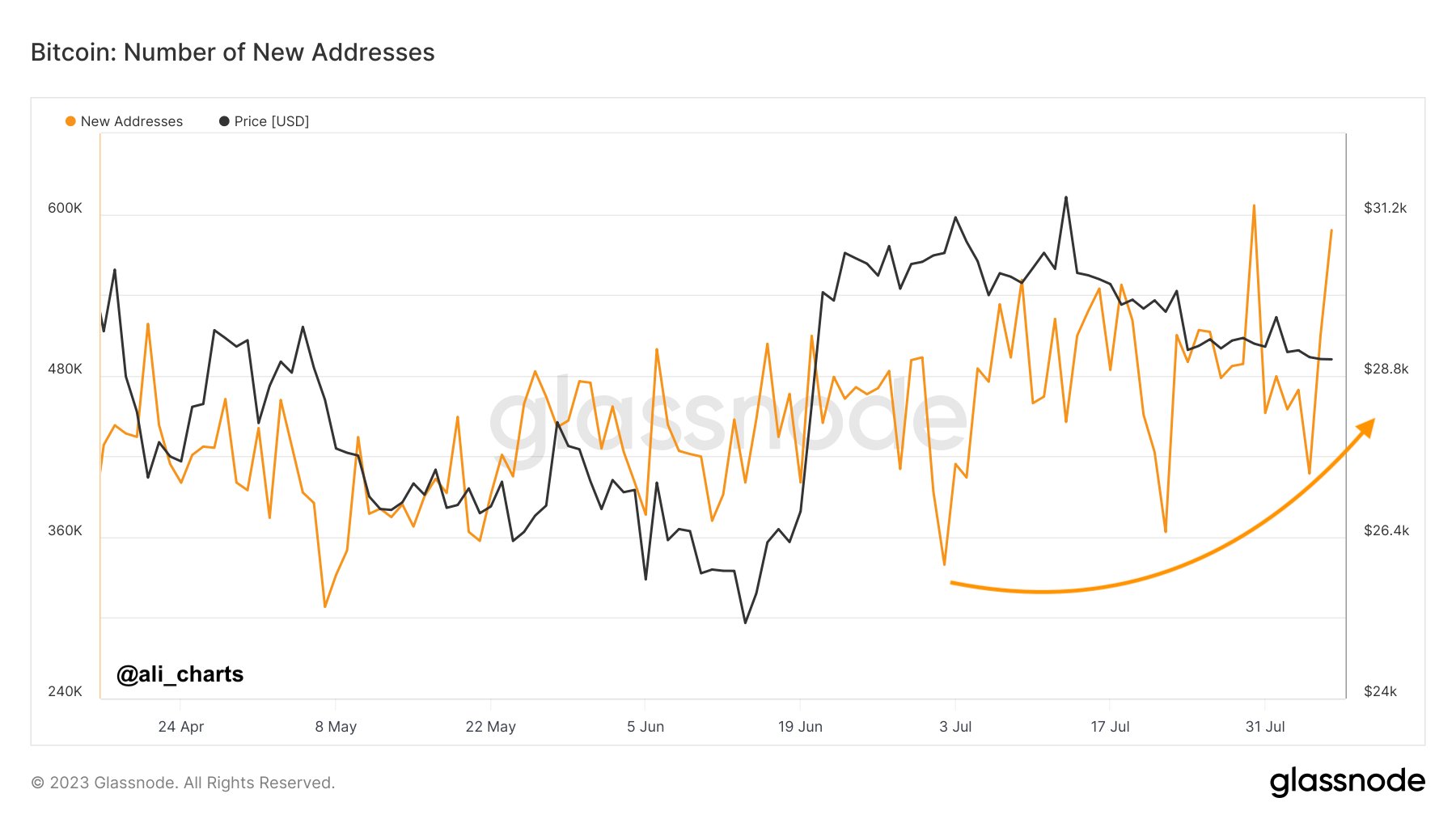

To further support the accumulation narrative, the number of Bitcoin wallets has maintained an upward trend despite the BTC price falling below $30,000 after reaching local highs.

“This bullish divergence between price and network growth suggests a stable long-term BTC uptrend,” noted popular analyst Ali alongside Glassnode data.

“Buy the dip!”

Bitcoin new addresses annotated chart. Source: Ali/X

Bitcoin new addresses annotated chart. Source: Ali/X

Fundamentals indicate signs of recovery

This week, Bitcoin network fundamentals present a mixed picture, reflecting a notably uncertain market sentiment.

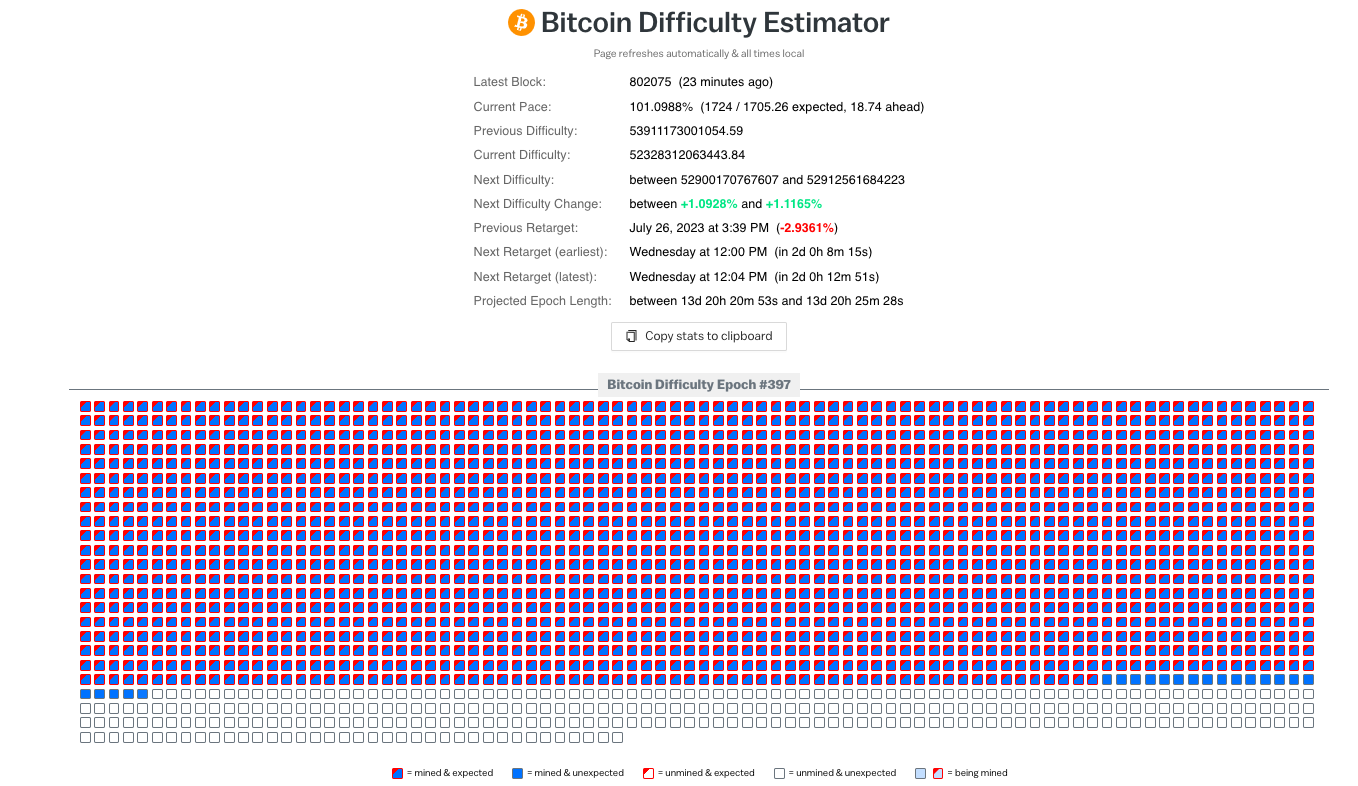

After a decline of just over 3% during its previous automated adjustment two weeks ago, Bitcoin network difficulty is expected to recover some of those losses.

According to estimates from Bitcoin educational resource Bitrawr, difficulty is projected to rise by approximately 1.2%, nearing new all-time highs.

Bitcoin difficulty estimator graphic (screenshot). Source: Bitrawr

Bitcoin difficulty estimator graphic (screenshot). Source: Bitrawr

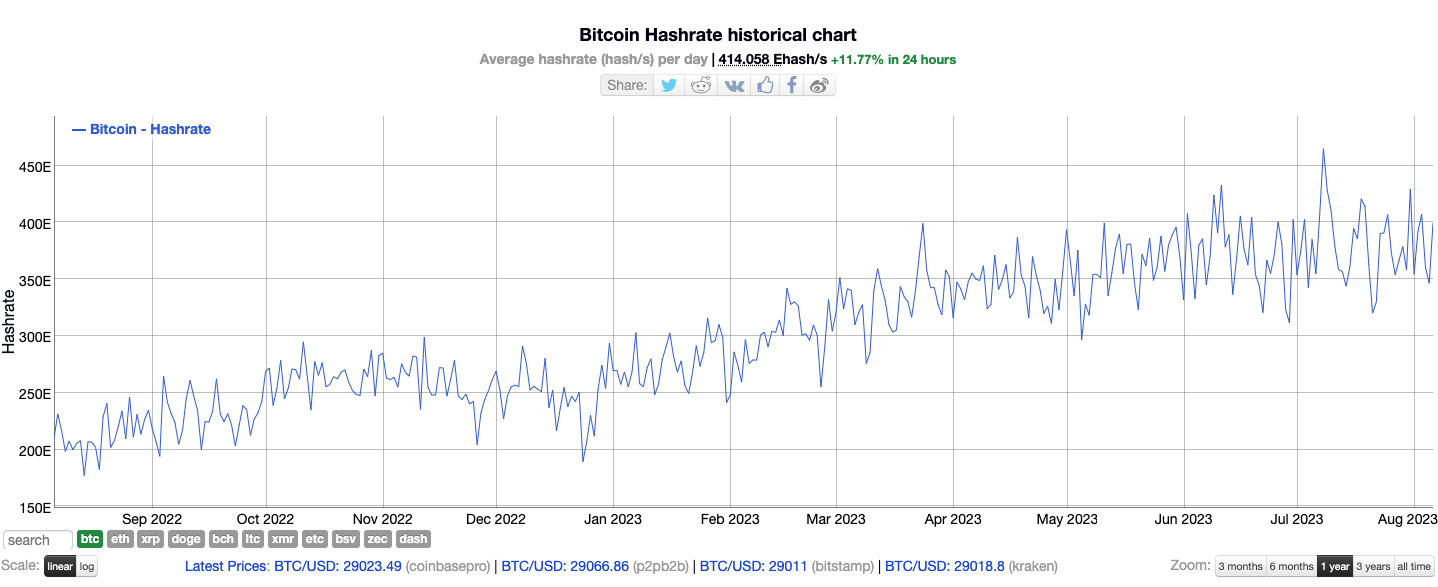

Regarding hash rate, the current setup is characterized by a consolidation phase within a broader uptrend.

Hash rate values vary significantly by estimate, but following recent all-time highs, spikes in activity have subsided in recent weeks.

Bitcoin hash rate chart (screenshot). Source: Bitinfocharts

Bitcoin hash rate chart (screenshot). Source: Bitinfocharts

CPI approaches ahead of September Fed rate decision

Beyond Bitcoin, the focus is on the week’s significant macro data release in the form of the U.S. CPI report for July.

Related: BTC price upside ‘yet to come’ at $29K after Bitcoin RSI reset — Trader

With inflation indicators almost universally trending downward, CPI serves as a classic volatility driver, making August 10 a day filled with potential trading opportunities.

“Inflation data this week should provide more insight into what the Fed will decide in September,” financial commentary source The Kobeissi Letter predicted, ahead of what it termed “another busy week.”

Other macro data scheduled for release in the coming days includes the July Producer Price Index (PPI) report on August 11, along with S&P 500 company earnings throughout the week.

Key Events This Week:

1. July CPI Inflation data – Thursday

2. Jobless Claims data – Thursday

3. July PPI Inflation data – Friday

4. Consumer Sentiment data – Friday

5. Total of 3 Fed members speaking

6. ~15% of S&P 500 companies reporting earnings

Another busy week ahead.— The Kobeissi Letter (@KobeissiLetter) August 6, 2023

While Bitcoin has exhibited increasingly muted responses to CPI reports in recent months, when viewed from a broader perspective, the outlook for some market participants remains closely linked to inflation.

“It’s remarkable how if you project Bitcoin’s price forward by 9 months, it precisely tracks the rate of change in inflation. It’s almost as if it can predict the future,” Steven Lubka, Managing Director and Head of Private Clients and Family Offices at Bitcoin investment firm Swan remarked in part of recent social media commentary.

‘#Bitcoin didn’t hedge inflation’

‘#Bitcoin had no relationship with CPI’

It’s remarkable how if you project Bitcoin’s price forward by 9 months, it precisely tracks the rate of change in inflation. It’s almost as if it can predict the future pic.twitter.com/BfPyJH7jm6— Steven Lubka (@DzambhalaHODL) July 30, 2023

Magazine: Experts want to give AI human ‘souls’ so they don’t kill us all

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should conduct their own research before making a decision.