Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

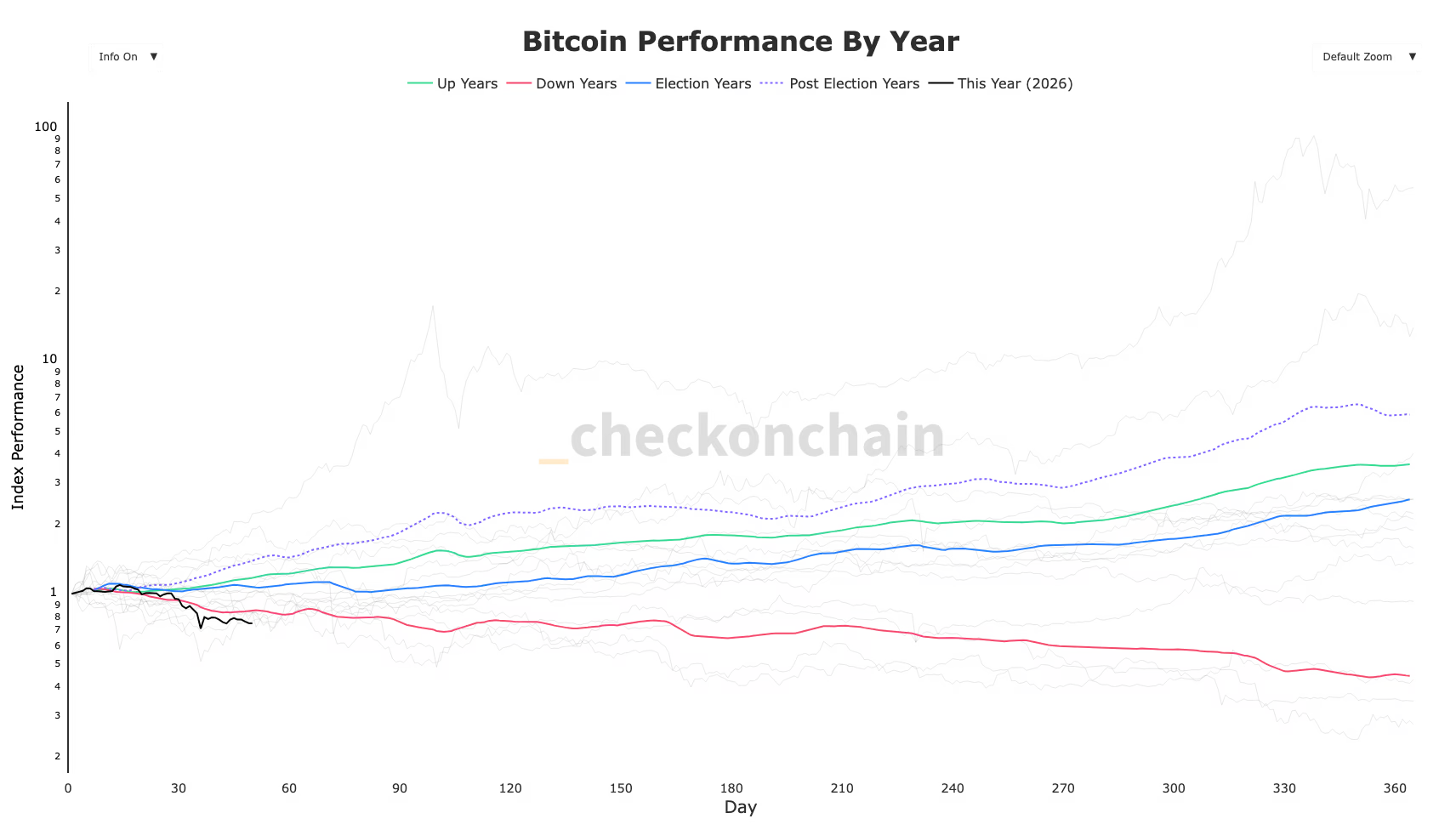

Bitcoin experiences its lowest performance in the initial 50 days of a year on record.

Bitcoin is on track for its first-ever consecutive declines in January and February.

Bitcoin Performance by Year (CheckonChain)

Bitcoin Performance by Year (CheckonChain)

Key points:

- Bitcoin has decreased by 23% in the first 50 days of 2026, indicating its poorest start to a fiscal year on record.

- The cryptocurrency has never experienced consecutive declines in January and February, and February appears likely to deepen January’s losses.

As of fifty days into 2026, bitcoin is experiencing its worst recorded start to a fiscal year, based on Checkonchain data. The asset is down 23% year-to-date, with a 10% drop in January followed by an additional 15% in February.

According to Coinglass data, bitcoin has not previously shown back-to-back declines in January and February. While there have been significant reductions in January in years such as 2015, 2016, and 2018, each instance was succeeded by a positive February. Should the losses persist, bitcoin may also be on track for its poorest consecutive monthly performance since 2022.

STORY CONTINUES BELOWDon't miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Checkonchain data indicates that in a typical down year, the average index reading is 0.84, 50 days in, which is a benchmark traders often utilize to assess cyclical drawdowns. Currently, bitcoin stands at 0.77, highlighting the extent of the drawdown.

This downturn follows a 17% drop in 2025, a post-election year. Historically, post-election years have generally outperformed election years and have exceeded the performance of positive years on average, making the recent underperformance more notable.