Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Arthur Hayes indicates that the Bitcoin bull market commenced in March, with broader recognition expected within a year.

Bitcoin (BTC) has experienced a bullish trend for approximately the last six months, and the market has yet to react — but it is expected to do so within the next six to twelve months, as stated by BitMEX co-founder and former CEO Arthur Hayes.

During a keynote address on September 5 at Korea Blockchain Week, Hayes asserted that Bitcoin’s bullish trend commenced on March 10, the day the Federal Deposit Insurance Corporation took control of Silicon Valley Bank (SVB).

Just two days prior to SVB’s takeover on March 8, Silvergate Bank entered liquidation. Subsequently, on March 12, Signature Bank was compelled to shut down by New York regulators.

In response to these events, and to prevent additional potential failures, the Federal Reserve established the Bank Term Funding Program (BTFP), which provides banking loans for up to a year in exchange for posting “qualifying assets” as collateral.

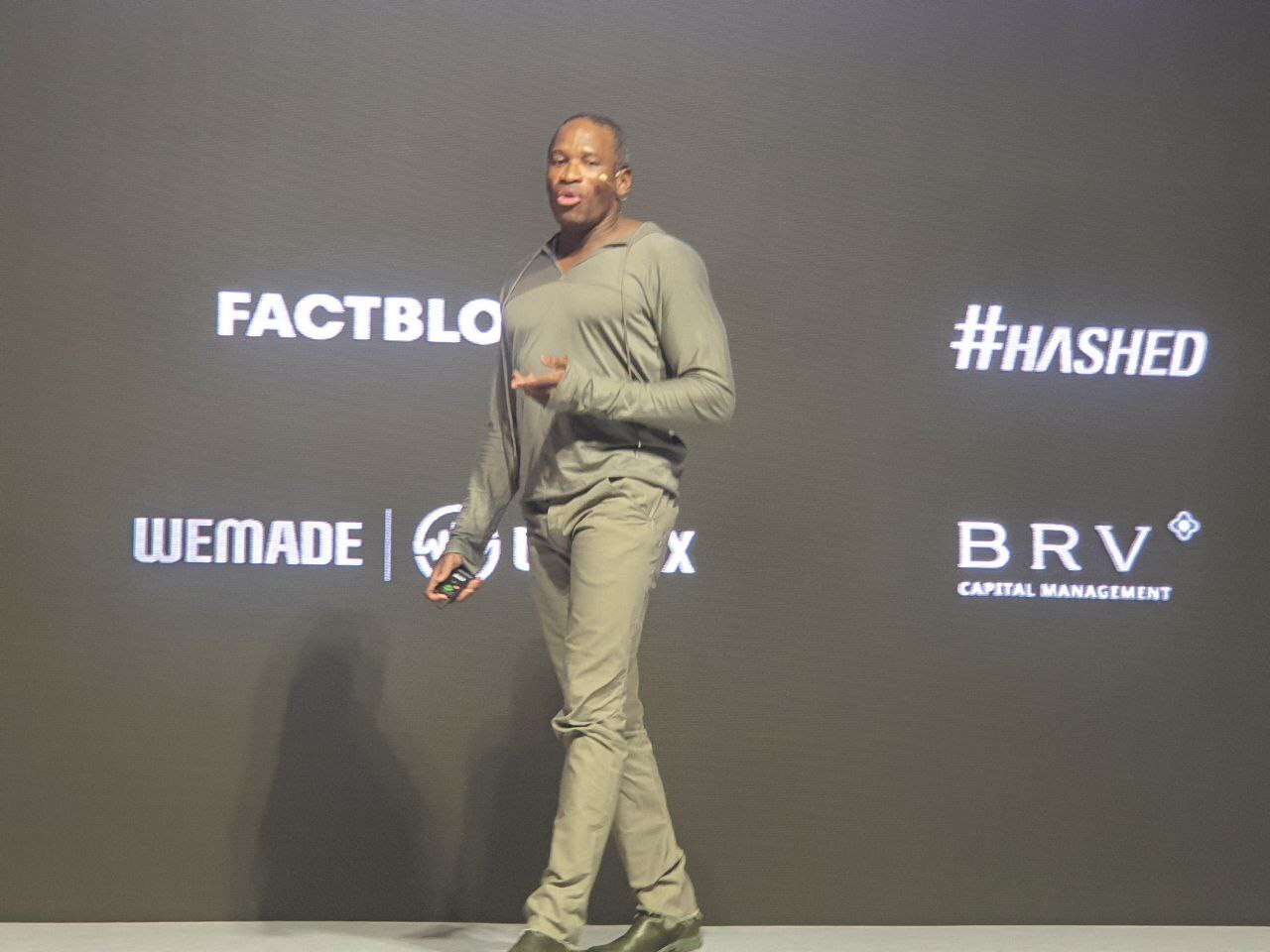

Hayes speaking at Korea Blockchain Week in Seoul. Source: Andrew Fenton/Cointelegraph

Hayes speaking at Korea Blockchain Week in Seoul. Source: Andrew Fenton/Cointelegraph

“Essentially, what [the Fed] did was backstop the entire banking system by saying: ‘Please give me your underwater dogshit bonds, and I’ll give you fresh dollars,’” Hayes remarked.

“Me and the rest of the market rightly saw through this as basically them admitting that they caused this problem — the structure of the banking system — and this is one of the ways you can fix it, which is: print more money.”

Since that point, Bitcoin’s price has risen — currently by about 26% — which is why he asserts that the bull market began on that date.

“We basically ditched this whole facade that we care about the value of the dollar and the value of any fiat currency.”

This has led traders to consider fixed-supply assets like Bitcoin, according to Hayes.

Related: Why is Jerome Powell gaslighting us about the odds of recession?

However, the broader market has not yet reacted, but he provided a timeline of six to twelve months for that to happen.

Hayes indicated that even if the Fed and other central banks persist with interest rate increases to facilitate economic tightening or if they “print more money,” Bitcoin would still perform favorably.

“On both scenarios, whether the Fed raises or cuts, we are in a good position as the cryptocurrency industry,” he stated.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in