Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin hash rate declines amid winter storm in the U.S., yet markets remain unfazed by the mining interruptions.

The temporary decrease in mining power highlights academic worries that geographic and pool concentration may amplify infrastructure failures, although the markets showed minimal immediate response.

(Zac Durant/Unsplash)

(Zac Durant/Unsplash)

What to know:

- Bitcoin’s hashrate dropped roughly 10% during a winter storm in the U.S., highlighting how local power interruptions can impact the network’s ability to handle transactions.

- Studies have revealed that concentrated mining, as evidenced by a 2021 regional outage in China, can result in slower block times, increased fees, and wider market disturbances.

- With several large pools now accounting for the majority of Bitcoin’s hashrate, the network is becoming increasingly susceptible to localized infrastructure breakdowns, even as the price of BTC remains relatively stable in the short term.

A significant decrease in the Bitcoin blockchain’s hashrate, which fell by 10% on Sunday during this week’s winter storm in the U.S., serves as a real-time stress test of a concern long noted by researchers: mining centralization has transformed local infrastructure failures into risks at the system level.

Hashrate refers to the amount of computational power available for processing transactions necessary to maintain the Bitcoin blockchain’s operation at any given moment. A sharp decline reduces the network’s capacity to process transactions, heightening the risk of delays before the difficulty adjustment occurs.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up (CoinWarz)

(CoinWarz)

Although the Bitcoin blockchain kept functioning through the storm — with only 10% of the blockchain’s hashrate going offline — an increasing number of academic studies indicate that its vulnerability to such incidents has escalated.

In a 2021 working paper titled Bitcoin Blackout: Proof-of-Work and the Risks of Mining Centralization, researchers Philipp Scharnowski and Jiahua Shi demonstrated that a regional mining outage in China in 2021 resulted in extended block times, elevated transaction fees, and diminished market quality, illustrating how concentrated mining can convert local power failures into widespread network disruptions.

This research provides context for the significance of rising concentration in BTC mining, as block generation has become increasingly concentrated among a select few dominant pools.

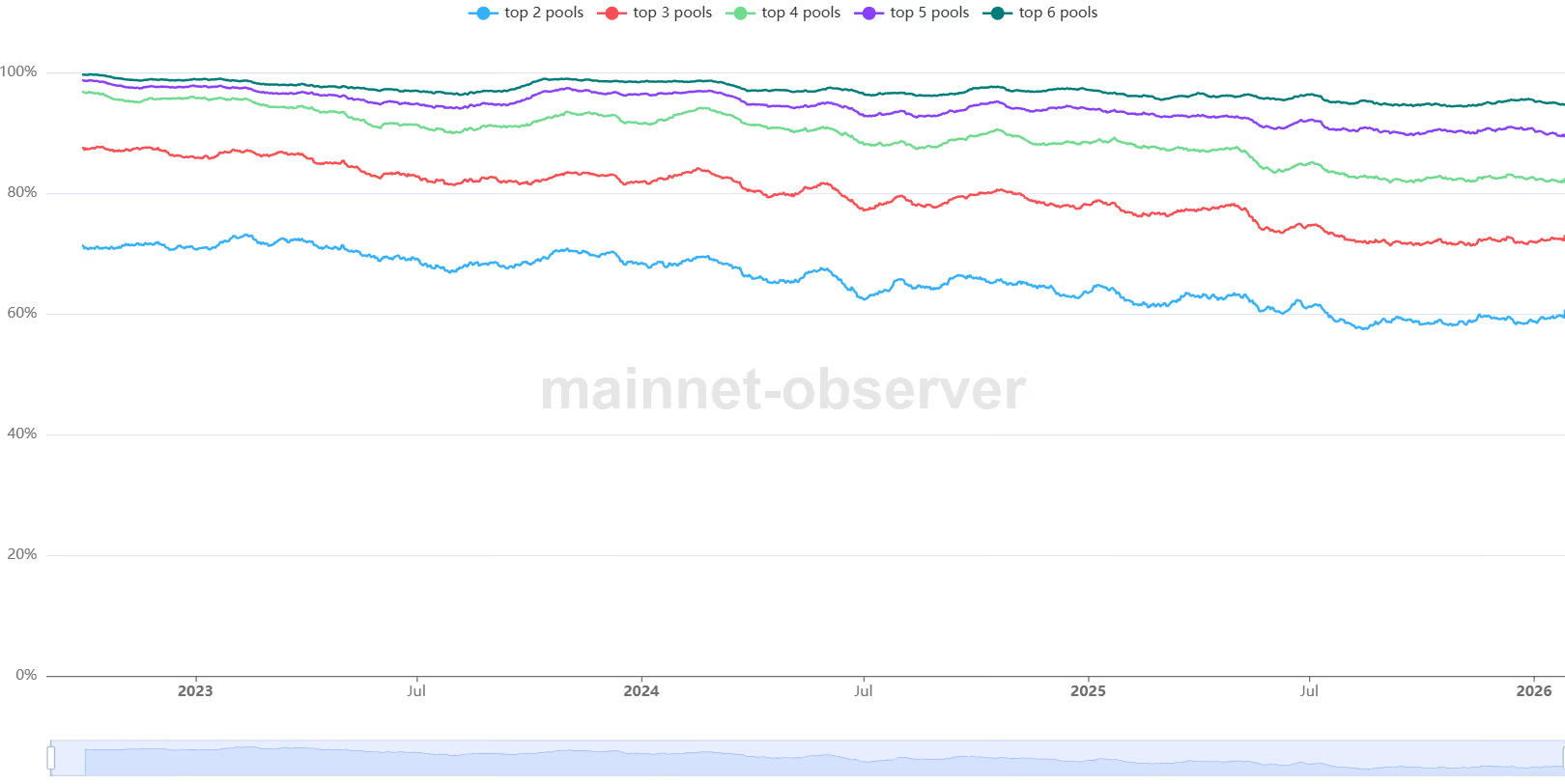

The Mining Centralization Index shows that block production is now predominantly controlled by a small number of pools, which diminishes the network’s capacity to withstand localized shocks.

(Mining Centralization Index/mainnet.observer)

(Mining Centralization Index/mainnet.observer)

In recent years, the leading two mining pools have frequently held more than 50% of Bitcoin’s hashrate, while the top six pools have consistently made up approximately 80% to 90% of all blocks, placing a substantial portion of the network’s transaction processing in the hands of a limited number of operators.

At this time, markets seem unaffected, as BTC barely fluctuated on the day, but this incident emphasizes how the increasing concentration of Bitcoin mining can transform physical infrastructure failures into systemic stress without immediately reflecting in the price.