Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin bears maintain dominance but show signs of fatigue as BTC price recovers to $29,000.

On August 8, Bitcoin (BTC) climbed back above $29,000 as a trader anticipated a possible breakout already in progress.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

BTC price hints at falling wedge breakout

Data from Cointelegraph Markets Pro and TradingView indicated a slight rebound in BTC price following local lows of $28,670.

Remaining within a narrow range, Bitcoin closely mirrored U.S. equities during the Wall Street trading session on August 7.

Although there was no sustained momentum in either direction, market participants sought indications that a trend reversal might already be occurring.

For well-known trader Jelle, these indications manifested as a potential falling wedge breakout on daily charts.

“This current formation has a target of $32,000. Can it overcome the key resistance?” he questioned in part of the day’s analysis.

The wedge in question originated at the beginning of July and represents Bitcoin’s second occurrence in two months, with another having been established from April to late June.

BTC/USD annotated chart. Source: Jelle/X (Twitter)

BTC/USD annotated chart. Source: Jelle/X (Twitter)

Michaël van de Poppe, founder and CEO of trading firm Eight, described the previous day’s decline as a “standard correction.”

“Immediately flipped back, decent daily candle. Let’s see what CPI will bring on Thursday,” he added.

Van de Poppe referred to the primary macro event of the week — the July release of the U.S. Consumer Price Index (CPI) — which is typically a catalyst for volatility in the crypto market.

On intraday charts, the situation remained mixed, as a contest unfolded between market makers and takers on exchanges.

$BTC

Takers cut & sold what was bought earlier https://t.co/8plHMTnbEu pic.twitter.com/DtxKDjIxrF— Skew Δ (@52kskew) August 8, 2023

“Failure to break down forced hands, especially from spot takers, to be bid, particularly since spot takers initiated the sell-off in the first place (related to the spot buying around $29K),” popular trader Skew clarified.

Analysis: Bitcoin “close to being oversold”

In a more positive market overview, Yann Allemann and Jan Happel, co-founders of on-chain analytics firm Glassnode, proposed that the dip below $28,000 held greater significance as a local bottom than many might have realized.

Related: Bitcoin price can go ‘full bull’ next month if 200-week trendline stays

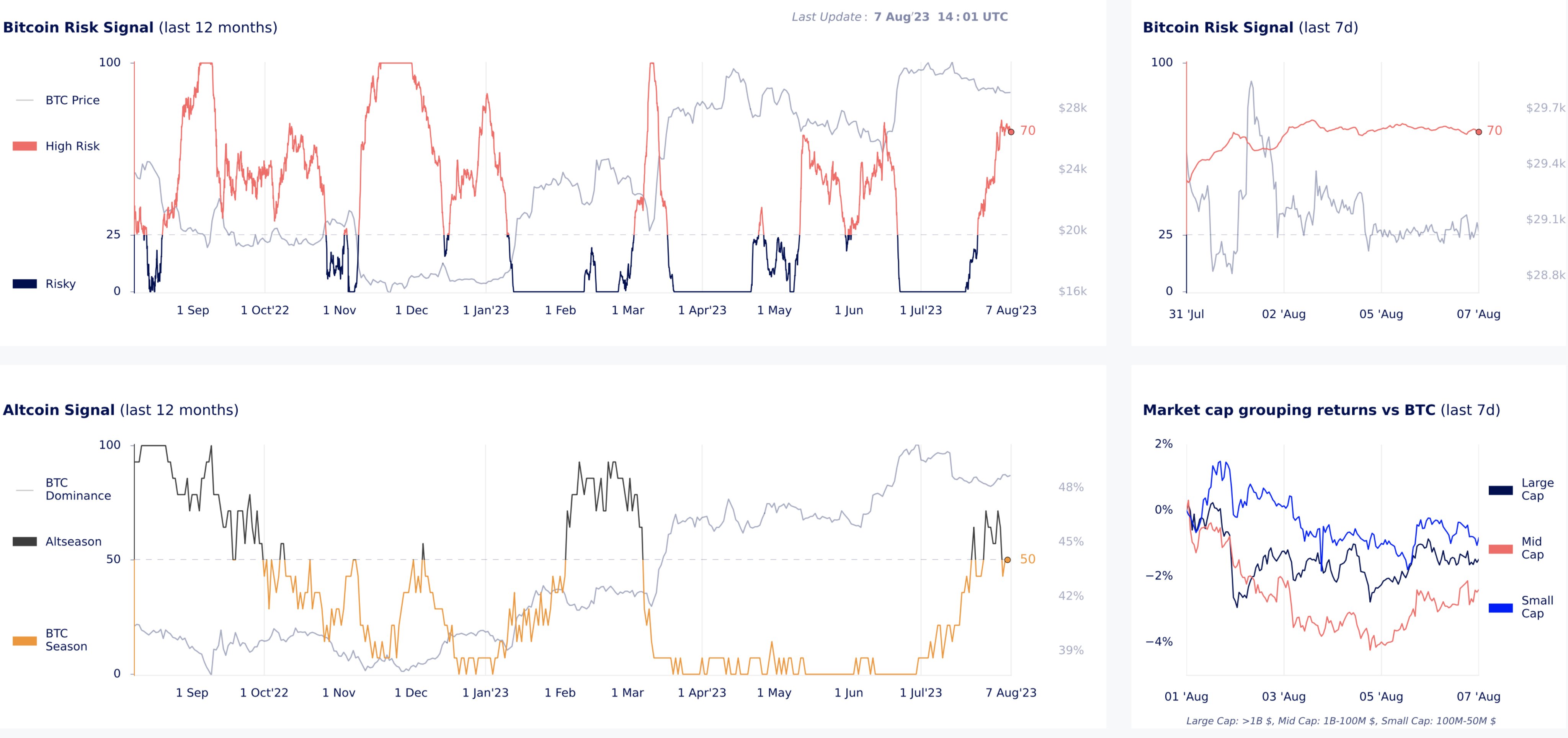

According to the Risk Signal metric, Bitcoin is at its most “high-risk” trading level in several months.

Combined with a neutral signal on altcoins amid overall volatility near its lowest historical values, the market is primed for energized bulls to enter, Glassnode asserted.

“Bears in control, but getting exhausted,” part of an X (formerly Twitter) post featuring the relevant charts stated.

“Bitcoin is close to being oversold, we’re going to tap the liquidity pool (demand) around $28.5k. This could be the reversal we were hoping for.”

Bitcoin, alt metrics comparison. Source: Yann Allemann/Jan Happel/X

Bitcoin, alt metrics comparison. Source: Yann Allemann/Jan Happel/X

Magazine: Deposit risk: What do crypto exchanges really do with your money?

This article does not provide investment advice or recommendations. Every investment and trading action carries risk, and readers should perform their own research before making decisions.