Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin (BTC) Value Drops to $66,000 Prior to FOMC Announcement

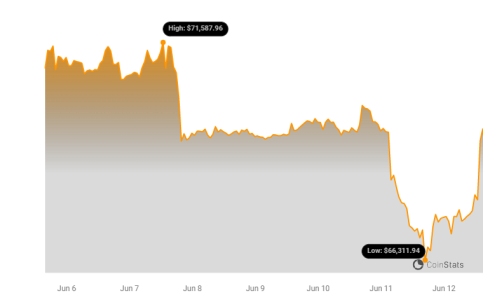

The price of Bitcoin (BTC) fell nearly 5% on Tuesday, reaching a low of $66k as the cryptocurrency market experienced a downturn ahead of this week’s FOMC meeting.

BTC’s value dropped to a low of $66,018 on Coinbase, erasing the gains made when prices peaked at $71,974 last Friday.

Data from CoinStats indicated that Bitcoin traded nearly 5% lower over the past 24 hours. The leading cryptocurrency has reduced its weekly gains and was down 6% during this timeframe at the time of writing.

BTC Price Chart | Source: Coinstats

BTC Price Chart | Source: Coinstats

Reasons Behind Bitcoin’s Decline on Tuesday

The challenges faced by the benchmark cryptocurrency this week follow a notable 19-day streak of net inflows for spot Bitcoin ETFs, which ended on Monday. Reports indicated that the sector experienced outflows totaling approximately $65 million.

Additionally, on Tuesday, a Bitcoin wallet that had remained inactive for over 5 years became active and transferred 8,000 BTC, valued at more than $535 million, to various addresses, including Binance.

According to Lookonchain, this wallet received 8,000 BTC on December 6, 2018, when Bitcoin was priced at $3,810.

A wallet that had been dormant for 5.5 years transferred 8K $BTC($535.64M) to #Binance 40 mins ago.

The wallet received 8K $BTC on Dec 6, 2018, when the $BTC price was $3,810.https://t.co/zvxAKbHKi6 pic.twitter.com/ZKZHdm4JkR

— Lookonchain (@lookonchain) June 11, 2024

Risk-Averse Sentiment Ahead of CPI and FOMC

While the price remains significantly above the psychological threshold of $60,000, investors are closely monitoring the forthcoming FOMC minutes and comments from Fed Chair Jerome Powell.

This is linked to the broader macroeconomic context, including the economic reports anticipated this week, and market analysts have indicated that this scenario could be a key consideration for investors.

“Markets are in a risk-off mode ahead of CPI and FOMC tomorrow. This month’s FOMC will also release the Dot Plot, which informs the market about the number of cuts the Fed expects for the remainder of 2024,” analysts at QCP Capital, a global digital asset trading firm and market maker, stated.

3/

3. Markets are in a risk-off mode ahead of CPI and FOMC tomorrow. This month's FOMC will also release the Dot Plot, which informs the market about the number of cuts the Fed anticipates for the rest of 2024.

— QCP (@QCPgroup) June 11, 2024

Analyst Observations: ‘We’ve Seen This Before’

While prices may decline further in anticipation of these macroeconomic reports and the Fed’s interest rate decision, pseudonymous crypto analysts Moustache and Max suggest that FOMC meetings have historically been favorable for Bitcoin.

“FOMC tomorrow and $BTC is forming a bullish inverse head & shoulders pattern here. Previous FOMC meetings have already marked the low of the left shoulder + head. Is the right shoulder next?” crypto trader Moustache remarked to his 123,000 X followers.

#Bitcoin

FOMC tomorrow and $BTC is forming a bullish inverse head & shoulders pattern here.

Previous FOMC meetings have already marked the low of the left shoulder + head. Is the right shoulder next?

Probably just a coincidence.

So far, these meetings have mostly been bullish for BTC. pic.twitter.com/EbtYIkgswZ

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) June 11, 2024

Sharing a Bitcoin price chart with FOMC meetings highlighted, Max observes that the last three have coincided with a dip followed by a bullish reversal. “We’ve seen this before,” the analyst posted on X.

Last 3 FOMC meetings marked out over $BTC's price action.

We've seen this before. pic.twitter.com/GQhTLV5pll

— Max (@MaxBecauseBTC) June 11, 2024

“Bitcoin tends to rebound after each FOMC meeting,” another crypto analyst, Ali Martinez, commented.

#Bitcoin tends to rebound after every FOMC meeting! pic.twitter.com/i9UghrD1vJ

— Ali (@ali_charts) June 11, 2024

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

(@el_crypto_prof) June 11, 2024

(@el_crypto_prof) June 11, 2024