Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin hash rates pose a risk to the decentralization of blockchain technology.

Blockchain technology emerged in 2008 as a decentralized, secure, and transparent framework for handling digital transactions. Its main objective was to address significant issues associated with conventional transactional systems, including trust, security, decentralization, and efficiency. Since then, blockchain has broadened its applications beyond finance, finding uses in supply chain management, healthcare, gaming, digital media, and social networking, among others.

Nevertheless, the blockchain sector continues to encounter considerable obstacles — including a lack of diversity, wealth concentration among a few holders, hash rate challenges, and a diminishing promise of decentralization.

Hash rate and why it’s a problem

The cryptocurrency that is currently capturing attention — and held in the digital wallets of over 400 million individuals globally — is Bitcoin (BTC). Bitcoin’s hash rate refers to the computational power necessary to validate transactions and generate new blocks on the Bitcoin blockchain. A robust hash rate is essential for preserving the integrity of the Bitcoin network, yet it also introduces several notable challenges.

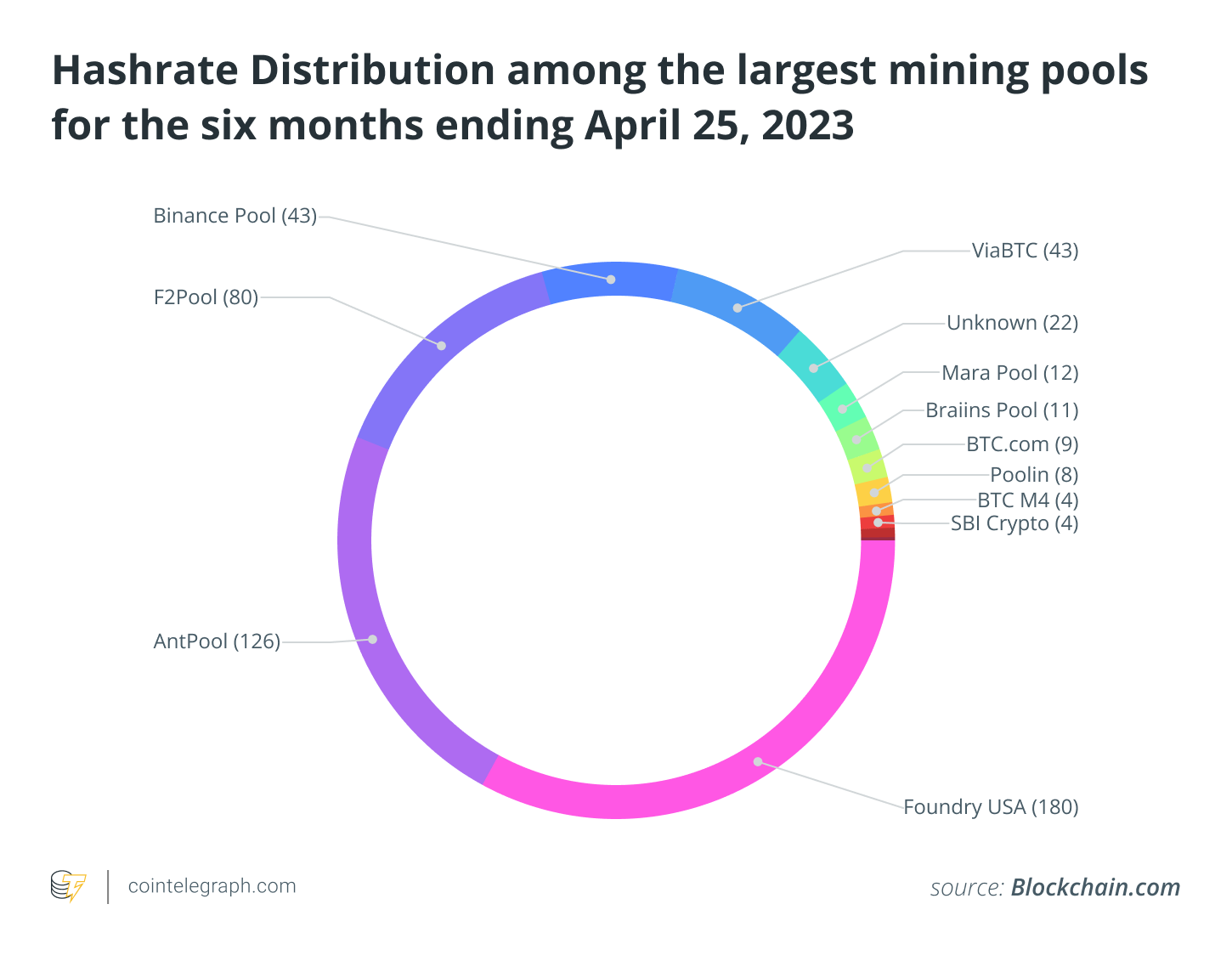

Hash rate distribution among the largest mining pools for the six months ending April 25, 2023.

Hash rate distribution among the largest mining pools for the six months ending April 25, 2023.

One of the most urgent concerns is the substantial energy consumption needed to uphold a high hash rate. As more miners participate in the network, the hash rate rises — along with the energy demands required to maintain it. The environmental ramifications of BTC mining have raised alarms throughout Bitcoin’s tumultuous history and ascent to mainstream recognition.

Another issue related to Bitcoin’s hash rate is the centralization of mining capabilities within a few dominant mining pools. As the hash rate has escalated over time, it has become increasingly challenging for individual miners to compete with these large pools, raising worries about the potential for these pools to monopolize the network and influence the trajectory of Bitcoin’s evolution.

Related: Elizabeth Warren wants the police at your door in 2024

There is also the risk of 51% attacks by mining pools that possess the majority of the hash rate. If a single mining pool or a coalition of mining pools controls more than 50% of the hash rate, they could potentially dominate the network and execute harmful actions, such as double-spend attacks or altering transaction histories. This poses a significant risk to the security and integrity of the Bitcoin network.

Lastly, the limited scalability of the Bitcoin network presents another challenge linked to its hash rate. As more users join the network and transaction volumes rise, the network may become congested, resulting in slower transaction times and elevated fees. This can hinder its effectiveness as a practical payment system and has sparked ongoing discussions within the Bitcoin community regarding how to tackle these scalability issues.

Phantom decentralization comes in many forms

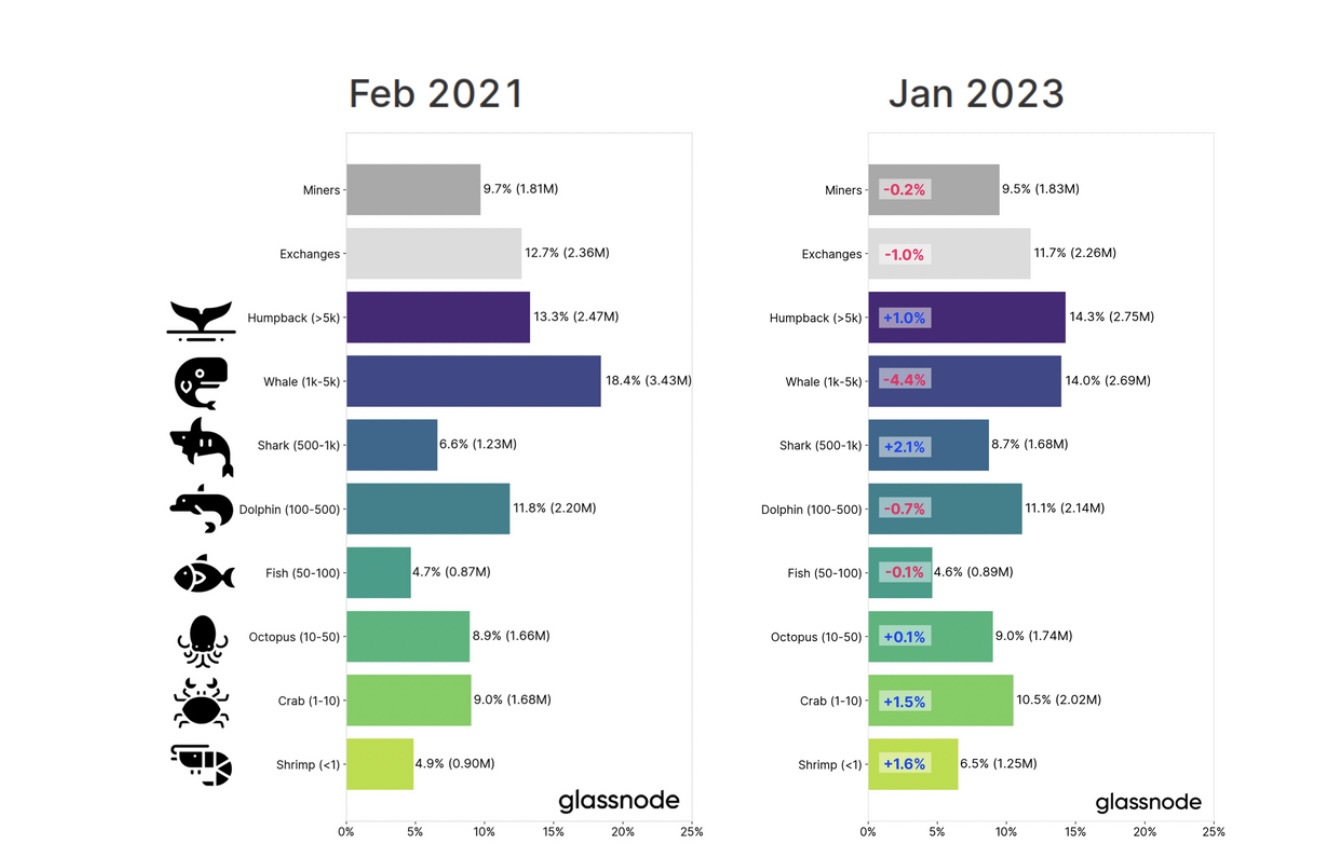

The blockchain sector has rapidly developed a significant power imbalance, resembling the traditional finance industry. The concentration of wealth and authority within a small group of individuals has resulted in an industry that is far from decentralized. Early adopters of blockchain technology, especially Bitcoin, were able to amass considerable wealth through mining, investing, and trading.

This has resulted in a concentration of wealth and influence among a limited number of individuals. The complexity of blockchain has further restricted early adoption to a tiny fraction of individuals in the tech sector. This accumulation of power and wealth has created barriers for new entrants to the market, making it difficult to challenge the supremacy of established players.

Bitcoin ownership concentration, 2021 v. 2023. Source: Glassnode

Bitcoin ownership concentration, 2021 v. 2023. Source: Glassnode

The high entry barriers have also contributed to the power imbalance in the blockchain sector. The expenses associated with establishing and managing a successful blockchain project can be considerable, and not everyone possesses the necessary resources or expertise. This has made it challenging for new startups to penetrate the market and contest the dominance of established entities.

Network effects also influence the power imbalance within the blockchain industry. Blockchain networks depend on network effects, meaning that the network’s value increases as more individuals utilize it. This creates a self-reinforcing cycle where established networks become increasingly dominant, complicating efforts for new networks to gain traction.

From phantom decentralization to the real thing

In spite of the challenges confronting the blockchain industry, there are strategies to tackle these issues and foster a more sustainable, equitable system.

One of the most urgent concerns regarding Bitcoin’s hash rate is its substantial energy consumption. To mitigate this, the industry could transition towards renewable energy sources, such as wind or solar power, to fuel mining operations. This would not only lessen the environmental impact of Bitcoin mining but also enhance its sustainability over time.

Related: CBDCs will lead to absolute government control

To address the scalability limitations of the Bitcoin network, initiatives should focus on enhancing the underlying technology. This could involve developing new protocols or adopting existing ones, such as the Lightning Network, which could greatly enhance the speed and efficiency of Bitcoin transactions.

Lastly, increased efforts should be directed towards educating the public about blockchain technology and its potential. This could be accomplished by providing better access to information and resources, offering training programs and workshops, and collaborating with educational institutions to incorporate blockchain into their curricula.

Alexa Karp is head of marketing at Lumerin and a former founding marketing manager at Metaplex. She is also an angel investor and adviser to more than 20 Web3 projects. She graduated with a BBA degree from Baruch College in New York.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.