Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin bears require BTC value to dip beneath $27K prior to Friday’s $900M options expiration.

The $900 million Bitcoin (BTC) weekly options expiry on May 12 could significantly influence whether the price falls below $27,000.

Bitcoin price faces rejection at $30,000

BTC bears are likely to exploit macroeconomic challenges, concerns surrounding Silk Road coins, and the uncertainty stemming from a spike in Bitcoin’s transaction fees to drive the price lower in the coming days.

Bitcoin 4-h price movements during option expiries. Source: TradingView

Bitcoin 4-h price movements during option expiries. Source: TradingView

The BTC/USD pair surpassed $29,800 on May 6, but the momentum quickly reversed as the resistance proved to be more formidable than expected.

The following 8.2% correction over two days tested the $27,400 support level, supporting the notion of sideways trading as investors assess the dynamics of the economic crisis and its potential effects on cryptocurrencies.

Meanwhile, Warren Buffett, the billionaire investor and owner of Berkshire Hathaway, has expressed a lack of optimism regarding the growth of the U.S. economy. This pessimistic outlook for the global economy may clarify why some Bitcoin traders opted to decrease their exposure over the past week, significantly lowering the chances of surpassing $30,000.

Bitcoin options: bulls displayed excessive optimism

The open interest for the May 12 options expiry stands at $900 million, although the actual amount will be lower since bears anticipated price levels below $28,000.

These traders became overly optimistic after Bitcoin’s price increased by 11.2% between April 9 and April 14, testing the $31,000 resistance.

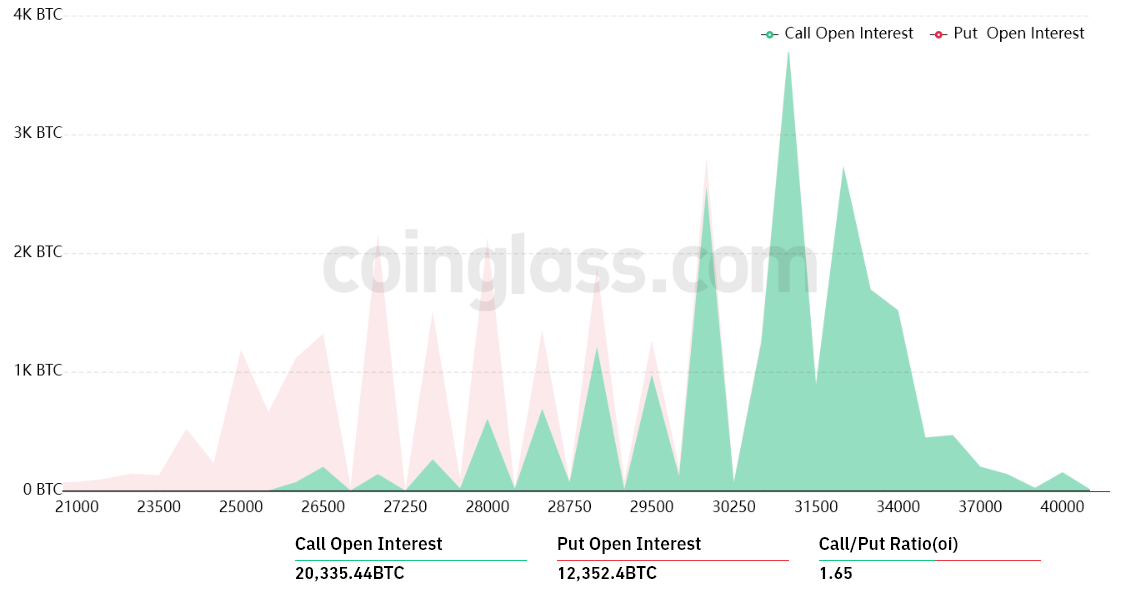

Bitcoin options aggregate open interest for May 12. Source: CoinGlass

Bitcoin options aggregate open interest for May 12. Source: CoinGlass

The call-to-put ratio of 1.65 indicates an imbalance between the $560 million in call (buy) open interest and the $340 million in put (sell) options.

However, if Bitcoin’s price remains around $27,500 at 8:00 am UTC on May 12, only $11 million worth of these call (buy) options will be in play. This discrepancy arises because the right to purchase Bitcoin at $28,000 or $29,000 becomes irrelevant if BTC is trading below those levels at expiry.

Bitcoin bulls target $28,000 to equalize the situation

Outlined below are the four most probable scenarios based on the current price movements. The number of options contracts available on May 12 for call (bull) and put (bear) instruments varies according to the expiry price.

The imbalance favoring each side represents the theoretical profit:

- Between $25,000 and $27,000: 100 calls vs. 9,900 puts. Bears hold total control, profiting $230 million.

- Between $27,000 and $28,000: 400 calls vs. 5,000 puts. The net outcome favors the put (sell) instruments by $120 million.

- Between $28,000 and $29,000: 1,500 calls vs. 2,100 puts. The outcome is balanced between put and call options.

- Between $29,000 and $30,000: 3,300 calls vs. 800 puts. The net result favors the call (bull) instruments by $70 million.

This rough estimate considers the call options utilized in bullish bets and the put options solely in neutral-to-bearish trades. Nonetheless, this simplification overlooks more intricate investment strategies.

For example, a trader might have sold a put option, thereby gaining positive exposure to Bitcoin above a certain price. Unfortunately, estimating this effect is not straightforward.

Ultimately, once it became evident that the Bitcoin network was functioning as intended, the selling pressure eased, leading to Bitcoin’s price stabilizing around $27,500. However, traders should remain vigilant as the bears still hold a more advantageous position ahead of Friday’s weekly options expiry, favoring downward price movements.

Related: PayPal’s crypto holdings increased by 56% in Q1 2023 to nearly $1B

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.