Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin halving expected to increase ‘efficient’ BTC mining expenses to $30,000.

Bitcoin (BTC) Ordinals are enhancing miner earnings, yet new research indicates that “income stress” may be on the horizon.

In the most recent issue of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode forecasted new challenges for miners following Bitcoin’s upcoming block subsidy halving.

The impact of Bitcoin halving on miners could be “severe”

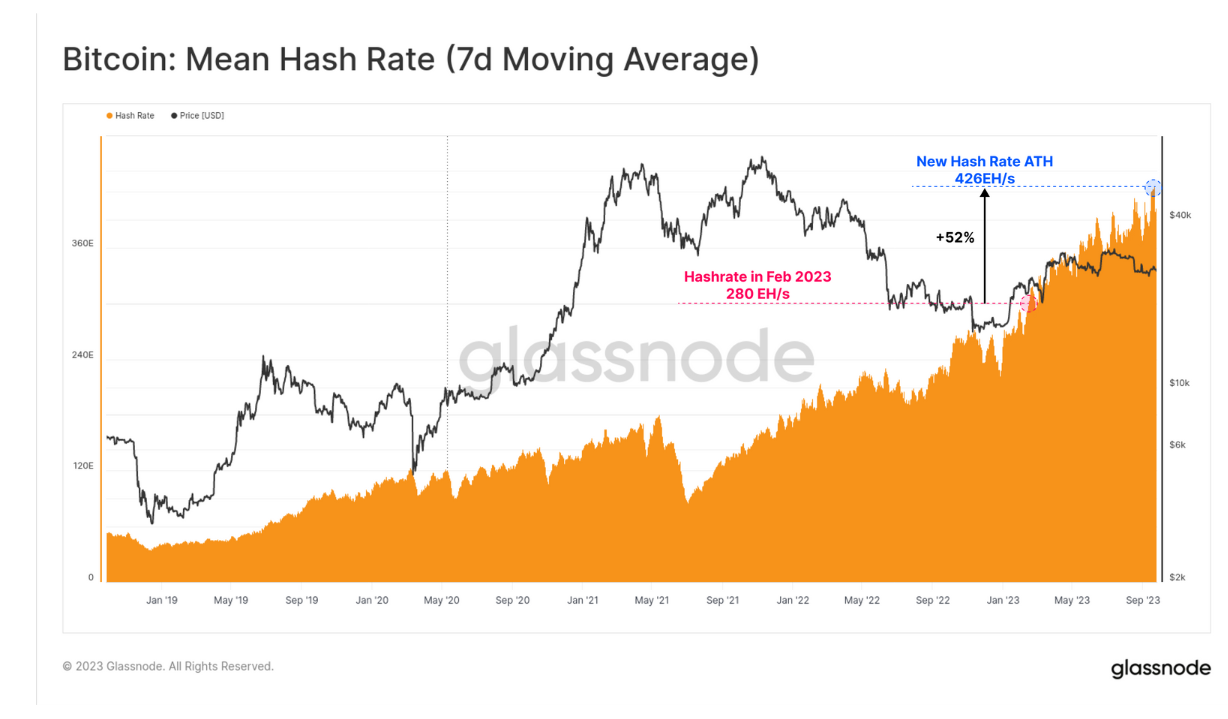

Competition among Bitcoin miners is surging, with the hash rate — the estimated total processing power utilized on the blockchain — reaching unprecedented levels.

According to Glassnode, this signifies extraordinary circumstances for miners striving to sustain their operations at current BTC price points.

Ordinal inscriptions are providing assistance, functioning as “packing-filler” that transforms unutilized blockspace into a revenue stream for miners.

“As demand for blockspace rises, miner revenues will naturally benefit,” it stated.

Bitcoin Mean Hash Rate (7-day moving average) chart (screenshot). Source: Glassnode

Bitcoin Mean Hash Rate (7-day moving average) chart (screenshot). Source: Glassnode

The share of income derived from fees has risen by 1% to 4% compared to the lows observed during Bitcoin bear markets, although it remains modest by historical measures.

“At the same time, the hashrate competing for these rewards has surged by 50% since February, as more miners and newer ASIC rigs come online,” “The Week On-Chain” observes.

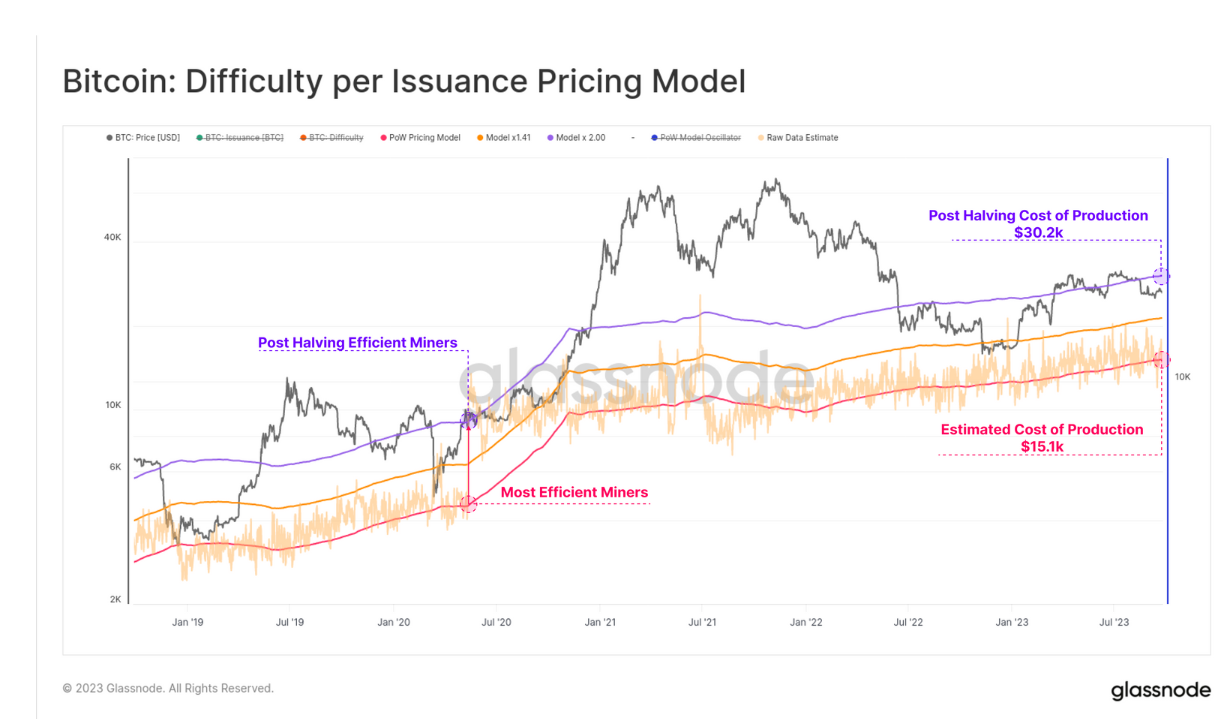

This increase in hash rate is setting the stage for an impending confrontation. In April 2024, miner rewards per block will be halved, effectively doubling the so-called “production cost” per BTC. Currently around $15,000, this will exceed $30,000 — surpassing the current spot price.

Glassnode provided two models to estimate the price at which miners, collectively, would begin to incur losses, with the aforementioned model comparing issuance to mining difficulty.

“According to this model, we estimate that the most efficient miners on the network have an acquisition price of approximately $15.1k,” the researchers clarified.

“However, the purple curve illustrates the post-halving ‘doubling’ of this threshold to $30.2k, which would likely place the majority of the mining sector under significant income stress.”

Bitcoin Difficulty per Issuance Pricing Model (screenshot). Source: Glassnode

Bitcoin Difficulty per Issuance Pricing Model (screenshot). Source: Glassnode

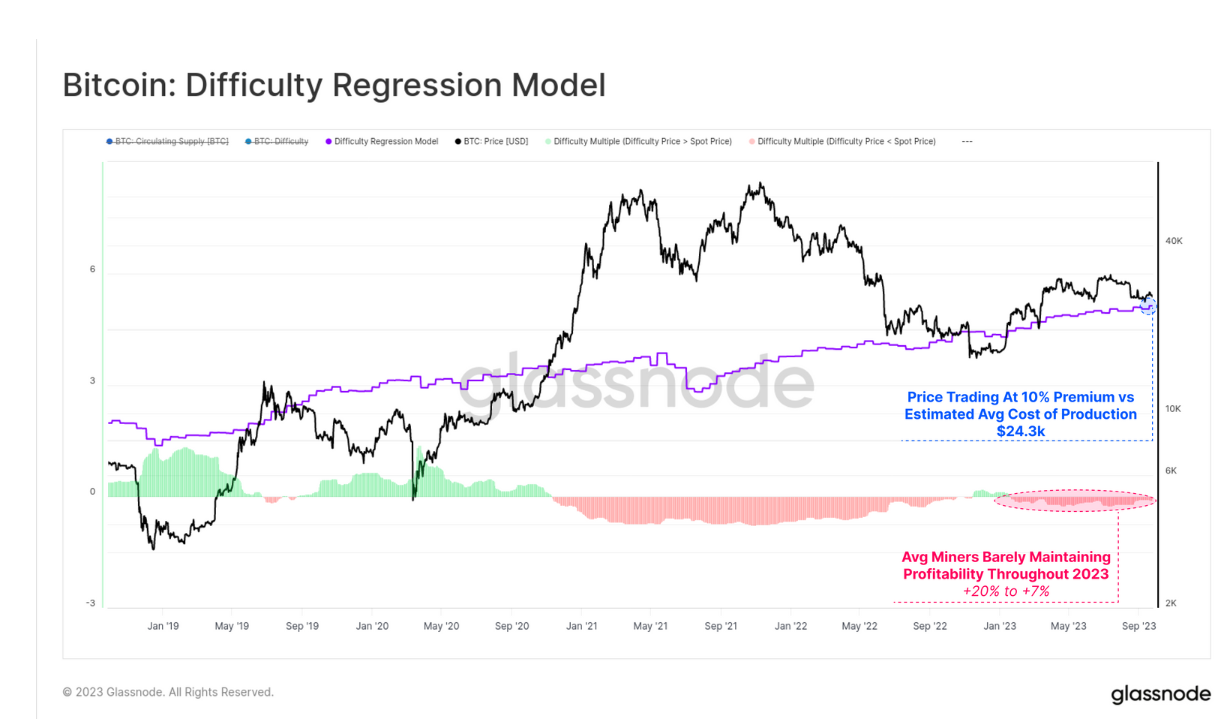

A prior model estimated the average miner acquisition price at $24,300 per Bitcoin — roughly 8% below the spot price as of Sept. 28.

Bitcoin Difficulty Regression model (screenshot). Source: Glassnode

Bitcoin Difficulty Regression model (screenshot). Source: Glassnode

BTC price incentives

Others hold a more positive view regarding how miners will navigate the lead-up to the halving.

Related: Bitcoin exchange volume tracks 5-year lows as Fed inspires BTC hodling

In a recent interview with Cointelegraph, analyst Filbfilb, co-founder of trading suite DecenTrader, emphasized that miners would increase BTC accumulation ahead of the event.

“Miners are motivated to ensure that prices remain significantly above marginal cost prior to the halving,” he noted in an X (formerly Twitter) thread in August.

“Whether they consciously collude or not, they are collectively incentivized to drive prices higher before their marginal revenue is effectively halved.”

BTC/USD chart with miner accumulation data. Source: Filbfilb/X

BTC/USD chart with miner accumulation data. Source: Filbfilb/X

Supporting BTC supply dynamics will be what Filbfilb refers to as smart money “buying the rumor” regarding the halving and its potential effect on the quantity of BTC being minted.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any choices.