Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

As Bitcoin continues to drop, industry experts suggest it may be an opportune moment to invest.

Your day-ahead look for Feb. 11, 2026

U.S. jobs data may offer additional market direction. (Helene Braun/CoinDesk)

U.S. jobs data may offer additional market direction. (Helene Braun/CoinDesk)

What to know:

You are reading Crypto Daybook Americas, your daily update on the developments in the crypto markets overnight and what to anticipate in the upcoming day. Crypto Daybook Americas will start your morning with thorough insights. If you haven’t subscribed to the email yet, click here. You won’t want to miss out on it.

By Francisco Rodrigues (All times ET unless noted otherwise)

Bitcoin declined for the third consecutive day after failing to hold above the $70,000 mark reached during the weekend rebound as spot trading volumes decreased and the Crypto Fear and Greed Index remained in the “extreme fear” zone.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

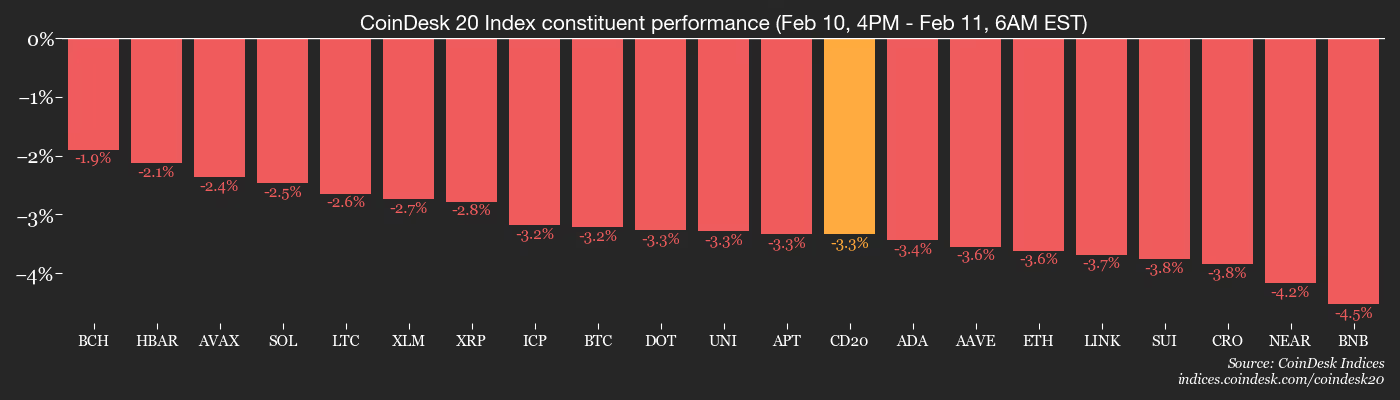

The total crypto market capitalization has decreased to approximately $2.28 trillion, with the CoinDesk 20 (CD20) index dropping 3.4% in the last 24 hours. Nevertheless, on-chain data aggregator Glassnode characterized the decline as modest compared to historical standards, with no indications of panic selling observed in previous cycle peaks.

Despite the reduced volumes and unfavorable sentiment, inflows to spot bitcoin ETFs have remained consistent over the last three days, alleviating some selling pressure. The market is currently in a price discovery phase, according to Wintermute.

“With spot volumes still relatively light, leverage is influencing short-term movements as demonstrated by BTC rebounding from the lows last Friday due to heavily crowded perpetual shorts,” Wintermute desk strategist Jasper De Maere stated in an emailed update. “It’s probable that the market will continue to oscillate within this range as it remains in price discovery.”

Key figures seem to maintain a bullish outlook. At Consensus Hong Kong, Tom Lee, chief investment officer of Fundstrat and chairman of ether treasury firm BitMine Immersion (BMNR), advised investors to seek entry points rather than attempting to time a bottom.

On CNBC, Michael Saylor, executive chairman of bitcoin treasury firm Strategy (MSTR), reaffirmed his long-term commitment to the cryptocurrency, expressing his expectation for it to surpass traditional equities despite the downturn.

Weak U.S. retail sales have moderately increased expectations for interest rate cuts in the U.S. and put pressure on the dollar. Focus will now shift to today’s nonfarm payrolls data and inflation figures, which could further impact risk appetite. Remain vigilant.

Read more: For insights on today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a detailed schedule of events this week, refer to CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Feb. 11: Immutable will finalize the merge of Immutable X and Immutable zkEVM.

- Macro

- Feb. 11, 8:30 a.m.: U.S. nonfarm payrolls for January Est. 70K (Prev. 50K)

- Feb. 11, 8:30 a.m.: U.S. unemployment rate for January Est. 4.4%(Prev. 4.4%)

- Feb. 11, 8:30 a.m.: U.S. average hourly earnings for January YoY Est. 3.8% (Prev. 3.6%)

- Earnings (Estimates based on FactSet data)

- No earnings scheduled.

Token Events

For a comprehensive overview of events this week, check CoinDesk’s “Crypto Week Ahead”.

- Governance votes & calls

- Feb. 11: Ripple will host XRP Community Day on X Spaces to discuss XRP adoption, regulated finance, and innovation.

- Unlocks

- Feb. 11: will unlock 0.32% of its circulating supply valued at $14.33 million.

- Token Launches

- Feb. 11: Coinbase plans to list RaveDAO (RAVE), DeepBook (DEEP), and Walrus (WAL).

Conferences

For a detailed list of events occurring this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 2 of 3: Consensus Hong Kong

- Day 2 of 3: Solana Breakout (Online)

- Feb. 11: Solana Accelerate (Hong Kong)

Market Movements

- BTC is up 0.25% from 4 p.m. ET Tuesday at $66,868.63 (24hrs: -3.14%)

- ETH is down 2.96% at $1,947.84 (24hrs: -3.25%)

- CoinDesk 20 is down 2.75% at 1,900.89 (24hrs: -3.53%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.83%

- BTC funding rate is at -0.0023% (-2.536% annualized) on Binance

- DXY is down 0.3% at 96.50

- Gold futures are up 1.73% at $5,117.80

- Silver futures are up 6.22% at $85.39

- Nikkei 225 closed up 2.28% at 57,650.54

- Hang Seng closed up 0.31% at 27,266.38

- FTSE is up 0.50% at 10,405.94

- Euro Stoxx 50 is down 0.41% at 6,022.26

- DJ