Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

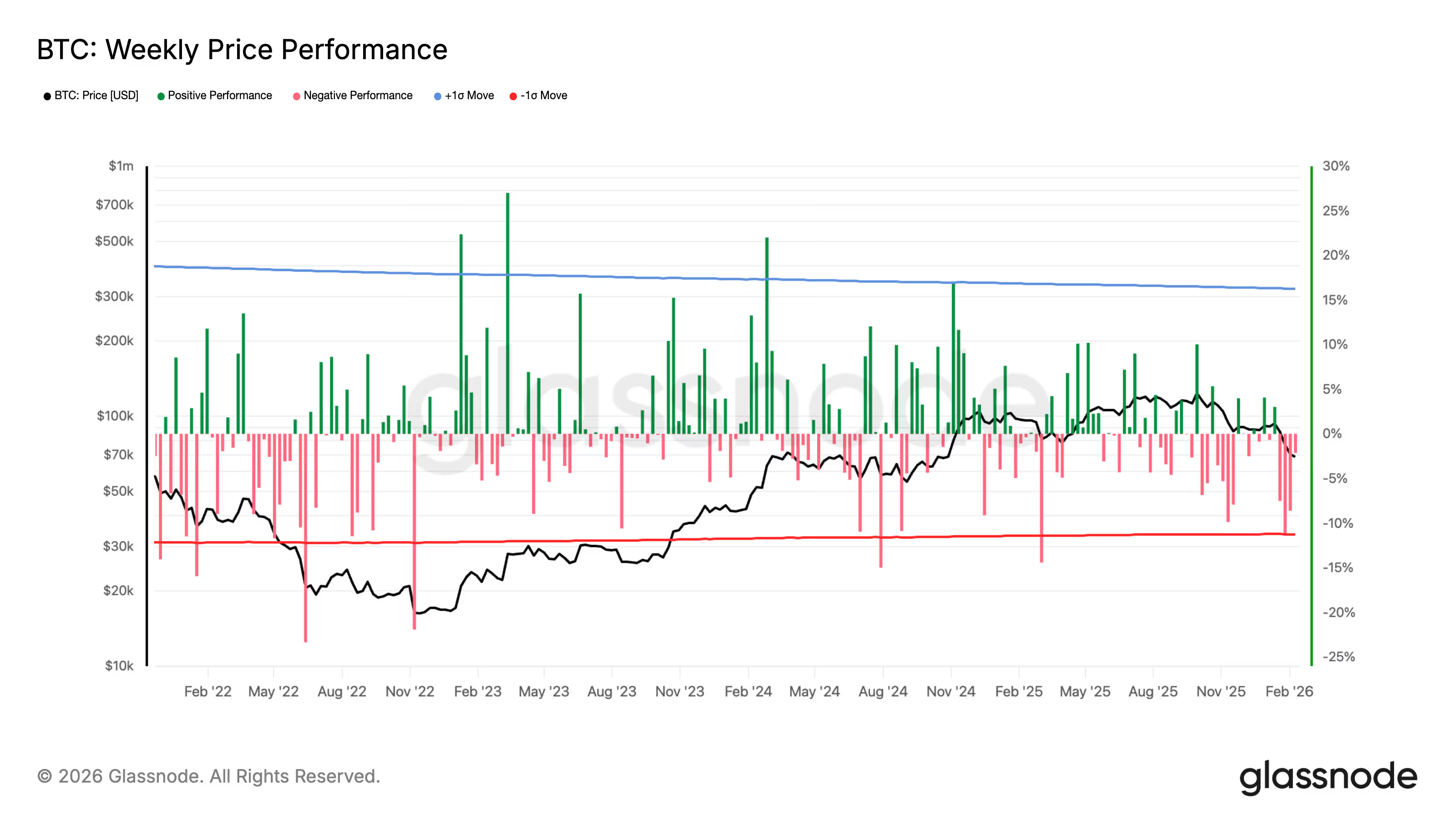

Bitcoin is on the verge of recording its most extended decline since 2022 amid rising geopolitical tensions affecting risk assets.

Geopolitical tensions elevate the U.S. dollar and crude oil prices, intensifying pressure on an already delicate crypto market.

What to know:

- Rising tensions in the Middle East have boosted both the U.S. dollar index and WTI crude, tightening financial conditions and stressing risk assets.

- Bitcoin is poised to register its fifth consecutive weekly drop, a pattern not observed since March to May 2022.

Bitcoin is set to record its fifth consecutive weekly decline, representing the first such occurrence since the period from March to May 2022, when bitcoin experienced nine consecutive weeks of downturn.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

As of Thursday Asia time, the largest cryptocurrency by market capitalization has already decreased by approximately 3% this week, falling below $67,000, as indicated by CoinDesk market data, making it susceptible to another weekly closing in the negative.

Macroeconomic pressures are compounding the technical vulnerabilities. According to the Wall Street Journal, the U.S. has assembled its largest concentration of air power in the Middle East since the 2003 invasion of Iraq. While reports suggest that Washington is ready to initiate strikes on Iran, President Donald Trump has yet to reach a final decision, with Polymarket bettors estimating a 27% likelihood of strikes occurring by the end of the month.

The geopolitical instability has driven the dollar index up to 97.7, its highest point since February 6, while WTI crude oil has risen to $65 from a low of $62 on Wednesday. A stronger dollar along with increasing oil prices generally exerts pressure on risk assets, creating further obstacles for bitcoin, which reinforces a potential negative weekly close.

Bitcoin has dropped over 50% from its peak of nearly $126,500 in October, reaching lows around $60,000.

On a monthly basis, bitcoin has recorded five consecutive declines since October, marking the second-longest losing streak in its history, only surpassed by the six-month downturn from 2018 to 2019.

In comparison to gold, bitcoin has fallen for seven consecutive months against the precious metal, representing its longest period of underperformance in that comparison.