Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin heading towards ‘bearadise?’ $20K returns as a BTC price objective

Bitcoin (BTC) remained above $26,000 as the weekly close approached on Aug. 20, amid persistent doomsday BTC price predictions.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Analysis: Bitcoin could present a new "generational buying opportunity"

Data from Cointelegraph Markets Pro and TradingView indicated a strange stillness enveloping BTC/USD over the weekend, with the market experiencing an 11% decline over the past week.

Nervous market analysts remained extremely wary, and looking forward, Keith Alan, co-founder of the monitoring entity Material Indicators, perceived only limited potential for enhancement.

“I believe that $25k will eventually break down and open a path to retest support at the 2017 Bull Market Top, which was slightly below $20k, but I don’t anticipate a direct drop there,” he concluded in an analysis on X on Aug. 19.

“I’m anticipating a retest of the $25k support, which could potentially create a double bottom and establish a solid base for another exit rally. If that scenario occurs, the $28k – $29k range seems feasible.”

BTC/USD 1-week chart with 100 SMA. Source: TradingView

BTC/USD 1-week chart with 100 SMA. Source: TradingView

Alan further stated that such a rebound might even reach the 100-week simple moving average (SMA), currently positioned at $31,368, and if that happens, it would “add insult to the injuries of this week’s losses.”

“If/When we achieve the retest of $25k, my focus shifts to the next series of Lower Lows,” he encapsulated.

“The first will be $24,749 ( @coinbase ) and the next is $19,567, which is conveniently located just beneath a crucial R/S flip zone at the 2017 Bull Market Top. Losing that level paves the way to bearadise and a prospective generational buying opportunity.”

BTC/USD annotated chart. Source: Keith Alan/X

BTC/USD annotated chart. Source: Keith Alan/X

Others echoed the sentiment that $20,000 would resurface should $25,000 fail to serve as support.

“A break below $25.3K likely targets $24K – $23K for a more robust buyback reaction, otherwise, we may see a continuation towards $20K,” popular trader Skew informed X subscribers in part of a post that day.

“A deep sweep beneath $20K is the extreme scenario where I would consider swing long there.”

Nonetheless, Skew proposed that intraday BTC price movements might experience a bounce around the weekly close, with $28,500 as a plausible target if buy-side pressure increases.

BTC/USD annotated chart. Source: Skew/X

BTC/USD annotated chart. Source: Skew/X

BTC price penetrates Whale volume

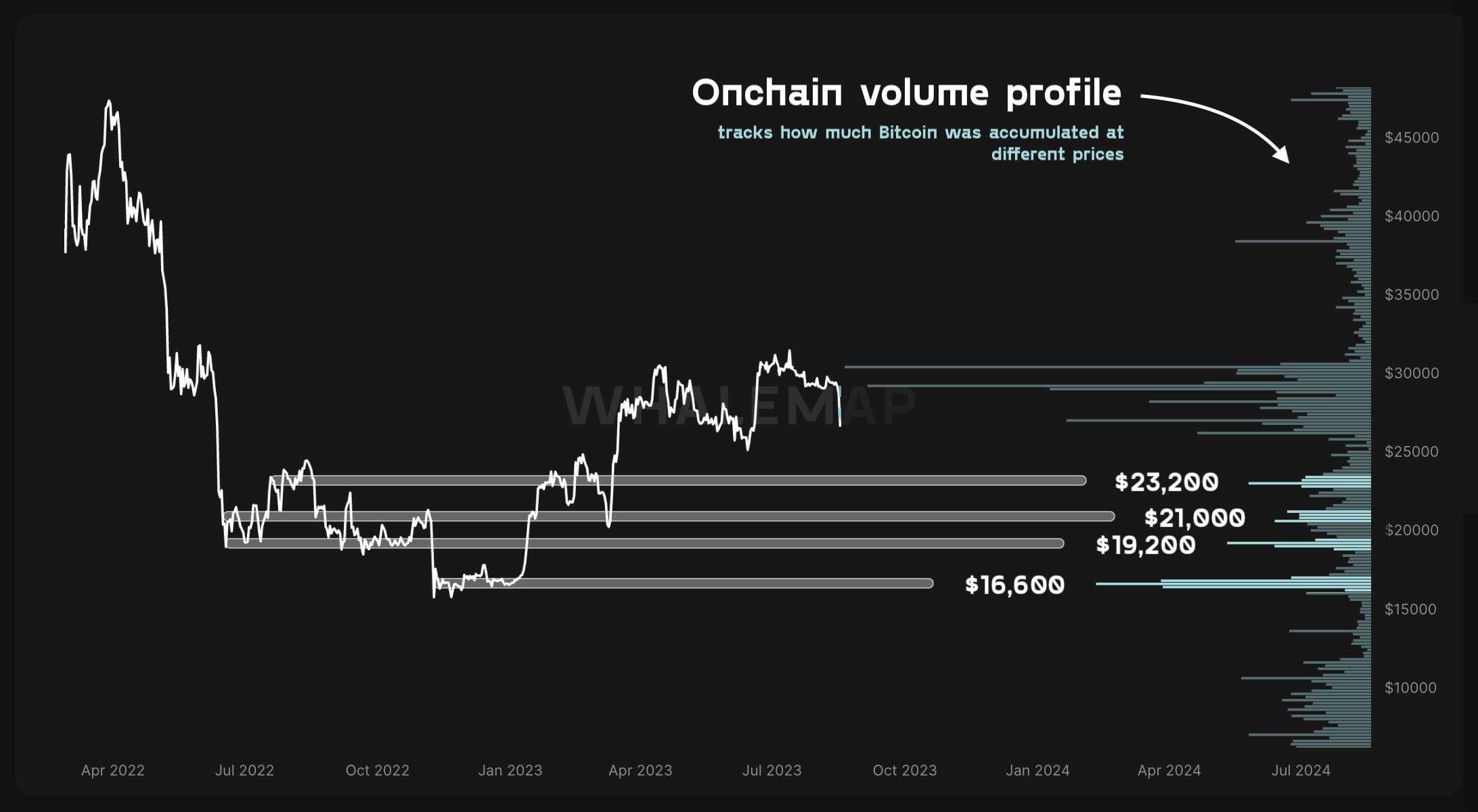

Some less severe support levels below $25,000 were noted by the analytics platform Whalemap, which identified areas of whale buying volume from previous activity.

Related: Why is the crypto market down today?

It pointed out that significant areas of on-chain volume still exist at $23,200 and $21,000.

“In case we dip even lower,” it remarked on a print of its data shared on X, adding that $19,200 and $16,600 were additional points of interest.

BTC/USD annotated chart. Source: Whalemap/X

BTC/USD annotated chart. Source: Whalemap/X

Previous whale support at $28,250 and $26,950, however, did not manage to sustain the market during the downward trend.

This article does not include investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research when making a choice.