Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin indicators ‘enhance optimistic prospects’ as BTC price maintains 200-week trendline.

Bitcoin (BTC) continues to maintain crucial support, which new analysis indicates “enhances bullish probabilities.”

In a thread on X (formerly Twitter) dated Oct. 17, Caleb Franzen, a senior analyst at Cubic Analytics, highlighted two moving averages that are currently defining the BTC price battleground.

Analysis: Persistent Bitcoin support “a positive indicator”

Bitcoin is positioned between the 200-week simple moving average (SMA) and the 200-week exponential moving average (EMA), according to data from Cointelegraph Markets Pro and TradingView.

BTC/USD 1-week chart with 200-week SMA, EMA. Source: TradingView

BTC/USD 1-week chart with 200-week SMA, EMA. Source: TradingView

As of Oct. 18, the two trendlines are at $28,277 and $25,744, respectively, having established support and resistance since mid-August.

Franzen considers this a significant aspect to observe on weekly timeframes and one of several positive features of the BTC/USD chart.

“One reason I’ve remained patient with $BTC, despite leaning defensive, is that the price has been attempting to utilize the 200-week moving average cloud as support,” a portion of one post stated.

It further noted that bulls successfully maintaining the 200-week EMA was a “positive indicator.”

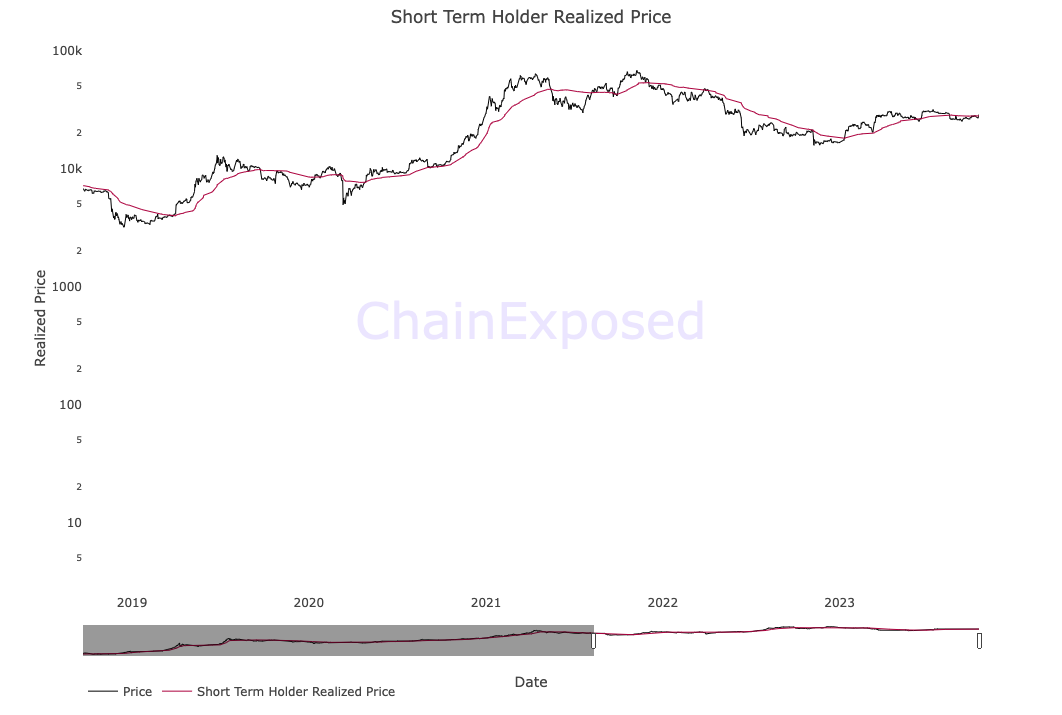

Franzen also referenced the short-term holder realized price (STHRP) — the cumulative on-chain price at which coins held by newer investors last changed hands.

Currently around $26,900, this metric has garnered significant attention in 2023 due to its capacity to serve as market support.

“Price is moving above the STHRP, which is a key trait of an uptrend & it has a history of functioning as dynamic support,” the thread continued, supported by data from on-chain analytics platform ChainExposed.

“This enhances bullish odds.”

Bitcoin short-term holder realized price (STHRP) chart (screenshot). Source: ChainExposed

Bitcoin short-term holder realized price (STHRP) chart (screenshot). Source: ChainExposed

Franzen was quick to clarify that despite these signals, there was no implication that BTC price movements would yield bull market-style increases as a consequence.

“Overall, these indicators demonstrate that constructive dynamics are occurring and enhancing bullish probabilities,” he elaborated.

“They don’t imply price increases. They indicate that positive developments are taking place.”

BTC price cycle deja vu emerges

The observations align with other recent studies into Bitcoin’s on-chain activity.

Related: BTC price models suggest a $130K target following the 2024 Bitcoin halving

As Cointelegraph reported, BTC/USD is up approximately 6% this week, despite brief volatility disrupting market conditions.

As network fundamentals reach new all-time highs, anticipation is growing regarding potential outcomes for BTC price movements as it approaches the April 2024 block subsidy halving.

Among the more vocal optimists is well-known social media trader Moustache, who this week continued to draw parallels between Bitcoin’s performance in 2023 and that of 2020.

An illustrative chart shared on X correlates the COVID-19 cross-market crash in March 2020 with Bitcoin’s two-year lows following the FTX collapse at the end of 2022.

“Still appears textbook, doesn’t it?” part of the accompanying commentary questioned, pondering whether a “significant move” could be imminent.

BTC/USD annotated chart. Source: Moustache/X

BTC/USD annotated chart. Source: Moustache/X

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a choice.