Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin miners require BTC value to exceed $98K by the halving — Analysis

Speculations regarding Bitcoin (BTC) achieving a six-figure price by the conclusion of 2024 continue to emerge, even as the BTC price has recently dipped below the $30,000 mark.

For publicly traded Bitcoin miners, particularly, a price exceeding $100,000 may be more of a requirement than a prediction if they wish to sustain profitability in their business models.

Bitcoin halving: Challenges for public miners?

This year, Bitcoin mining stocks have experienced significant growth, greatly surpassing BTC in performance over the past few months. While BTC has undergone reduced volatility and a phase of consolidation, the stocks of Bitcoin mining firms have surged by nearly 100% within a few months.

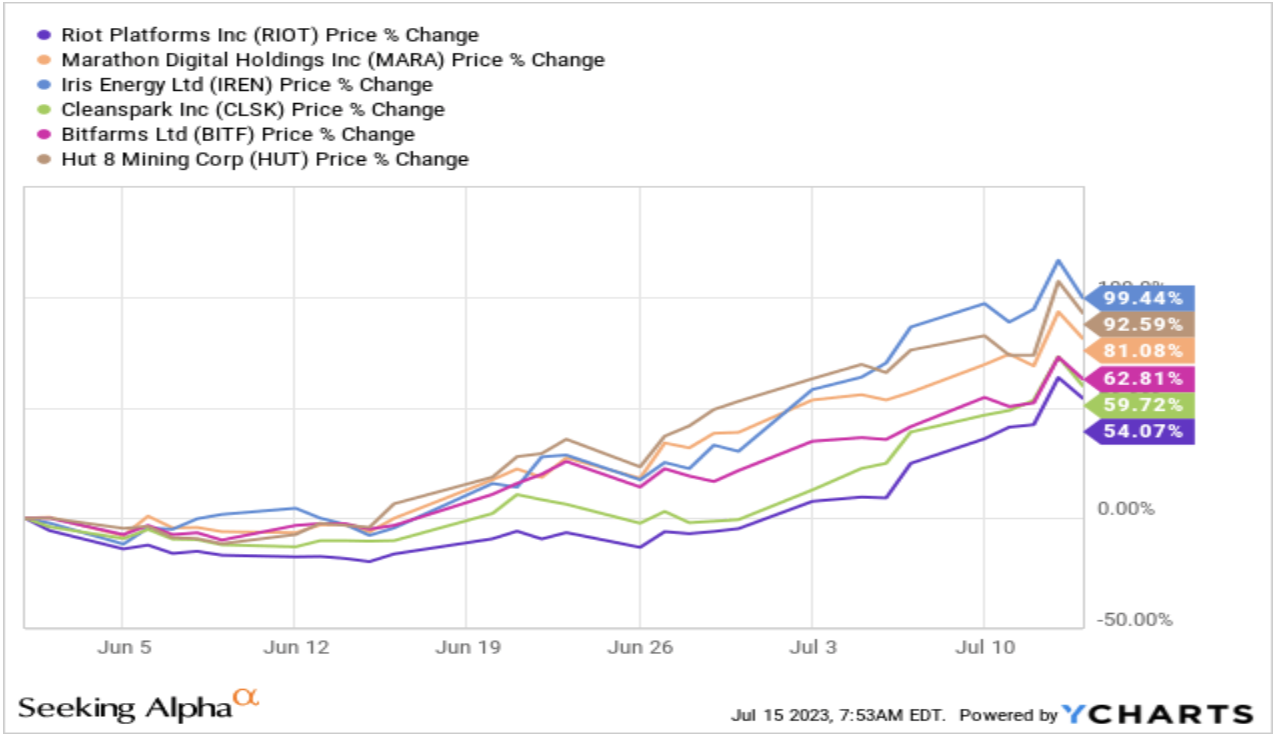

Recent performance of popular BTC mining stocks. Source: Seeking Alpha

Recent performance of popular BTC mining stocks. Source: Seeking Alpha

A recent analysis by Seeking Alpha delves into BTC mining, focusing on a notable miner: Riot Platforms.

The report highlights that although Riot is projected to triple its mining capacity in 2024, the company and Bitcoin miners as a whole may encounter significant challenges due to the halving. A 50% reduction in BTC block rewards would halve the primary revenue source for miners.

Miners such as Riot can also issue new equity shares to finance their operations. This results in the dilution of existing shares, implying that even if the company’s fundamental performance remains stable, the share price may not align accordingly.

Related: $160K at next halving? Model counts down to new Bitcoin all-time high

When considering that many miners might already be overvalued at current price levels, the outlook for public Bitcoin mining stocks appears challenging. Despite public mining stocks outperforming Bitcoin in 2023, an uptick in BTC being transferred to exchanges could suggest a waning momentum.

A substantial rise in Bitcoin’s price will thus be essential for miners to maintain profitability at the current hash rate levels.

Bitcoin miners have had a remarkable year.

RIOT is up 457%

MARA is up 421%

BITF is up 337%

CLSK is up 246%

Both Bitcoin and Nvidia have risen less than public miners this year — 80% and 222% respectively.

The best way to gain leveraged/high-beta exposure to BTC.

h/t @zackvoell pic.twitter.com/xTsJqikh0L— Joe Consorti ⚡ (@JoeConsorti) July 18, 2023

Miners may require six-figure Bitcoin to remain viable

What price must BTC reach for miners to sustain their current valuations? The aforementioned report concludes that nearly $100,000 could be necessary for miners to continue operating as usual:

“Unless Bitcoin exceeds our Bitcoin thesis, we don’t foresee any scenario where the Bitcoin sector can emerge unscathed. Even with RIOT’s ambitious 35 EH/s, our model indicates that Bitcoin must trade above $98,000 to validate RIOT’s current valuation (post-halving).”

Consequently, the report cautions that holding BTC mining stocks is “extremely risky,” as the underlying fundamentals may not align with current valuations that might not account for next year’s Bitcoin halving yet.

BTC price to $125,000 in 2024?

In the meantime, a recent report from Matrixport titled “Matrix on Target: Prepare for the Soaring 2024 Year-End Bitcoin Target of $125,000” outlines how BTC could reach $45,000 by the end of this year and $125,000 by the end of 2024.

The authors emphasize the importance of Bitcoin reaching a one-year high for the first time in a year.

This signal has historically marked the onset of a new bull market:

“On June 22, 2023, Bitcoin achieved a new one-year high, marking the first occurrence in a year. This signal has traditionally indicated the conclusion of bear markets and the commencement of new crypto bull markets. Previous instances occurred in August 2012, December 2015, May 2019, and August 2020, with actual bull markets emerging in 2013, 2017, and 2021.”

The report continues:

“This signal has been activated four times, and in each instance, the bull market fully developed within 12-18 months. If historical patterns hold, there is now a 100% probability that by the end of 2024, Bitcoin will undergo another significant bull market with a price target of $125,000 (+310%) — based on the previous three signals.”

This six-figure Bitcoin price forecast aligns with several others. Standard Chartered, for instance, anticipates a Bitcoin price of $120,000 by the end of 2024. Notably, this projection is largely predicated on BTC miners retaining their Bitcoin holdings prior to the halving.

Bitcoin may reach $120,000 by the end of 2024, Standard Chartered forecasts, as an expected improvement in crypto miners’ fortunes allows them to hold on to more of the tokens https://t.co/Z9z0BbKCqS

— Bloomberg Crypto (@crypto) July 11, 2023

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a decision.