Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin approaches $65,000, on track for its largest single-day decline since the FTX collapse.

Analyst identifies the 200-day moving average — currently between $58,000 and $60,000 — as a significant support level to monitor.

Bitcoin falls beneath $65,000 amid ongoing selloff (Getty Images+/Unsplash)

Bitcoin falls beneath $65,000 amid ongoing selloff (Getty Images+/Unsplash)

Key points:

- Bitcoin declined over 10% in the last 24 hours, dropping below $66,000 and approaching its most significant single-day drop since the FTX-triggered crash in November 2022.

- The sell-off impacted markets beyond cryptocurrency, with silver plunging 15% and gold decreasing by more than 2%, while software stocks and major U.S. equity indices also experienced declines.

- One analyst cautioned that there remains no definitive bottom for bitcoin, indicating the $58,000 to $60,000 range as critical support, as altcoins like XRP face even greater losses.

Bitcoin fell below $66,000 during the early afternoon U.S. hours as this week’s cryptocurrency sell-off intensified into a severe downturn on Thursday.

The leading cryptocurrency dropped over 10% in the past 24 hours to a session low of $65,156, according to CoinDesk data, marking its lowest point since October 2024 and falling below the 2021 peak.

STORY CONTINUES BELOWStay informed on the latest updates.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

February 5 could mark one of the most significant declines in bitcoin’s history. BTC is on track to register its largest single-day drop — 10.5% since midnight UTC at current values — since November 8, 2022, when the collapse of the FTX exchange caused BTC to fall below $16,000 after a 14.3% decrease that day.

Cryptocurrency was not the only asset class facing intense selling pressure. Silver also dropped 15% throughout the day, now nearly 40% below its all-time high just a week prior. Gold also decreased more than 2.8% to $4,820, although this decline was not as severe as silver’s. The precious metal is currently trading about 15% lower than its record from last week.

Software stocks, which often move in tandem with bitcoin, continued to experience declines, with the thematic iShares Expanded Tech-Software ETF (IGV) falling over 3% and down 24% year to date. The S&P 500 and the tech-heavy Nasdaq also dropped by 1%.

Cryptocurrency stocks were affected as well. Coinbase (COIN), Galaxy (GLXY), Strategy (MSTR), and BitMine (BMNR) saw declines of more than 10%, while several crypto miners, including Bitfarms (BITF), CleanSpark (CLSK), Hut 8 (HUT), and Mara (MARA), faced similar losses.

“One significant factor is simply very thin liquidity,” remarked Adrian Fritz, chief investment strategist at 21shares. “If there is some sell pressure, it typically triggers numerous liquidations.”

In a delicate market environment with limited buy and sell orders to absorb trades, even slight sell-offs can lead to substantial price reactions, which in turn can cause further liquidations.

While some have claimed the worst is behind us for weeks, Fritz holds a differing view.

“There’s still no indication that we have hit bottom. I think it’s premature. There’s no confirmed reversal,” he stated.

He highlights the 200-day moving average — currently situated between $58,000 and $60,000 — as a crucial support level to keep an eye on. This range also coincides with bitcoin’s “realized price,” or the average cost basis of all bitcoin holders, which he believes could provide strong, multi-year support.

Read more: Bitcoin can still fall further. Historical data shows $60,000 will be the bottom

Altcoins severely impacted

Bitcoin’s situation may appear less severe compared to the harsh sell-off in altcoins.

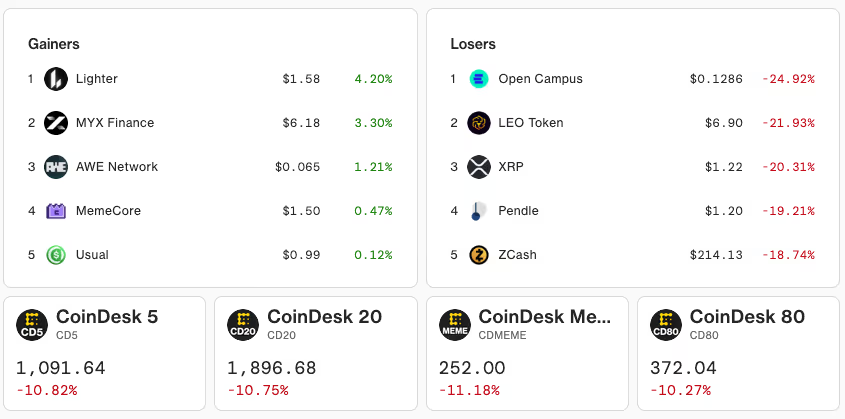

Nearly all CoinDesk index prices, covering major tokens and memecoins, have decreased by more than 10% in the past 24 hours.

Crypto price as of 6:29 pm UTC (CoinDesk data)

Crypto price as of 6:29 pm UTC (CoinDesk data)

XRP, which experienced a 19% decline in the same 24-hour timeframe, lagged behind most other large-cap cryptocurrencies.

While Fritz indicated that there is no particular factor exerting additional pressure on the token, he noted that “from a technical perspective, there’s not a substantial amount of support levels for XRP.”

Read more: Here is what industry veterans are saying as bitcoin tumbles below $70,000