Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin approaches two-month lows as it enters $26K ‘bear market’ phase.

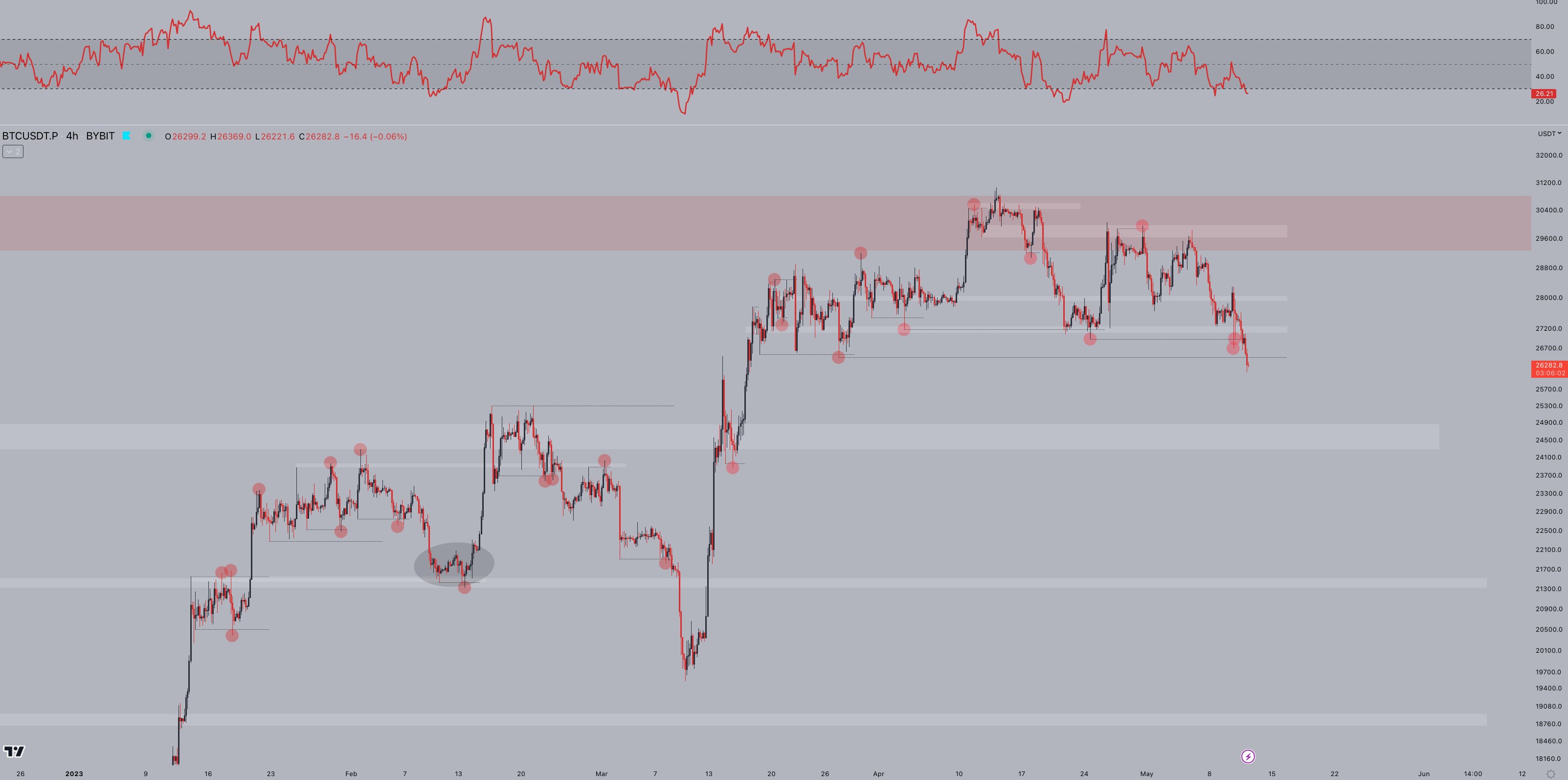

On May 12, Bitcoin (BTC) approached two-month lows amid concerns that a “head-and-shoulders” formation could favor bearish traders.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC Price Analysis: “Welcome to bearadise”

Data from Cointelegraph Markets Pro and TradingView indicated that BTC/USD hit $26,100 on Bitstamp, marking its lowest point since March 17.

Despite favorable macroeconomic conditions for risk assets, Bitcoin was unable to leverage the opportunity for gains as bid liquidity diminished.

“Welcome to bearadise,” summarized the on-chain analytics platform Material Indicators.

A chart shared on Twitter the previous day revealed that primary buy support was now around $25,750, with BTC/USD consuming liquidity higher overnight.

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

On daily charts, market participants expressed concerns about whether the pair would remain lower after three local peaks.

This “head-and-shoulders pattern,” now clearly evident on the chart, could set a negative precedent if confirmed.

“We simply cannot let the #Bitcoin head and shoulders crowd win,” asserted financial commentator Tedtalksmacro.

“Back above $27k things will get very interesting…”

BTC/USD annotated chart with "head and shoulders" pattern marked. Source: Tedtalksmacro/ Twitter

BTC/USD annotated chart with "head and shoulders" pattern marked. Source: Tedtalksmacro/ Twitter

Trader and analyst Moustache pointed out that it was time for the critical 200-week moving average (WMA) to be retested.

Regarded as a “make or break level,” the 200 WMA has acted as support since mid-March.

#Bitcoin (W)$BTC is currently testing the MA 200 (W). This line marked the bottom in 2015, 2019, and 2020.

At the same time, $BTC is testing the middle line in the Gaussian Channel.

This is really strong support and a make it or break it level imo. pic.twitter.com/auzL125G1W— ⓗ (@el_crypto_prof) May 12, 2023

As reported by Cointelegraph, several traders were already anticipating a deeper pullback to $25,000 or lower.

#BTC repeating same path

25k$ seems to be the logical level everyone tends to spam the BUY button

Anticipating pic.twitter.com/QUyYpOFahM— Mikybull Crypto (@MikybullCrypto) May 12, 2023

This included nominally bullish Jelle, who acknowledged on that day that Bitcoin might attempt a “last stab” at the $25,000 level before reversing.

He observed that relative strength index (RSI) readings were not favoring sellers on lower timeframes.

“Bitcoin nuked straight through support, next major zone of interest is around 24-25k,” he tweeted.

“RSI is failing to push into the extremes, suggesting sellers are getting exhausted. One last stab into 25k that gets quickly bought up, would make sense.”

BTC/USD annotated 4-hour chart with RSI. Source: Jelle/ Twitter

BTC/USD annotated 4-hour chart with RSI. Source: Jelle/ Twitter

Longs Gain Confidence as BTC Price Declines

Analyst Philip Swift, co-founder of trading suite DecenTrader and creator of data resource LookIntoBitcoin, expressed increased confidence that the worst losses would soon be behind.

Related: Bitcoin price can ‘easily’ hit $20K in next 4 months — Philip Swift

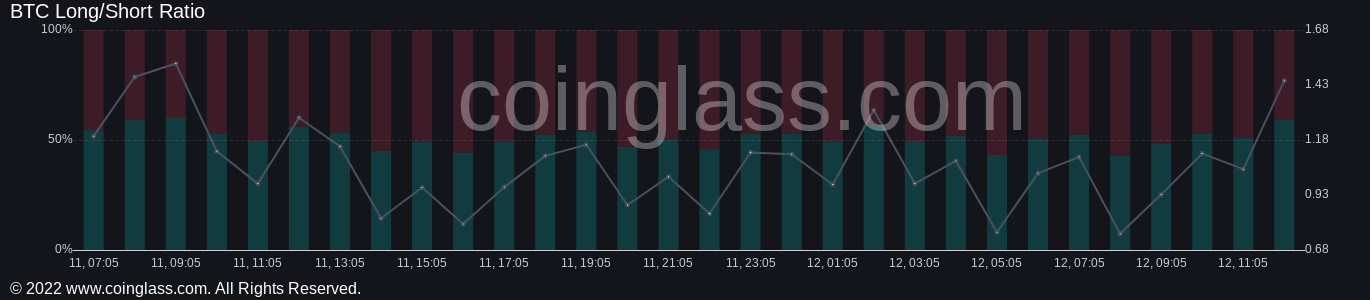

In a tweet, he remarked that while the price has been decreasing, the long/short ratio has diverged, with long positions becoming more common.

Im not convinced we have a major correction coming on this Bitcoin move down.

Near term though it is interesting to note that the long/short ratio has been climbing as price has trended down. pic.twitter.com/sefGEi39CD— Philip Swift (@PositiveCrypto) May 12, 2023

Additional data from Coinglass indicated that the long/short ratio was at 58.7% long at the time of writing on May 12.

BTC long/short ratio chart. Source: Coinglass

BTC long/short ratio chart. Source: Coinglass

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.