Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin enhancement proposal aimed at spam prevention faces criticism from key figures.

Your day-ahead look for Feb. 17, 2026

Bitcoin proposal draws heat from heavyweights (Ian Talmacs/Unsplash)

Bitcoin proposal draws heat from heavyweights (Ian Talmacs/Unsplash)

What to know:

You are viewing Crypto Daybook Americas, your morning briefing on overnight developments in the cryptocurrency markets and what to anticipate for the day ahead. Crypto Daybook Americas will provide you with extensive insights to start your morning. If you are not currently subscribed to the email, click here. You won’t want to miss it.

By Omkar Godbole (All times ET unless specified otherwise)

A new Bitcoin Improvement Proposal, BIP-110, aimed at reducing spam-like data congestion on the blockchain, is encountering criticism from some prominent figures in the industry who contend it could harm the network’s reputation more than the spam itself.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

BIP-110 is classified as a “soft fork,” a type of upgrade that integrates seamlessly with existing Bitcoin configurations without disrupting the blockchain. It aims to impose strict temporary restrictions on non-monetary data in transactions, especially Ordinals inscriptions that clutter Bitcoin blocks with images, videos, or tokens.

Implementing this could assist in combating “spam” and alleviate network congestion, making it more affordable for everyday users while maintaining the blockchain’s focus on transactions. On-chain activity has been relatively minimal in recent months.

However, Adam Back, CEO of Blockstream, disagrees, labeling the proposal as an assault on Bitcoin’s standing as a reliable currency.

"It’s worse as it is an attack on bitcoin’s credibility as a store of value, it’s security credibility, and a lynch mob attempt to push changes there is not consensus for. spam is just an annoyance, it all definitionally fits within the block-size. the op returns are 4x smaller," Back stated on X.

Several other stakeholders echoed this sentiment, suggesting that the proposed solution might undermine trust more than the spam itself.

Meanwhile, market activity remains subdued, with Bitcoin fluctuating between $67,000 and $70,000, nearing the lower end of that range as of this writing. The CoinDesk Memecoin Index (CDMEME) has declined by 3% over the past 24 hours, alongside 1% drops in other significant tokens such as Ether and BNB.

"The downturn of the largest cryptocurrencies is a concerning sign for smaller ones, as it could lead to a faster decline for them as well," noted Alex Kuptsikevich, senior market analyst at The FxPro, in an email.

He added that the market has entered a “stress zone” but has not yet reached the ultimate capitulation phase. "To establish a ‘true bottom,’ a peak in loss-taking and a complete exhaustion of selling pressure are essential," he pointed out.

In traditional markets, short positions on the dollar have reached their highest level in over ten years, while the recent fall in the inflation-adjusted yield on the U.S. 10-year note has provided a glimmer of hope for beleaguered Bitcoin supporters. Remain vigilant!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more detailed listing of events this week, refer to CoinDesk’s "Crypto Week Ahead".

- Crypto

- Feb. 17, 7 p.m.: Rocket Pool to initiate its Saturn One upgrade.

- Macro

- Feb. 17, 8:30 a.m.: Canada inflation rate YoY for January (Prev. 2.4%); Core rate YoY (Prev. 2.8%)

- Feb. 17, 8:30 a.m.: NY Empire State manufacturing index for February est. 7.1 (Prev. 7.7)

- Feb. 17, 6:50 p.m.: Japan’s balance of trade for January est.-2.142bn yen (Prev. 105.7bn yen)

- Earnings (Estimates based on FactSet data)

- Feb. 17: HIVE Digital Technologies (HIVE), pre-market, -$0.07

Token Events

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Governance votes & calls

- Feb. 17: Jito is set to conduct an X Spaces session with Hush Protocol.

- Feb. 17: Basic Attention Token will host a Brave Talk session on X Spaces.

- Balancer is holding a vote to change a signer on the Emergency subDAO multisigs to enhance operational responsiveness and security. Voting concludes on Feb. 17.

- Unlocks

- Feb. 17: will unlock 17.24% of its circulating supply valued at $20.84 million.

- Token Launches

- No significant launches.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Day 1 of 3: ETHDenver

Market Movements

- BTC has decreased by 1.03% since 4 p.m. ET Monday, now at $68,131.79 (24hrs: -1.28%)

- ETH has fallen by 1.11% to $1,976.32 (24hrs: -0.57%)

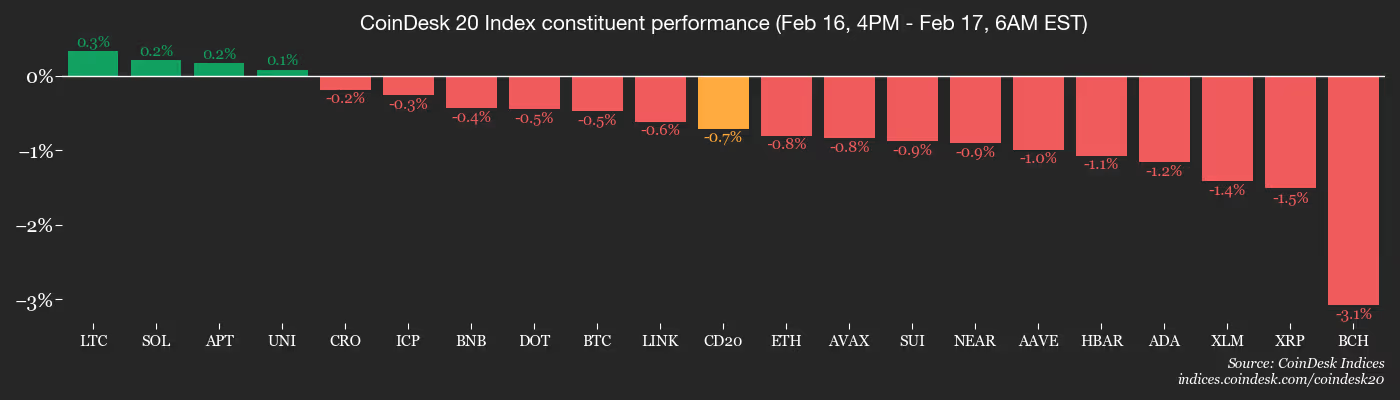

- CoinDesk 20 has dropped 1.28% to 1,978.56 (24hrs: -1.03%)

- Ether CESR Composite Staking Rate has increased by 6 basis points to 2.84%

- BTC funding rate stands at 0.002% (2.2119% annualized) on Binance

- DXY is up 0.21% at 97.12

- Gold futures have decreased by 1.87% to $4,952.10

- Silver futures are down 4.19% at $74.70

- Nikkei 225 ended down 0.42% at 56,566.49

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 0.37% at 10,512.50

- Euro Stoxx 50 is up 0.15% at 5,987.94

- DJIA finished on Friday up 0.10% at 49,500.93

- S&P 500 closed up 0.05% at 6,836.17

- Nasdaq Composite concluded down 0.22% at 22,546.67

- S&P/TSX Composite closed up 1.87% at 33,073.71

- S&P 40 Latin America closed on Monday down 0.64% at 3,717.23

- U.S. 10-Year Treasury rate has fallen by 2.7 basis points to 4.029%

- E-mini S&