Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Ordinals have not taken away blockspace from monetary transactions: Glassnode

Despite worries that Bitcoin Ordinals are congesting the network, there is scant evidence indicating that inscriptions are diverting blockspace from more valuable Bitcoin (BTC) monetary transactions.

“There is limited evidence that inscriptions are replacing monetary transfers,” on-chain analytics company Glassnode stated in a report dated Sept. 25.

The firm noted that this is likely due to inscription users typically opting for lower fee rates, indicating a willingness to endure longer waiting times for confirmations.

“Inscriptions seem to be utilizing and occupying the least expensive available blockspace, and can be easily displaced by more pressing monetary transfers.”

Bitcoin Ordinals were launched in February 2023 and have since represented the majority of network activity in terms of daily transaction volume.

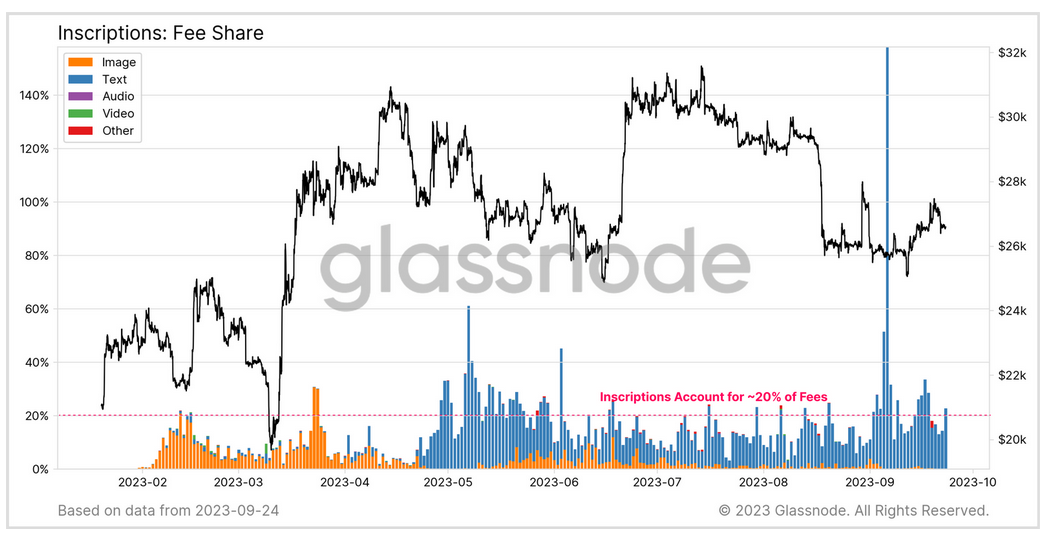

However, this has not necessarily been mirrored in its share of mining fees, with inscriptions contributing to approximately 20% of Bitcoin transaction fees, according to Glassnode.

Inscription fee distribution among images, text, audio, video, and other data types on Bitcoin. Source: Glassnode.

Inscription fee distribution among images, text, audio, video, and other data types on Bitcoin. Source: Glassnode.

Increased inscriptions lead to higher revenue — but with a caveat

While inscriptions have bolstered the baseline demand for blockspace and raised fees for miners, Glassnode indicates that Bitcoin’s hashrate has also surged by 50% since February.

This has led to intensified competition among miners aiming to capitalize on revenue fees, according to Glassnode:

“With intense miner competition in effect, and the halving event approaching, it is probable that miners are facing income pressure, with their profitability likely to be challenged unless BTC prices rise in the near future.”

Bitcoin is presently valued at $26,216, but many industry analysts anticipate some level of price increase as the Bitcoin halving event scheduled for April 2024 approaches.

Related: Bitcoin Ordinals creator Casey Rodarmor proposes BRC-20 alternative ‘Runes’

At this time, most inscriptions are generated from BRC-20 tokens, which were introduced a month after Casey Rodarmor launched the Ordinals protocol on Bitcoin in February.

On Sept. 25, Rodarmor introduced “Runes” as a possible alternative to BRC-20s, proposing that a UTXO-based fungible token protocol would not leave as much “junk” unspent transaction outputs on the Bitcoin network.

Magazine: Blockchain games aren’t truly decentralized… but that’s about to change