Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bhutan transfers bitcoin to trading companies and exchanges as BTC approaches $70,000.

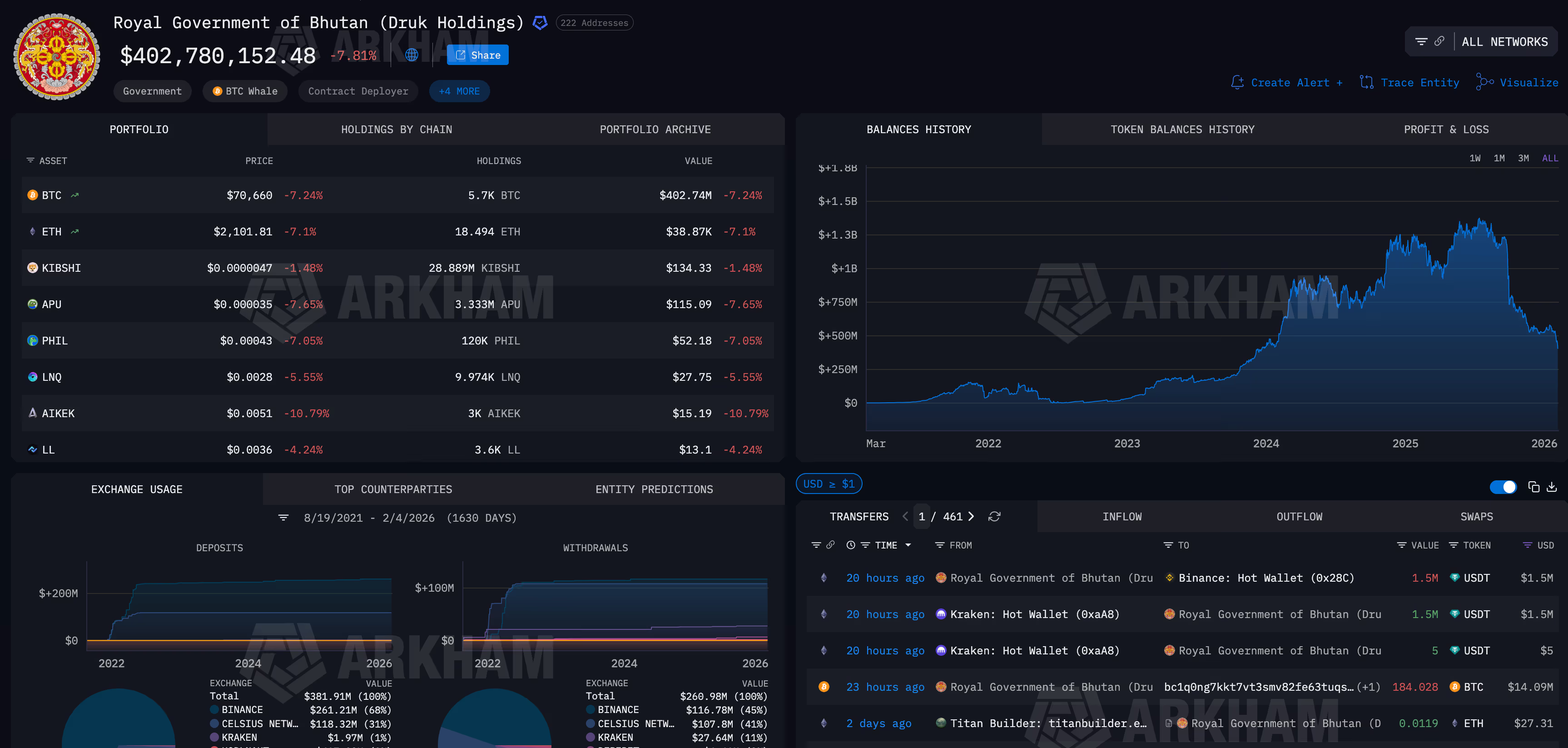

Wallet data indicates that the Royal Government of Bhutan has begun transferring bitcoin to trading firms and exchanges for the first time in several months, as markets decline and volatility increases across cryptocurrencies and metals.

What to know:

- Bitcoin wallets associated with Bhutan’s government have transferred over 184 BTC, equivalent to approximately $14 million, following about three months of dormancy amid a downturn in both crypto and broader markets.

- The transfers directed coins to new addresses and recognized counterparties such as QCP Capital and a Binance hot wallet, indicating trading, liquidity management, or potential sales rather than merely cold storage.

- While these actions do not definitively indicate selling, they underscore how Bhutan and other significant holders are increasingly utilizing bitcoin as an active balance-sheet tool during times of market distress.

The Royal Government of Bhutan has commenced transferring bitcoin after a prolonged period of inactivity in their wallets, reallocating funds to trading firms, exchanges, and new addresses as bitcoin dipped below $71,000 and broader markets faced turbulence.

Onchain data monitored by Arkham reveals that Bhutan-related wallets have moved over 184 BTC, valued at around $14 million, in the last 24 hours.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Some bitcoin was directed to new addresses, while other transactions were made to known counterparties such as QCP Capital and a Binance hot wallet, as per Arkham’s findings.

These endpoints are typically linked to trading, liquidity management, or possible sales. CoinDesk attempted to contact QCP Capital via Telegram for a response.

The recent activity signifies Bhutan’s first significant wallet movement in approximately three months and occurs during a tumultuous period for crypto markets. Bitcoin has dropped over 7% in 24 hours, while silver has seen a decline of up to 17%, as global equities have decreased amid concerns that artificial intelligence investments are disrupting traditional software business models.

Over the past two years, Bhutan has become one of the more atypical sovereign bitcoin holders, discreetly accumulating a reserve through state-supported mining associated with hydropower.

In contrast to corporate treasuries that publicly announce their accumulation strategies, Bhutan’s holdings have largely remained out of the public eye, making any changes in wallet behavior closely scrutinized by traders.

The latest transfers do not definitively indicate selling. The coins were distributed among various destinations, including new wallets, which could suggest internal reorganization or collateral management rather than immediate liquidation.

Nonetheless, transferring bitcoin to exchanges and trading firms during a significant downturn stands in contrast to the country’s otherwise extended periods of inactivity.

This activity also reflects a broader trend emerging in this selloff: major holders are increasingly viewing bitcoin not just as a static reserve asset but as a tool for balance-sheet management during times of stress.

Corporate treasuries, miners, and now sovereign-related entities are modifying their positions as liquidity tightens and price fluctuations intensify.