Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

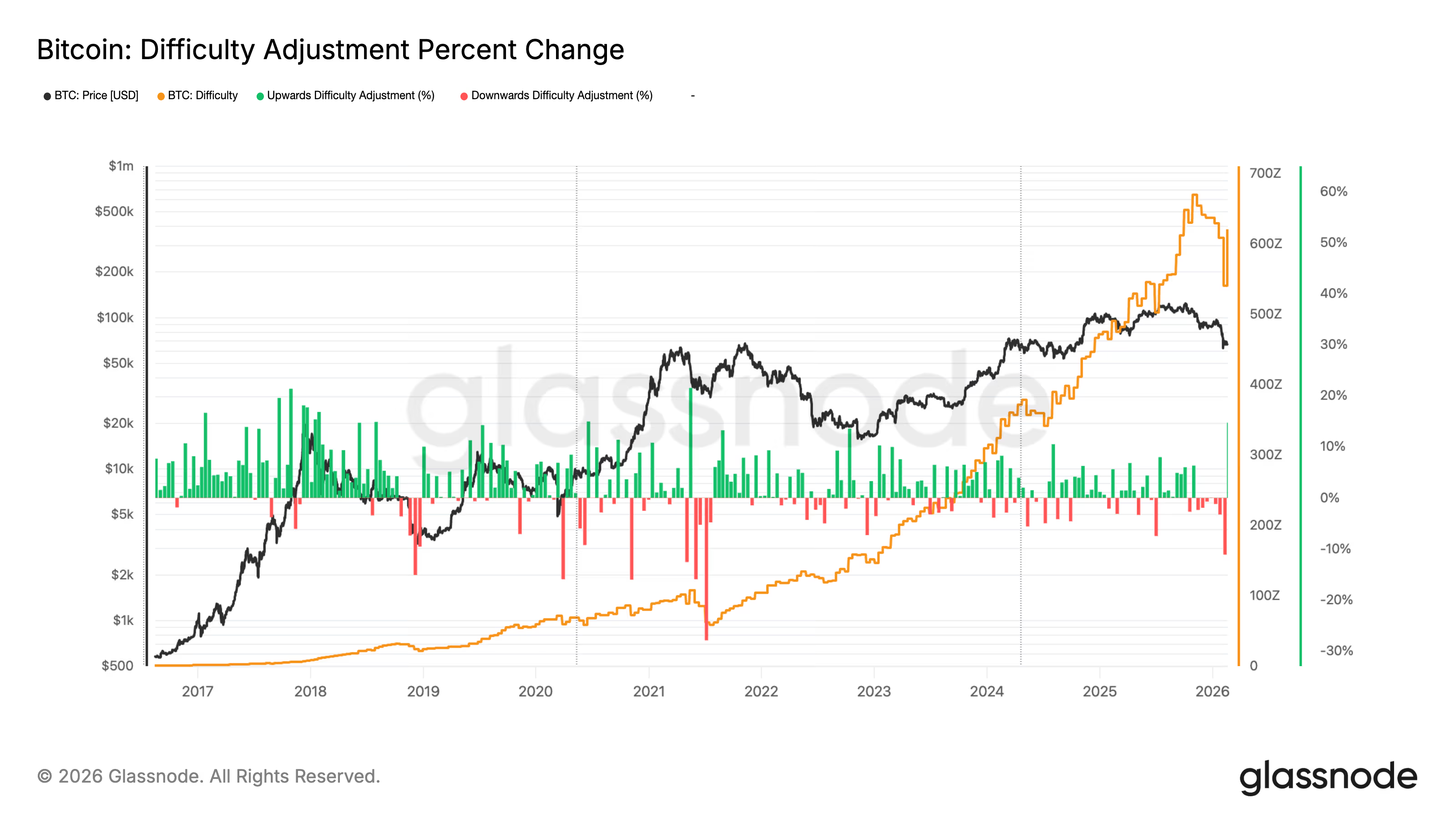

Bitcoin mining difficulty rises by 15%, marking the most significant surge since 2021, amid a decline in prices.

Bitcoin difficulty rebounds to 144.4T as hashrate recovers to 1 ZH/s despite multi year low hashprice.

BTC (Difficulty Adjustment Percentage Change (Glassnode)

BTC (Difficulty Adjustment Percentage Change (Glassnode)

What to know:

- Bitcoin mining difficulty increased to 144.4T, rising 15%, marking the largest percentage rise since 2021.

- Hashrate has bounced back to 1 ZH/s from 826 EH/s, even as hashprice remains at multi-year lows near $23.9 per PH/s.

Bitcoin mining difficulty has risen to 144.4 trillion (T), up 15%, representing the most significant percentage gain since 2021, when the mining ban in China caused a major disruption, which was followed by a 22% increase as the network stabilized.

Difficulty adjustments gauge the challenge of mining a new block on the network. This recalibration occurs every 2,016 blocks, approximately every two weeks, to ensure that blocks are produced roughly every 10 minutes, irrespective of variations in the hashrate.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The adjustment follows a 12% reduction in difficulty after a decline in the bitcoin hashrate, which represents the total computational power securing the network. Mining operations experienced their most significant setback since late 2021 due to a severe winter storm in the United States, which compelled several major operators to reduce their activities.

In October, when bitcoin achieved an all-time high of approximately $126,500, the hashrate also peaked at 1.1 zettahash per second (ZH/s). As prices dropped to as low as $60,000 in February, the hashrate fell to 826 exahash per second (EH/s). Since that time, the hashrate has bounced back to 1 ZH/s while the price has risen to around $67,000.

Concurrently, hashprice, the estimated daily revenue miners earn per unit of hashrate, remains at multi-year lows ($23.9 PH/s), affecting profitability.

Despite this pressure on profitability, large-scale operators with access to low-cost energy are continuing to mine vigorously. The United Arab Emirates, for instance, is currently holding approximately $344 million in unrealized profits from its mining endeavors.

Well-funded entities capable of efficient mining are contributing to maintaining the hashrate at elevated levels, even amid lower bitcoin prices.