Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin approaches $70,000 as on-chain indicators suggest a bear market and traders anticipate Fed stability in April: Asia Morning Briefing

On-chain metrics indicate diminishing demand and restricted liquidity, while prediction markets exhibit minimal anticipation for imminent rate reductions.

Key Points:

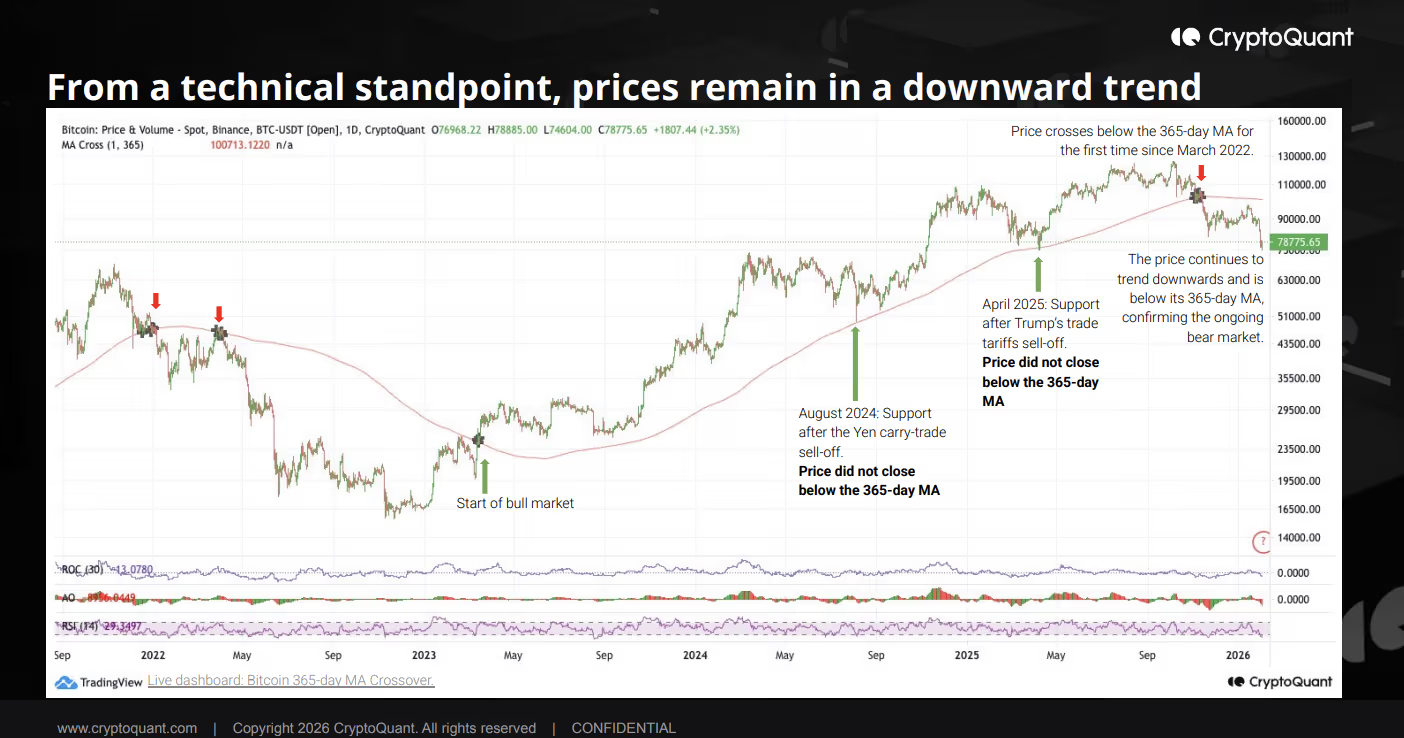

- Bitcoin is exhibiting clear signs of a bear market as on-chain analysis reveals diminishing engagement, low spot demand, and tightened liquidity, with prices stuck in the mid-$70,000 range.

- U.S. spot bitcoin ETFs have shifted from being net buyers to net sellers, and the Coinbase premium remains in negative territory, highlighting a significant decline in U.S. demand that has traditionally fueled bull markets.

- Wider macroeconomic factors, including expectations for stable Federal Reserve policies and political influences on rate decisions, are contributing to constrained liquidity and affecting crypto and tech-related risk assets throughout Asia.

Good Morning, Asia. Here’s the latest in market news:

Welcome to Asia Morning Briefing, a daily recap of significant stories during U.S. hours along with an overview of market movements and analyses. For a comprehensive summary of U.S. markets, refer to CoinDesk’s Crypto Daybook Americas.

Bitcoin is starting the Asian trading day with on-chain data indicating full bear market signals, as prices remain in the mid-$70,000s and global equity markets continue to seek direction.

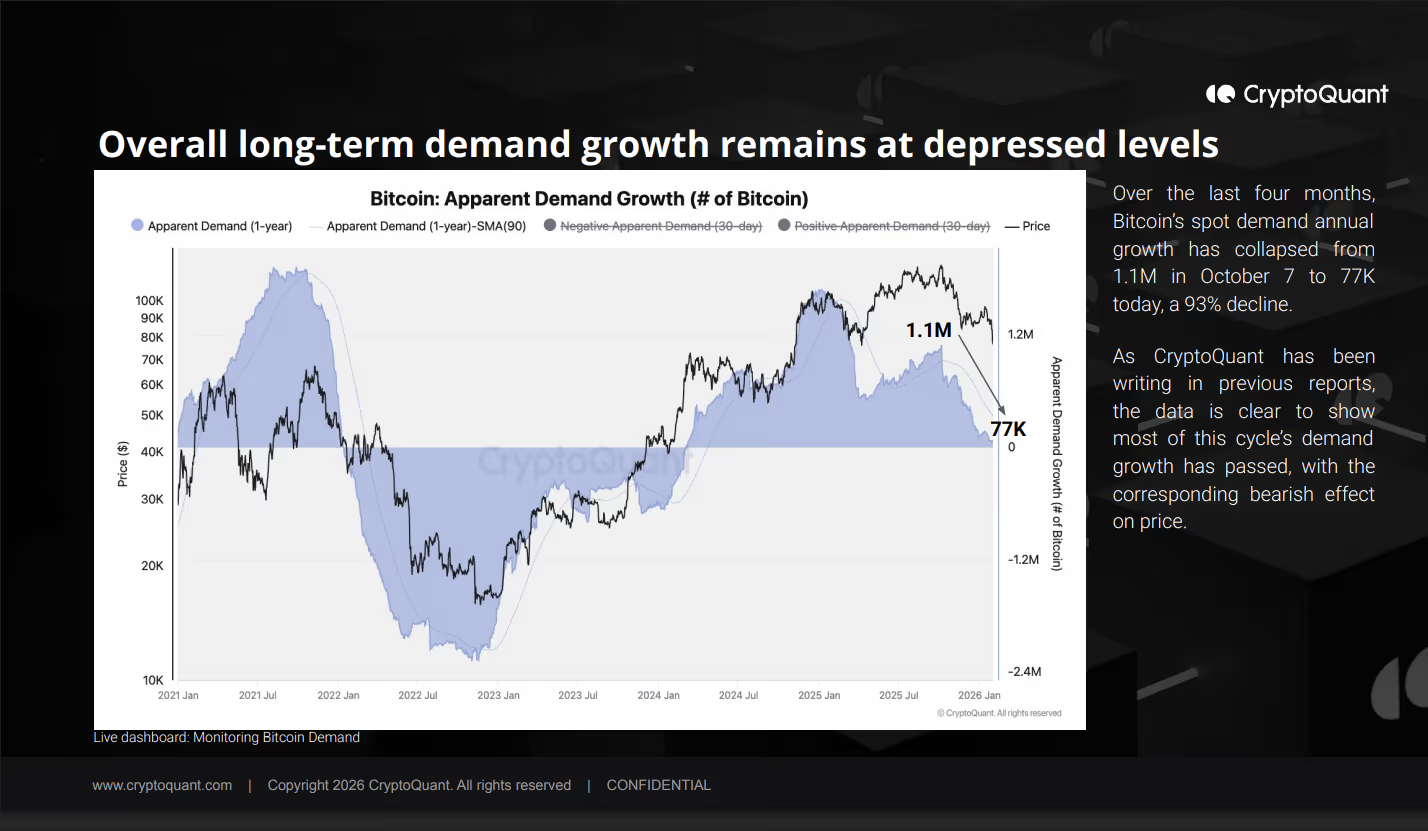

CryptoQuant’s recent weekly report presents the weakness as structural rather than cyclical, with its Bull Score Index at zero while bitcoin trades significantly below its October peak. The report suggests that the market is not processing gains but is instead functioning with a diminished buyer base and restricted liquidity.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Glassnode data supports this view, indicating low spot volumes and a lack of demand where selling pressure is not being countered by significant buying interest. Essentially, the situation reflects a decrease in participation rather than a state of panic.

Institutional flows highlight this transition. U.S. spot bitcoin ETFs, which were net buyers a year ago, have turned into net sellers, resulting in a significant year-over-year demand reduction measured in tens of thousands of bitcoin.

Simultaneously, the Coinbase premium has remained negative since October, indicating that U.S. investors are not significantly entering the market despite lower prices. Historically, strong bull phases have aligned with robust U.S. spot demand, which is currently lacking.

Liquidity conditions are also tightening subtly. The expansion of stablecoins, which generally supports risk appetite and trading activity, has stagnated, with USDT market cap growth experiencing a decline for the first time since 2023.