Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

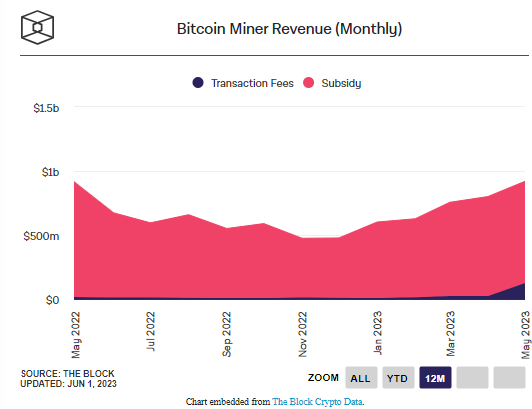

Bitcoin Miners Generate Notable $916 Million in Revenue for May

- BTC miner revenue increased to $916 million in May.

- The rise in revenue is linked to heightened on-chain activity.

- Bitcoin is currently around $27,000 after dipping to the $26,600 range today.

In May, Bitcoin mining revenue reached a remarkable $916.6 million, marking a significant month-over-month rise of 13.7%. Data from The Block’s Data Dashboard indicates that this amount includes transaction fees exceeding $120 million.

The increase in transaction fee revenue is attributed to a boost in on-chain activity, largely fueled by the growth of Bitcoin NFTs via platforms such as Ordinals.

Source: The Block

Source: The Block

Data indicates Bitcoin transaction increase in May

As per information from The Block Research, May saw a considerable rise in transaction activity on the Bitcoin network, with a total of 16.9 million transactions recorded for the month.

On Thursday, both Bitcoin and the wider cryptocurrency market experienced a two-day decline as worries about inflation and ongoing interest rate hikes emerged again. The U.S. House of Representatives passed the debt ceiling deal on Wednesday night, and the bill is now pending approval from the Senate.

Bitcoin saw a 1% drop during the day, trading at $26,800, and has incurred a loss of over 6% in the past month. According to CoinMarketCap data, Bitcoin is trading at $27,011 at the time of reporting. BTC rebounded from a 24-hour low of $26,671 to a high of $27,346 before settling at the current trading price. Nonetheless, the entire cryptocurrency market is exhibiting stability with no significant fluctuations.