Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin and Ethereum Values Decline Amid Economic Recession Concerns as Liquidation Rates Increase

- The price of Bitcoin dropped significantly below $62,000, while Ethereum fell beneath $3,000 as the repercussions of recession fears and a disappointing U.S. jobs report continue to resonate.

The cryptocurrency market is experiencing a downturn as of late Friday afternoon, with significant assets like Bitcoin and Ethereum declining by 5% or more following a dismal U.S. jobs report that also unsettled the stock market—raising concerns about a looming recession.

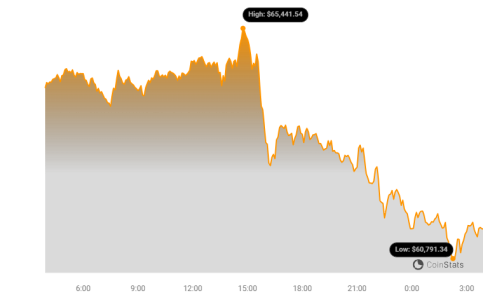

BTC Price Chart | Source: CoinStats

BTC Price Chart | Source: CoinStats

On Friday, Bitcoin’s price dropped well below $62,000, reaching a low of $61,308 according to data from CoinGecko. It has since recovered to just above $62,000 at the time of this writing, but remains down approximately 5% from a 24-hour high of $65,505.

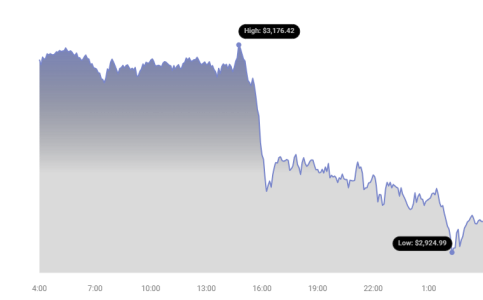

ETH Price Chart | Source: CoinStats

ETH Price Chart | Source: CoinStats

In contrast, Ethereum experienced a steep decline, falling to $2,967 after having been above the $3,200 threshold less than a day prior.

At its current price of just under $3,000, it is still down nearly 6% for the day. Other significant assets have also experienced similar or even greater declines, such as Solana, which is down over 7% at a price of $154.

Friday’s volatility in the cryptocurrency markets resulted in another surge in liquidations of both long and short positions, which are bets on whether the future price of a crypto asset will increase or decrease, respectively.

As of this writing, CoinGlass reports that $269 million worth of positions have been liquidated in the past 24 hours across the market, with $82 million of those being Bitcoin positions.

This marks the second consecutive day of substantial crypto liquidations as the prices of leading assets continue to decline.

A weaker-than-anticipated U.S. jobs report released early Friday seemed to unsettle markets universally, with the stock market showing losses across the board and crypto prices ultimately following suit.

The report indicated a rise in the unemployment rate as nonfarm jobs fell significantly short of expectations, raising concerns that a U.S. recession may be developing.

Nevertheless, while the panic has had noticeable short-term impacts on crypto prices, some analysts suggest that Bitcoin could ultimately gain from a weaker U.S. dollar and anticipated interest rate cuts from the Federal Reserve.

“With the Fed weakening monetary policy, it will be supportive for fixed-supply assets such as Bitcoin and gold,” stated CoinShares Head of Research James Butterfill.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.