Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin investors currently hold the smallest amount of BTC since the all-time peak of $69,000.

Speculators in Bitcoin (BTC) are currently driving a phase of “exhaustion and apathy” within the market, according to recent research.

In the latest issue of its weekly newsletter, “The Week On-Chain,” analytics company Glassnode discussed the diminishing confidence among Bitcoin’s short-term holders (STH).

Bitcoin speculators face unrealized losses

Following several months of stagnant BTC price movements, frustration among market participants has resulted in forecasts of further declines ahead.

Bulls have struggled to overcome resistance levels, while sellers are also contending with various support zones represented by trend lines between the current $29,000 and $25,000.

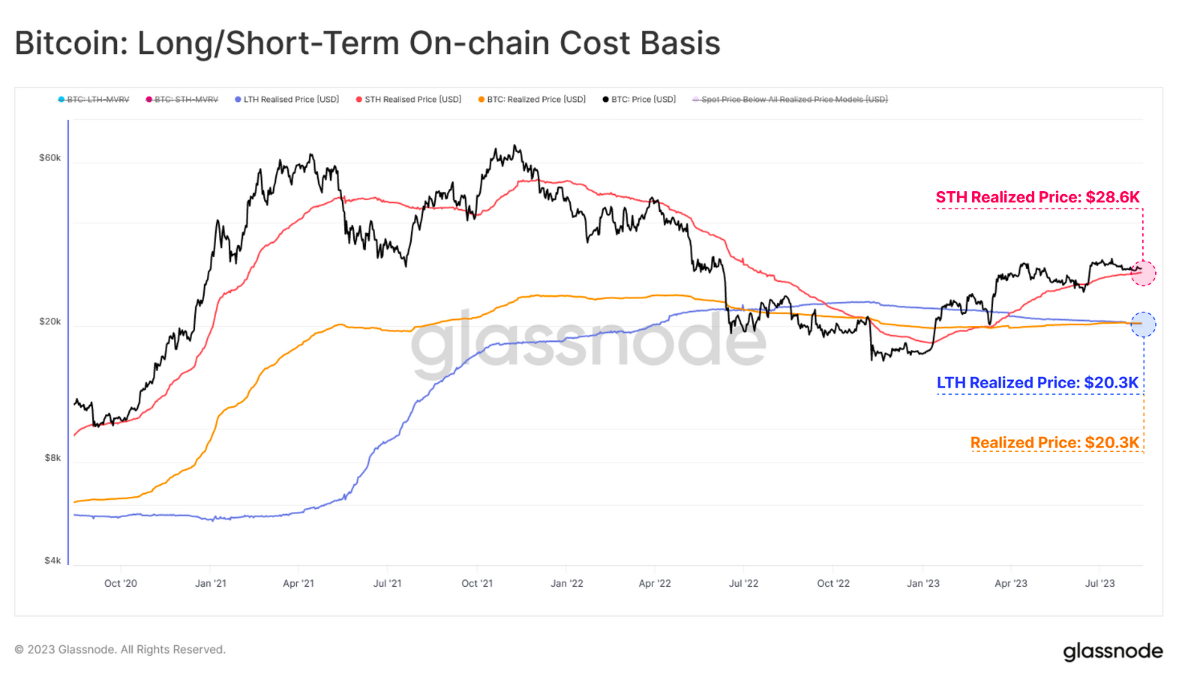

Included in this is the STH cost basis, or realized price. Glassnode defines STHs as entities holding coins for 155 days or fewer, representing the more speculative segment of Bitcoin investors.

The STH cost basis has served as support throughout 2023, but it is quickly increasing and now stands at $28,600.

In contrast, the long-term holder (LTH) cost basis, which indicates the average purchase price of the most steadfast holders, is significantly lower at $20,300.

“The gap between these two cost bases indicates that many recent purchasers have a relatively high acquisition price,” Glassnode noted.

Researchers further characterized the market as potentially “top heavy,” suggesting that even a slight decline in BTC price could push the STH group into negative territory.

“On a macro scale, this supply distribution resembles similar phases during past bear market recoveries,” they explained.

“However, on a shorter timeframe, it could be argued that the market is somewhat top heavy, with numerous price-sensitive investors at risk of experiencing unrealized losses.”

Bitcoin long/short-term on-chain cost basis annotated chart (screenshot). Source: Glassnode

Bitcoin long/short-term on-chain cost basis annotated chart (screenshot). Source: Glassnode

Bitcoin hodler conviction remains “impressively high”

Notwithstanding this, it seems that speculators have begun to reassess their market exposure.

Related: BTC price can reach $34K as Bitcoin faces support ‘kiss’ — QCP Capital

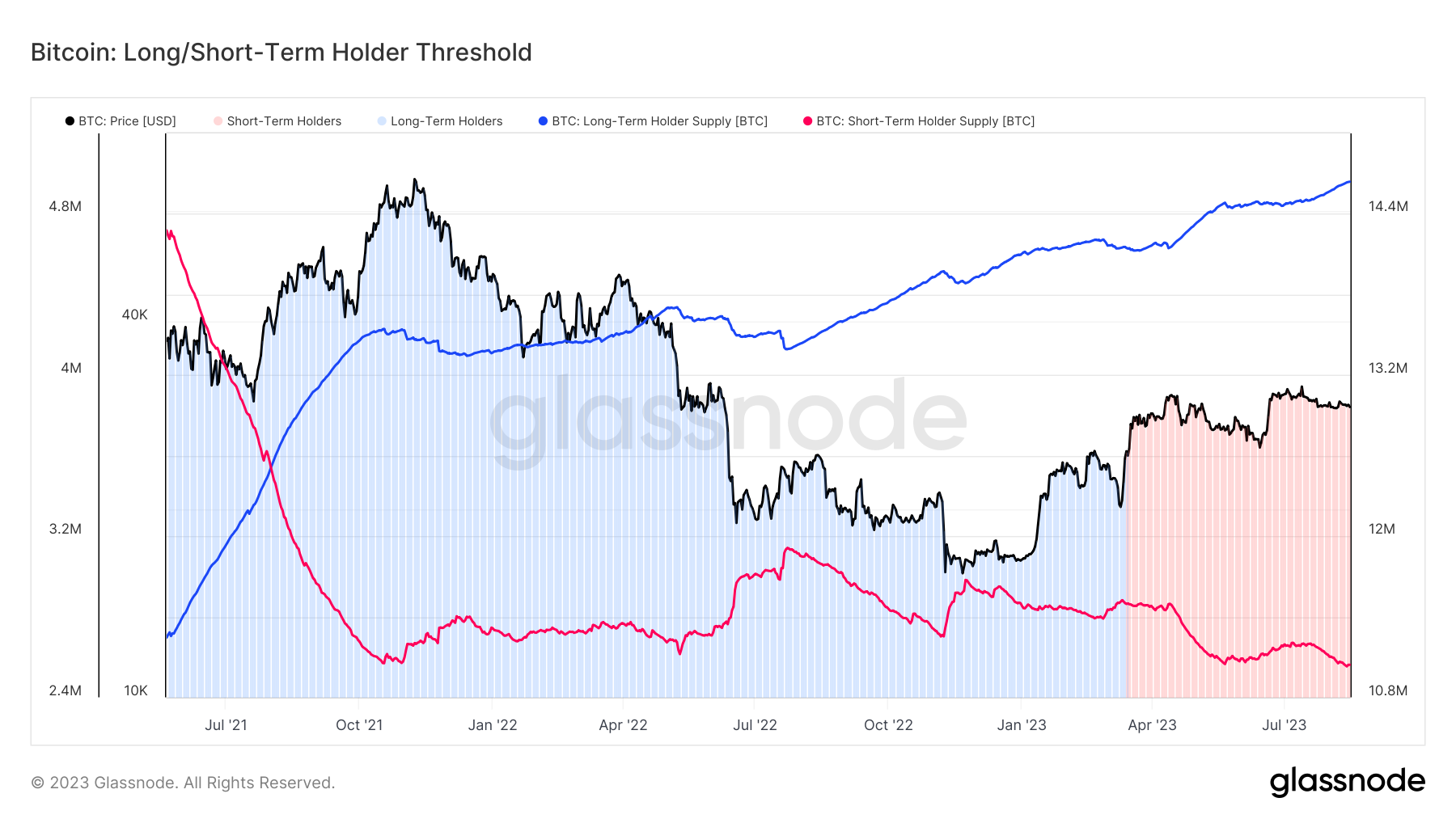

The share of the BTC supply held by STH entities has decreased, while LTHs now command a larger portion than ever before.

“We observe that the supply held by Long-Term Holders continues to rise, reaching an all-time high of 14.6M BTC. In stark contrast, Short-Term Holder supply has fallen to a multi-year low of 2.56M BTC,” The Week On-Chain noted.

“Overall, this indicates that the conviction of Bitcoin investors remains impressively high, with very few willing to liquidate their holdings.”

The last instance of STHs having such a minimal market presence was in October 2021, just prior to BTC/USD reaching its current all-time high of $69,000.

Bitcoin long/short-term holder threshold chart. Source: Glassnode

Bitcoin long/short-term holder threshold chart. Source: Glassnode

Magazine: Deposit risk: What do crypto exchanges really do with your money?

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any choices.