Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin offers decline to lowest level since March as BTC value falls below $25.7K.

Bitcoin’s (BTC) upward momentum is “diminishing” as liquidity changes signal a potential volatile shift, a recent analysis indicates.

In a post on X dated Sep. 6, Keith Alan, co-founder of the monitoring platform Material Indicators, highlighted new developments on the Binance order book.

Analyst: Bitcoin bulls and bears both lack “real strength”

BTC’s price has remained closely confined within a range since the weekend, yet exchange data implies that this stability may soon alter.

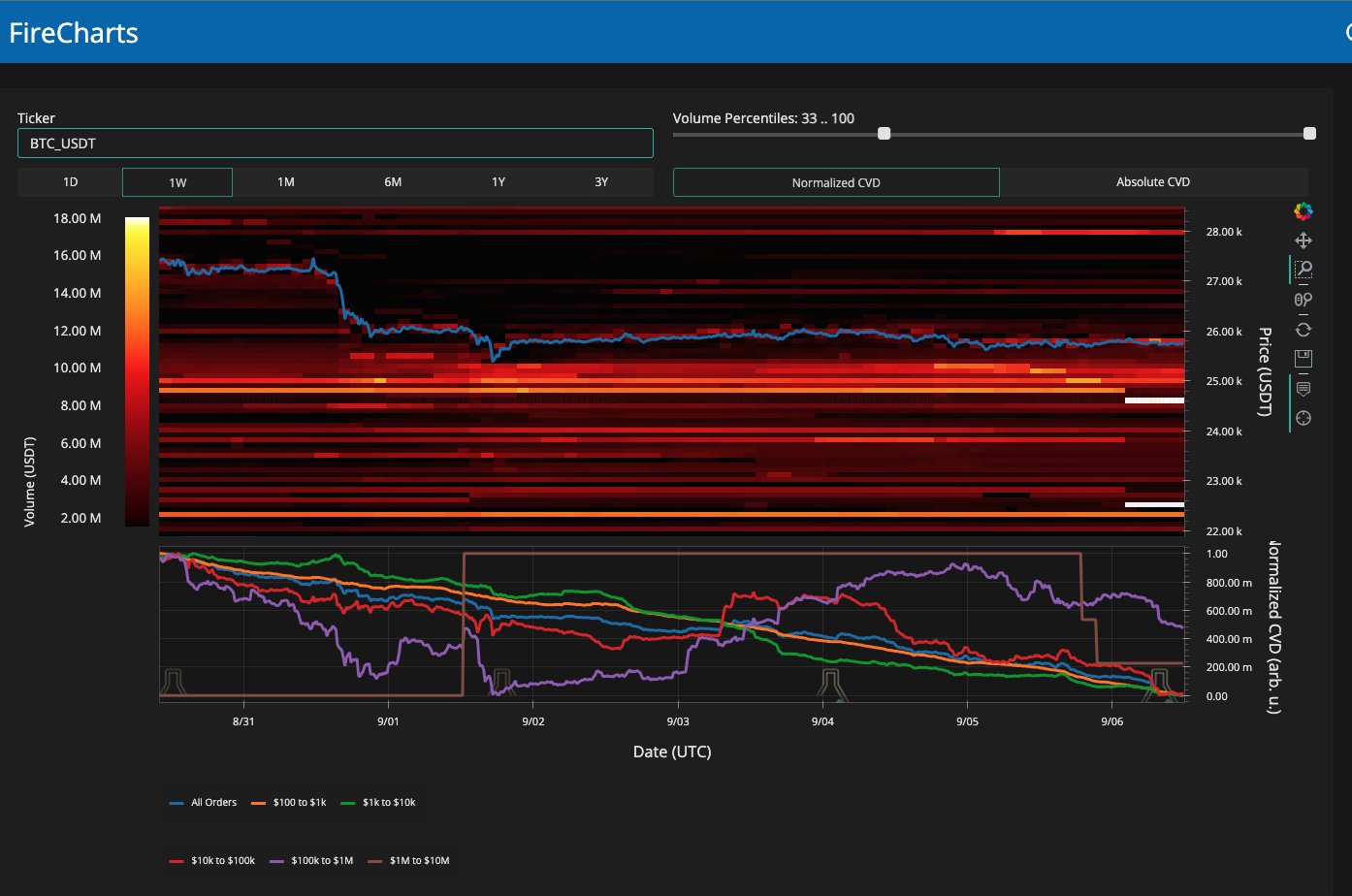

Sharing a snapshot of the BTC/USD order book on Binance, Alan expressed concern over what he described as “troubling” liquidity changes.

Bid support has shifted downward to focus around $24,600 on the day, a price point not observed on spot markets since March.

“What is most troubling here is that the largest concentrations of BTC bid liquidity have now moved below the previously established Lower Low at the bottom of the range,” a portion of the accompanying commentary noted.

BTC/USD recorded its lowest dip since March in mid-June, hitting $24,750 before bouncing back, as confirmed by data from Cointelegraph Markets Pro and TradingView.

BTC/USD 1-week chart. Source: TradingView

BTC/USD 1-week chart. Source: TradingView

Continuing, Alan mentioned that he anticipated a similar rebound from current spot levels before any downward movement resumes.

“From a macro perspective, I do expect to see a price breakdown eventually, so the idea of establishing a new LL isn’t surprising, but I did expect to see a more robust short-term rally from this range before that occurs,” he stated.

Nonetheless, bears have not yet fully taken control.

“At this point, I’m not observing either side demonstrating any genuine strength; in fact, IMO, this movement does not reflect strength in bearish momentum as much as it shows that bullish momentum and sentiment appear to be waning,” he concluded.

“Regardless of the situation, I do not have faith that those buy walls will simply remain and get filled.”

BTC/USD order book data for Binance. Source: Keith Alan/X

BTC/USD order book data for Binance. Source: Keith Alan/X

Alan had previously identified $24,750 as a critical level for bulls to maintain in order to safeguard the broader Bitcoin price uptrend.

“Another significant move brewing” for Bitcoin

In another perspective, well-known trader Skew concurred that volatility is likely to return soon, citing activity in the derivatives markets.

Choppy start to the week

Lots of over trading in derivatives market

Perp liquidity increasing a bit

Spot liquidity increasingly thin

Likely seeing toxic orderflow today (especially on the bid)

All points to another significant move brewing for $BTC— Skew Δ (@52kskew) September 5, 2023

Related: Bitcoin price metric mirrors movement that last occurred before -25% FTX crash

Another trader, Credible Crypto, recognized for his relatively optimistic outlook on BTC price potential, also expressed hope that any downside would be confined to the high $24,000 range.

“The local low on major liquid/spot exchanges is at 25.2k,” he informed X subscribers on the day, accompanied by an explanatory chart.

“Would love to see those lows taken while still holding the higher timeframe low at 24.8k (which is the more significant one) before a reversal back up to fill the inefficiency above us into supply (red).”

BTC/USD annotated chart. Source: CredibleCrypto/X

BTC/USD annotated chart. Source: CredibleCrypto/X

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a choice.