Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin, Ether, and XRP ETFs experience outflows as Solana shows resilience against the trend.

U.S. spot crypto ETFs experienced widespread redemptions primarily driven by bitcoin and ether funds, while Solana products attracted new inflows, indicating a selective shift in institutional investments rather than a complete withdrawal from digital assets.

What to know:

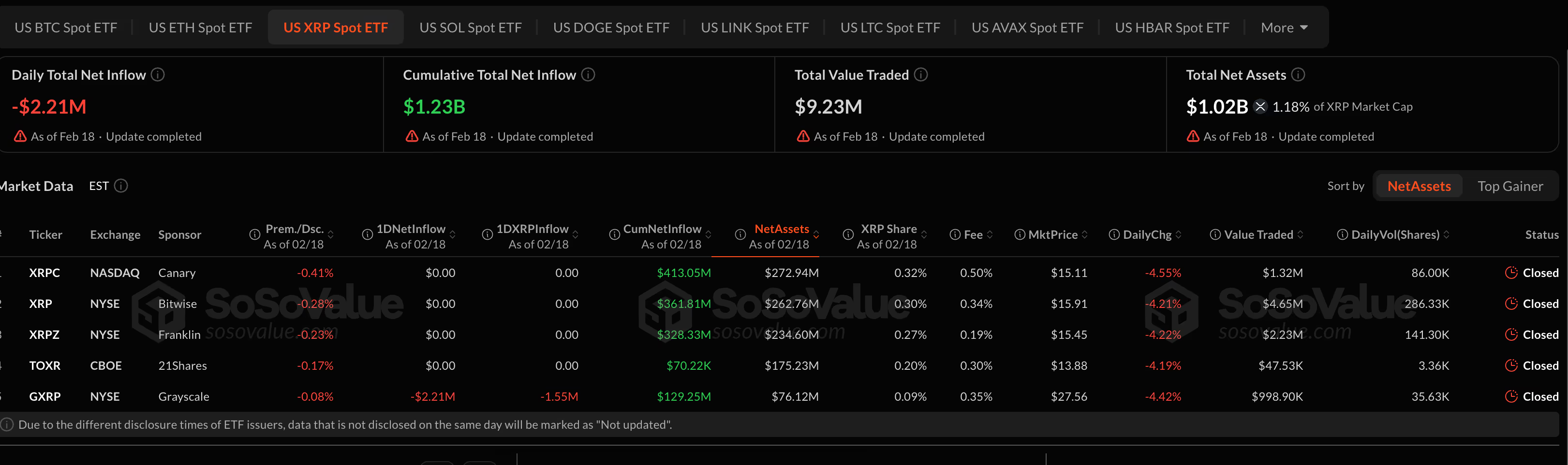

- U.S.-listed spot ETFs for bitcoin, ether, and XRP experienced significant net outflows on Feb. 18, indicating a reduction in institutional exposure rather than opportunistic buying.

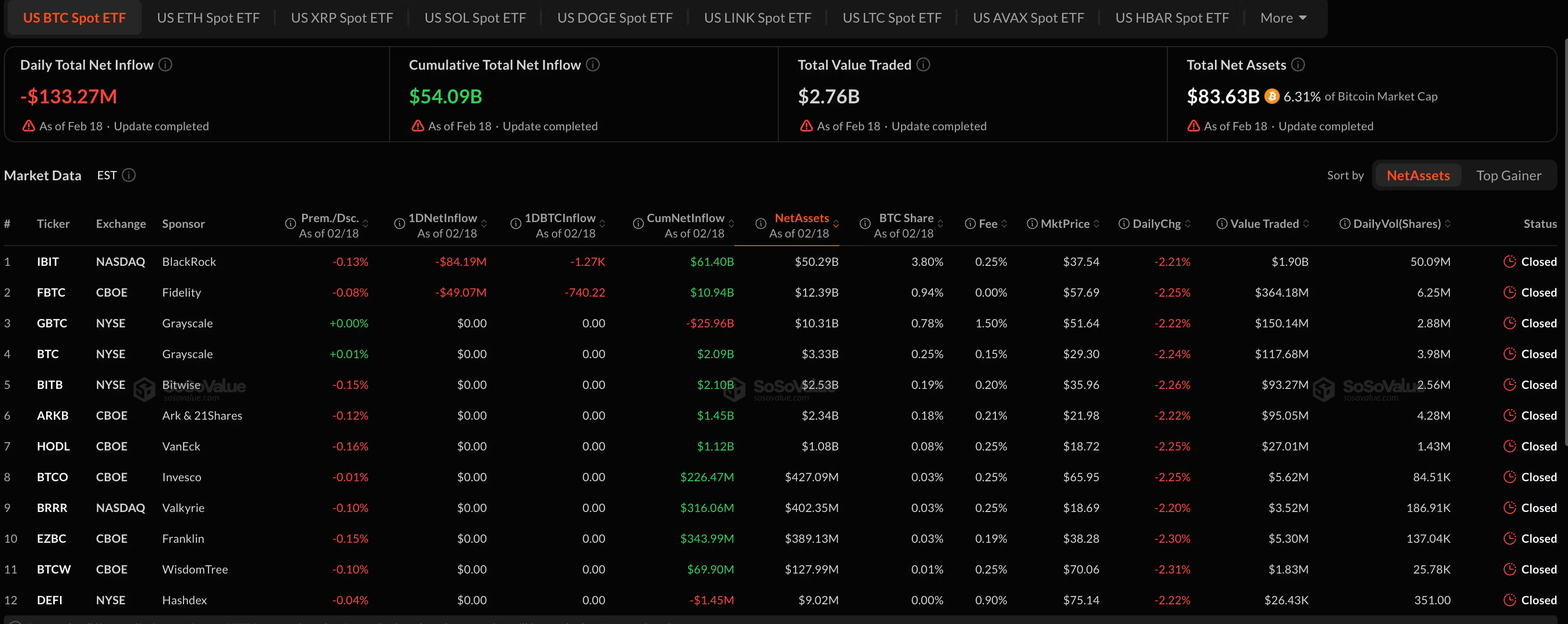

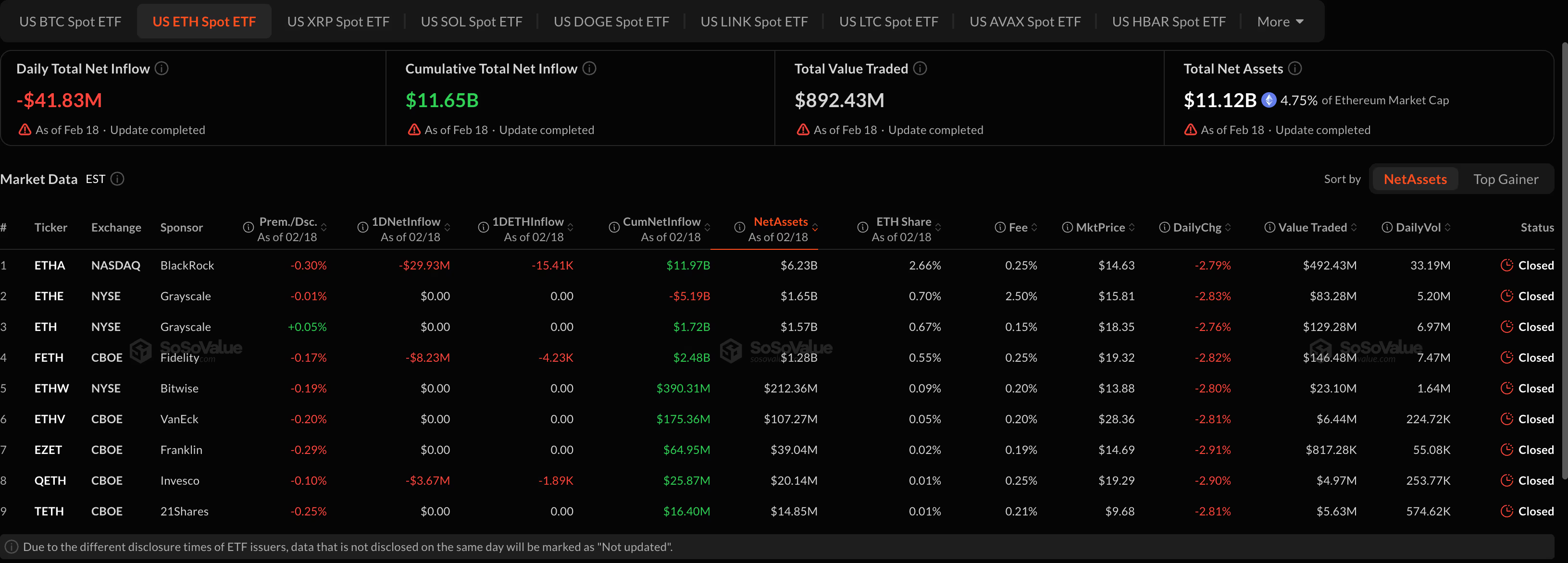

- Bitcoin spot ETFs faced a decrease of $133.3 million, while ether products lost $41.8 million in a single day, even though these funds constitute 6.3 percent and 4.8 percent of their respective market values.

- In contrast, Solana spot ETFs attracted $2.4 million in net inflows, implying that investors are reallocating within the crypto sector rather than exiting the market amid macroeconomic concerns.

U.S.-listed crypto ETFs are showing widespread losses overall, with one significant exception.

As of Feb. 18, bitcoin spot ETFs recorded $133.3 million in daily net outflows, primarily driven by BlackRock’s IBIT, which lost $84.2 million, and Fidelity’s FBTC, which saw a reduction of $49 million. The total net assets across bitcoin funds amount to $83.6 billion, representing approximately 6.3% of bitcoin’s market capitalization, but recent trends indicate that institutions are decreasing their exposure instead of capitalizing on dips.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Ethereum products exhibited a similar trend, with U.S. ETH spot ETFs registering $41.8 million in net outflows on that day, including a loss of nearly $30 million from BlackRock’s ETHA. The aggregate net assets across ether funds currently total $11.1 billion, accounting for about 4.8% of ETH’s market capitalization.

This persistent outflow occurs while ether trades below $2,000, facing challenges in gaining traction despite widespread anticipations of potential rate reductions later in the year.

XRP ETFs also experienced declines, with $2.2 million in daily outflows. The total net assets across XRP funds are slightly above $1 billion, which is approximately 1.2% of XRP’s market capitalization. The price movement in XRP reflects a cautious sentiment, with the token down over 4% for the day.

In contrast, Solana made a noticeable impact.

U.S. SOL spot ETFs saw $2.4 million in net inflows, bringing total inflows close to $880 million. Bitwise’s BSOL led the way with $1.5 million in new investment. While this amount may be small in relative terms, it stands in stark contrast to the overall risk-averse stance seen in bitcoin and ether products.