Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin falls back towards last week’s lows as concerns over AI impact technology stocks and precious metals decline.

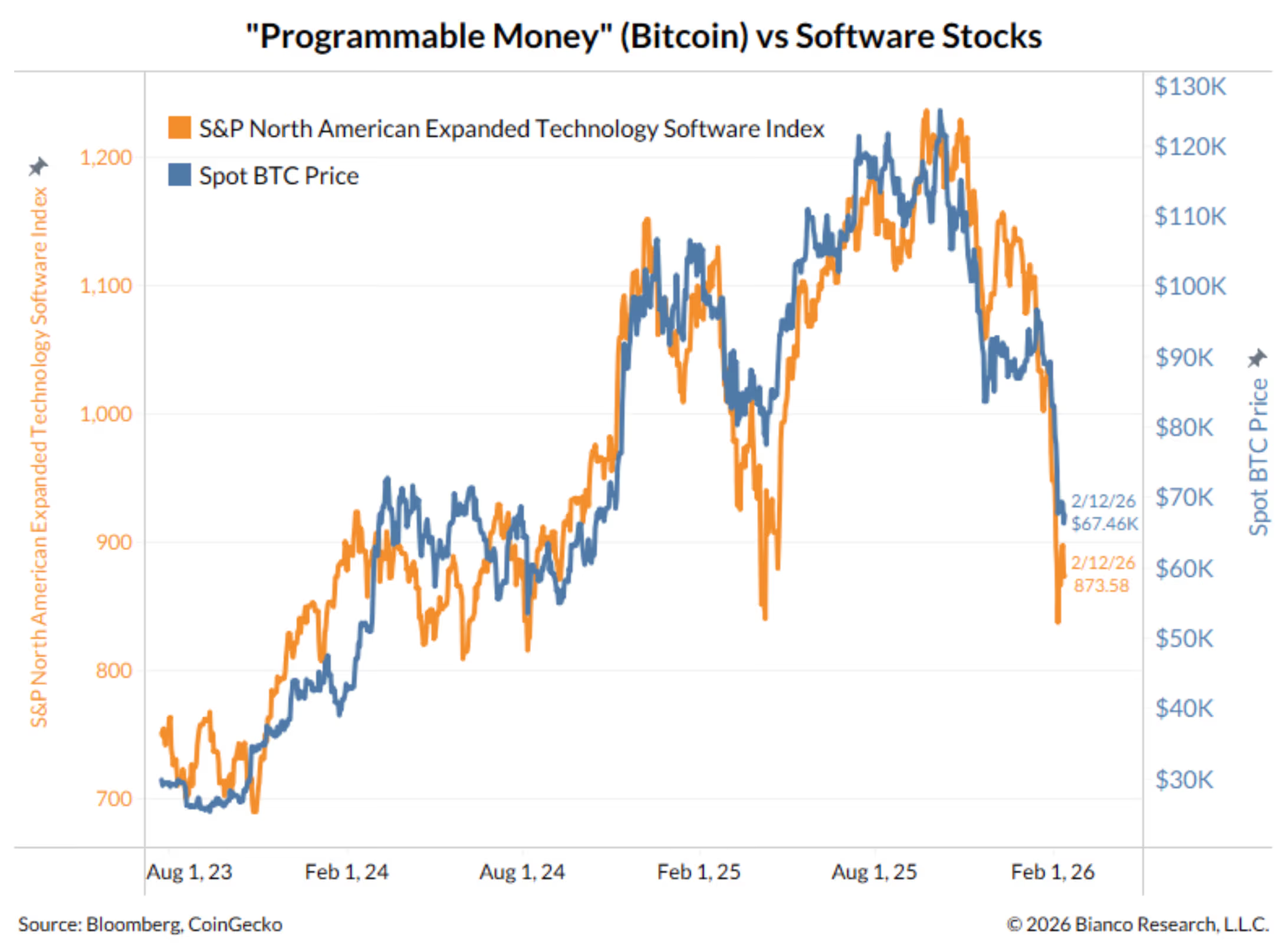

The significant relationship between the cryptocurrency market and the software industry reemerged on Wednesday

Bitcoin has largely reversed its earlier gains from Monday, moving back towards the $65,000 level. (CoinDesk)

Bitcoin has largely reversed its earlier gains from Monday, moving back towards the $65,000 level. (CoinDesk)

Key points:

- Bitcoin has mainly undone its rebound from last week’s cryptocurrency downturn, returning to the $65,000 range.

- The decline in digital assets followed a wider retreat in the technology sector, specifically among software companies that have shown a strong correlation with bitcoin.

- Both gold and silver experienced swift afternoon declines, with silver dropping from a slight daily gain to a 10% decrease.

Bitcoin has retreated towards the lows of last week, relinquishing nearly all of its recent increases above $70,000 and continuing its decline as it now trades around $65,000.

Bitcoin recorded a 2% drop in the last 24 hours, with losses observed in ether and solana following a similar trend.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The downturn reflected widespread price movements in the Nasdaq, which dropped 2% on Wednesday, particularly within the software sector, where the iShares Expanded Tech-Software Sector ETF (IGV) fell by 3%. The IGV is now down 21% year-to-date as investors reassess the high valuations in a landscape where the programming capabilities of artificial intelligence agents seem to be rapidly advancing.

“Software stocks are facing challenges once more today,” noted macro strategist Jim Bianco. “IGV is essentially back to last week’s panic lows.”

“Keep in mind there’s another kind of software, ‘programmable money,’ crypto,” Bianco remarked. “They are fundamentally the same.”

(Source: X/@biancoresearch)

(Source: X/@biancoresearch)

Precious metals not immune

After maintaining slight gains for much of the day, gold and silver experienced rapid and significant declines in the mid-afternoon. By the end of the session, silver had decreased by 10.3% to $75.08 per ounce, while gold had fallen by 3.1% to $4,938.