Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

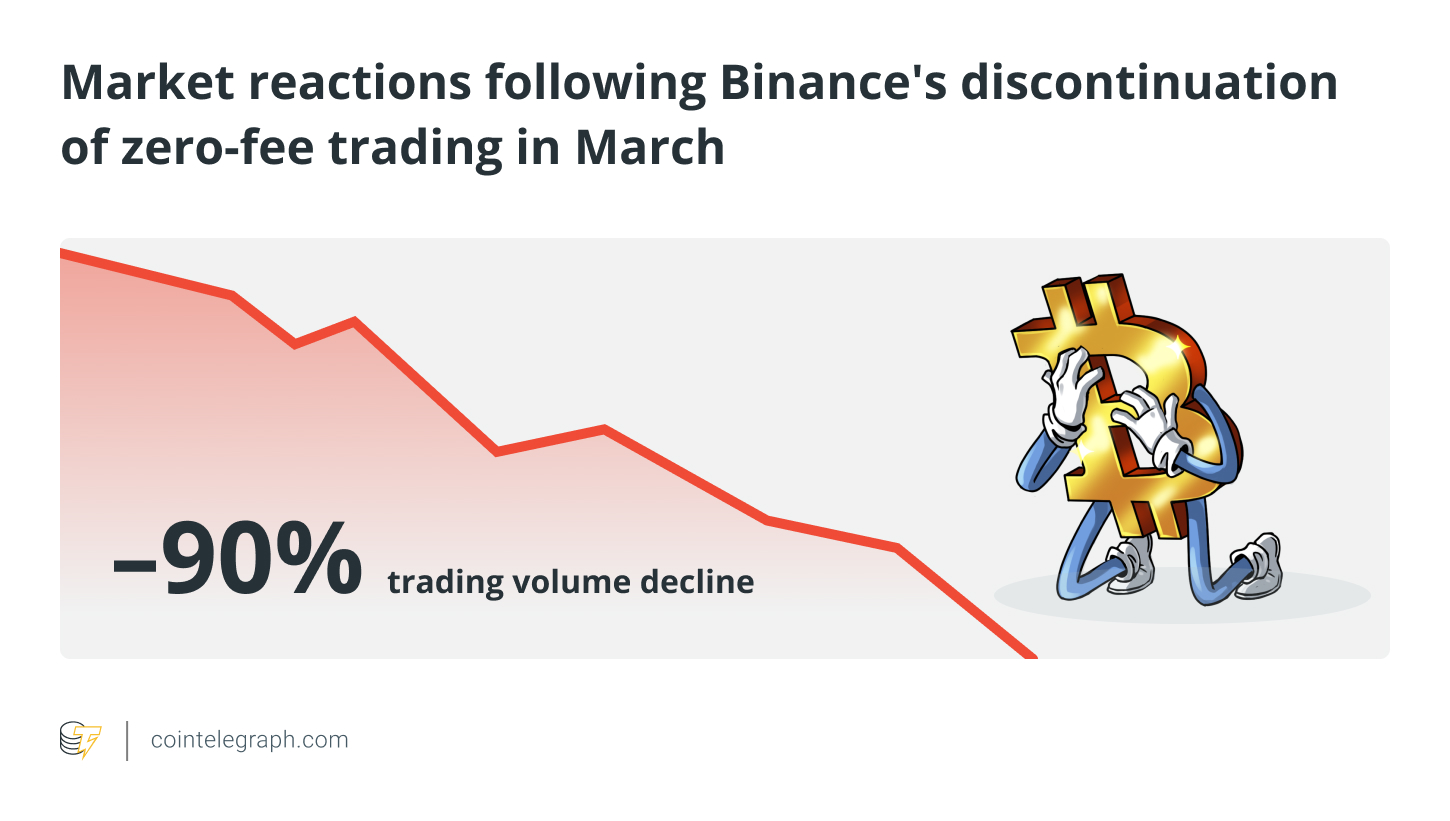

Binance’s no-fee Bitcoin announcement may reflect March decline.

On August 24, the Binance cryptocurrency exchange revealed its plans to alter its zero-fee Bitcoin trading initiative. This move could potentially trigger a notable market decline, similar to the 90% drop in trading volume that followed the cessation of zero-fee trading by Binance in March.

In an official announcement, Binance disclosed its intention to update the zero-fee Bitcoin trading program effective September 7. The exchange aims to revise the zero-fee Bitcoin trading for the Bitcoin (BTC)/ True USD (TUSD) spot and margin trading pair.

Previously, traders benefited from zero maker and taker fees while trading BTC with TUSD pairs. However, a standard taker fee will now be applied based on the user’s VIP status. Nevertheless, users will continue to enjoy no maker fees when trading Bitcoin on the BTC/TUSD spot and margin trading pair.

“The corresponding trading volume on the BTC/TUSD spot and margin trading pair will contribute to VIP tier calculations and all Liquidity Provider programs. Additionally, BNB discounts, referral rebates, and any other fee modifications will resume for BTC/TUSD spot and margin trading volumes.”

It appears that Binance is phasing out its zero-fee Bitcoin trading program for TUSD, suggesting a reduced support for the TUSD stablecoin due to various issues. Importantly, users will still have the advantage of zero maker and taker fees when trading Bitcoin within the FDUSD spot and margin trading pair.

Binance’s modification of its zero-fee Bitcoin trading policy for the BTC/TUSD spot and margin trading pair may unintentionally provoke another wave of sell-offs in the market.

Related: Binance labels restricted Russian banks on its platform as ‘Yellow’ and ‘Green’ cards

As per CoinMarketCap, the BTC/TUSD and BTC/USDT pairs are the most actively traded for Bitcoin, accounting for 11% and 7% respectively. The trading volume in Tether (USDT) pairs saw a significant decline after Binance ceased support for BUSD and designated TUSD as the exclusive trading pair for zero-fee Bitcoin trading.

Once again, the exchange is shifting focus from the commonly traded TUSD to the lesser-known FDUSD stablecoin. Notably, FDUSD does not rank among the top 10 Bitcoin pairs by trading volume, with its market capitalization at $324 million.

Collect this article as an NFT to commemorate this moment in history and demonstrate your support for independent journalism in the crypto sector.

Magazine: Deposit risk: What do crypto exchanges really do with your money?