Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin analysis reveals three main factors influencing investor indifference towards BTC valuation.

There has been considerable discussion regarding Bitcoin’s (BTC) recent lackluster price performance, with numerous analysts suggesting the possibility of continued bearish trends in the upcoming weeks.

However, it was not long ago that a variety of investors and cryptocurrency experts were enthusiastic about several notable fundamental indicators that remain quite optimistic.

Let’s examine three Bitcoin metrics that bullish investors may want to consider.

Bitcoin’s hashrate remains near an all-time high

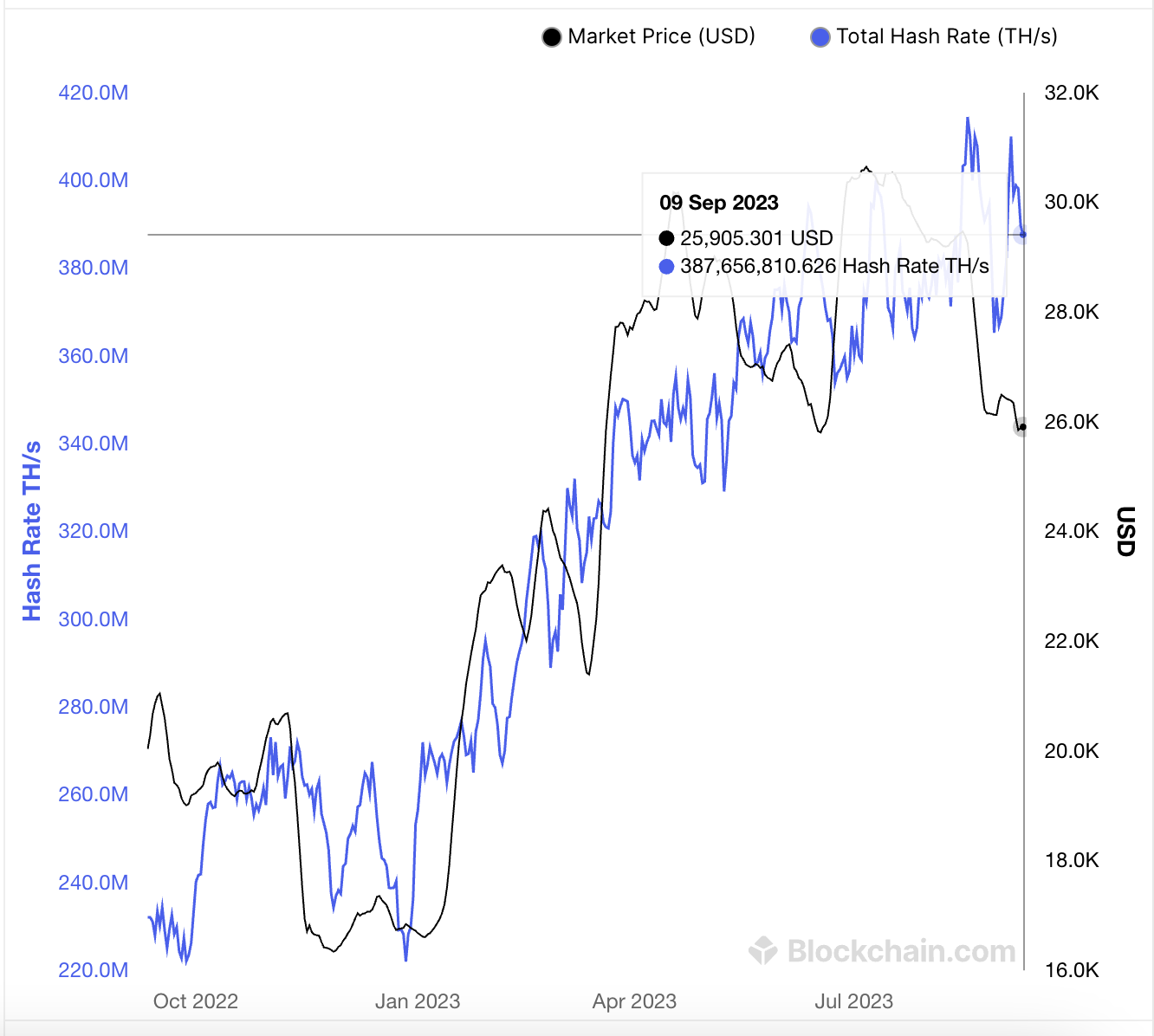

Bitcoin’s hashrate, which reflects the amount of computational power allocated to mining BTC, recently achieved an all-time high, signifying the overall robustness of the network and ongoing interest from miners. The security of Bitcoin has never been greater, underscoring that miners seem to have confidence in the future of the Bitcoin network.

BREAKING: #Bitcoin Hash Rate hits a new ATH! pic.twitter.com/kSD7LCCHkl

— Mister Crypto (@misterrcrypto) September 10, 2023

There is some debate regarding whether a high hashrate serves as a bullish indicator. Some investors view the increased hashing power as a precursor to a price rise, while others argue the contrary or claim that no correlation exists at all.

Analyzing data from the past year reveals a clear relationship between hashrate and price.

Bitcoin total hash rate vs market price (USD) 1-year chart. Source: Blockchain.com

Bitcoin total hash rate vs market price (USD) 1-year chart. Source: Blockchain.com

This correlation is logical, as miners are likely to increase their activities when prices rise. Hashrate and miners’ operations are also influenced by the Bitcoin difficulty adjustment that occurs approximately every two weeks. As hashrate increases, so does difficulty, meaning that more energy is required to mine 1 BTC.

A higher hashrate can only sustain lower prices for a limited time because miners’ production costs rise with difficulty, while their profits decrease. Consequently, either the price must increase or hashrate will decline at some point.

At present, the price has dropped significantly in relation to the hashrate. The last occurrence of this situation in June was followed by a rally.

See related:Bitcoin miners need BTC price over $98K by the halving — Analysis

In addition to the rising hashrate, there seems to be renewed interest in mining from nation-states. The nation of Oman has announced intentions to generate 7% of the Bitcoin hash rate within the next two years.

JUST IN: Oman plans to produce 7% of the global #Bitcoin hash rate by June 2025! pic.twitter.com/HOJDlCcyBU

— Crypto Rover (@rovercrc) September 10, 2023

Bitcoin addresses holding 0.1 BTC reach all-time high

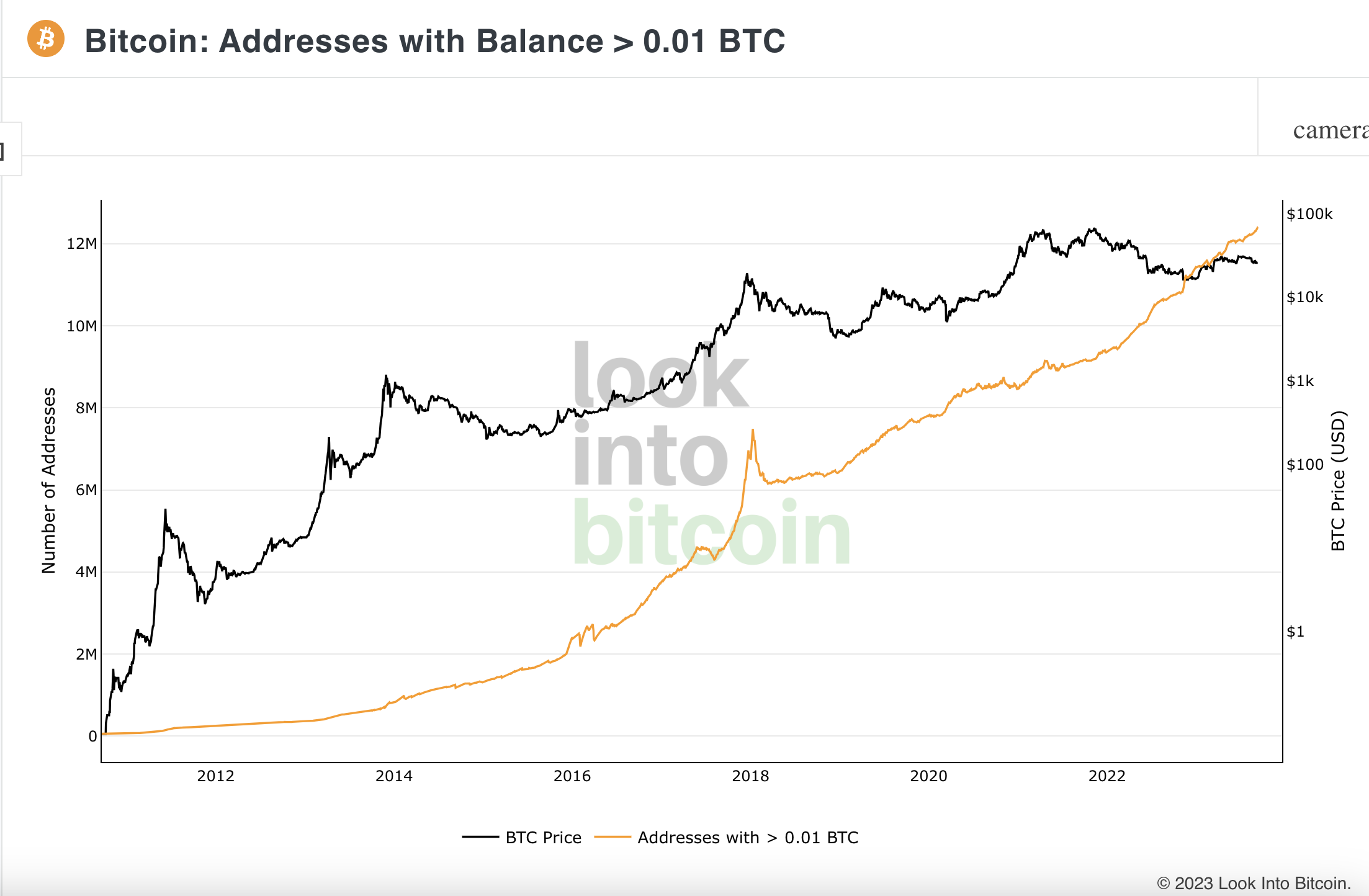

Bitcoin holders have remained resilient throughout the bear market, with the number of wallets containing 0.1 BTC or more reaching 12 million for the first time. This trend has persisted despite the current price fluctuations that include occasional corrections.

Bitcoin addresses with balance of over 0.01 BTC vs price. Source: Look Into Bitcoin

Bitcoin addresses with balance of over 0.01 BTC vs price. Source: Look Into Bitcoin

This indicates a level of confidence in the asset class despite the various challenges in the market. Adoption is increasing even as prices remain disappointing.

While 0.1 BTC may have previously been considered a negligible amount, it now holds significance, representing approximately $2,500 at current valuations. The fiat value can be considerably higher when converted into other currencies. The fact that 12 million entities have accumulated this much Bitcoin illustrates how seriously the global community is beginning to view such an investment.

Bitcoin balances held on exchanges decline

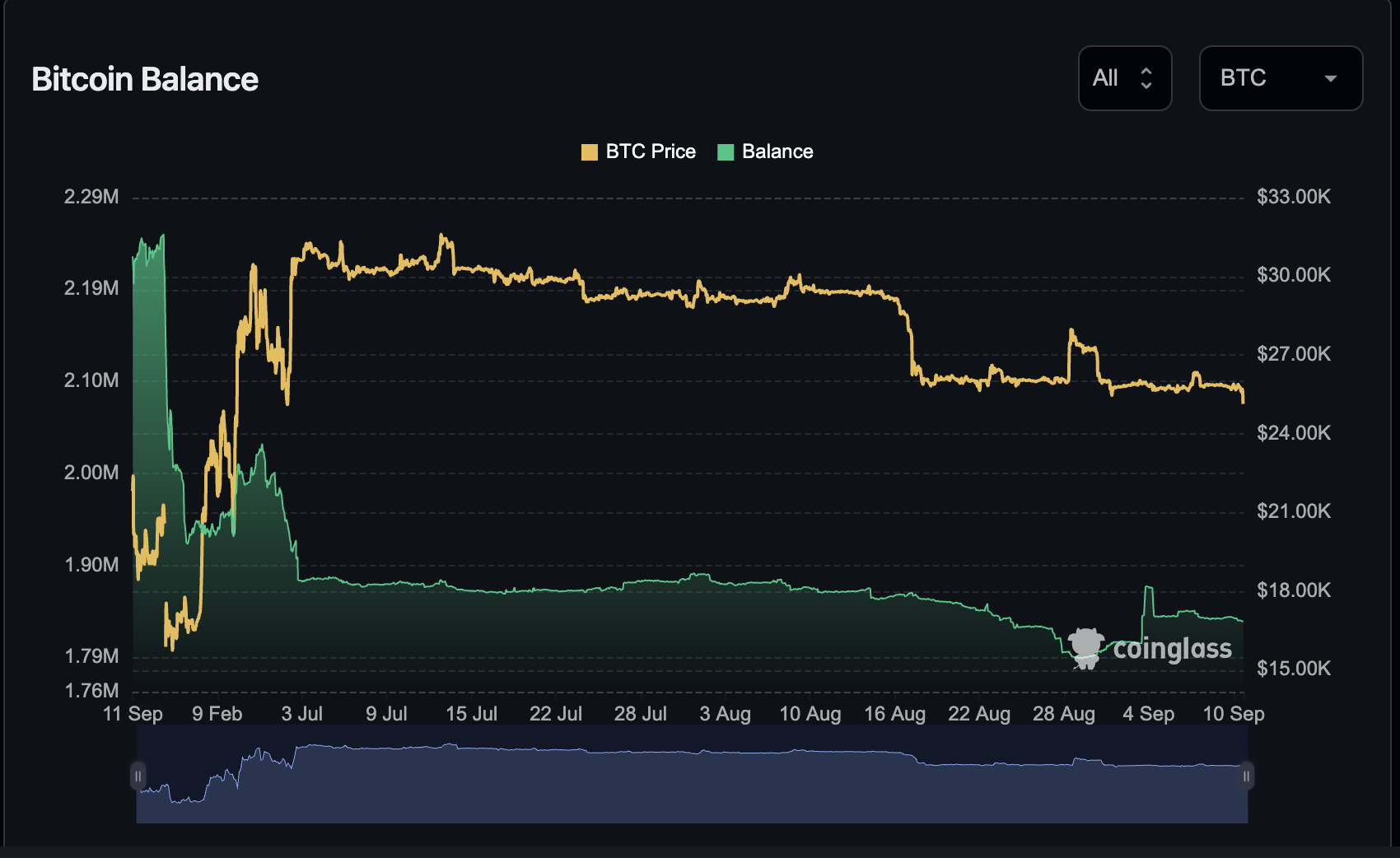

The number of wallets containing substantial amounts of Bitcoin has also increased, while the quantity of Bitcoin held on exchanges has been decreasing since the collapse of FTX in November 2022. This trend has accelerated since April of this year. This suggests that individuals are opting for self-custody of their coins, potentially indicating their lack of interest in selling in the near term.

BTC price vs balance held on exchanges one-year chart. Source: Coinglass

BTC price vs balance held on exchanges one-year chart. Source: Coinglass

Over the past week, the BTC balance held on exchanges has dropped from 1.88 million to 1.84 million. Historically, an influx of coins onto exchanges has often preceded periods of selling pressure, while outflows from exchanges have supported the Bitcoin price.

Collectively, these three metrics indicate that the rationale for purchasing Bitcoin has become stronger than ever. Bitcoin miners continue their operations, holders remain committed, and individuals are increasingly taking custody of their coins.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.